Pre-authorised payments: how they work and why businesses use them

.jpg)

.jpg)

Sometimes you don’t want to take money straight away – you just need to make sure it’s there. That’s what pre-authorisation charges are for.

This guide explains what pre-authorisation means, how it works, where it helps, and how to implement it securely.

Pre-authorisation (authorisation hold, pre-auth) is a two-step card transaction process where the issuer approves and reserves a specific amount on the customer’s account, confirming fund availability without moving money yet.

This approach answers a simple operational question: ‘Will this charge go through?’ — giving businesses confidence before delivering a product or service.

Here’s the process in short:

.jpg)

The duration of a pre-authorisation depends on the card network and merchant category. Typically, a pre-authorisation hold expires within 5-7 days. Industries like travel or rentals may apply longer holds (up to 30 days), especially if the service or final amount is uncertain.

In some cases, pre-authorisations may expire within hours once the transaction clears. This often happens with low-value or ‘micro’ authorisations, such as those used by fuel stations, online subscriptions, or digital wallets to verify that a card is active and has available funds.

Pre-authorised payments differ from other payment models mainly in timing and intent. Here’s a quick comparison:

| Type | Description | When captured | Common use cases |

|---|---|---|---|

| Pre-authorised payments | The merchant requests authorisation to hold a specific amount on the customer’s card without immediately taking the funds | Funds are captured later (usually after confirmation of goods/services) | Hotel bookings, car rentals, e-commerce pre-orders |

| Immediate payments | Funds are authorised and captured instantly in a single step | Immediately at checkout | Online purchases, digital goods, utility bills |

| Recurring payments | Scheduled or repeated payments that happen automatically after initial authorisation | Captured on a set schedule (e.g., monthly, yearly) | Subscriptions, memberships, SaaS, loan repayments |

Used correctly, pre-auths reduce risk, protect revenue, and improve operations. Let’s break that down.

Pre-authorised payments give merchants flexibility, but they also require careful handling. Here’s what to watch out for:

If a merchant forgets to capture or release a pre-authorisation charge within the allowed timeframe, the hold expires automatically. This can lead to failed captures or customer confusion when the final charge doesn’t go through. Businesses should track active authorisations and set up automated alerts to avoid missed settlements.

From the customer’s perspective, a pre-authorisation can look like a charge. If they see a pending amount on their statement without understanding that it’s temporary, it can cause concern or support requests. Clear communication is key — merchants should explain that it’s only a hold, not a payment, and when it will be released or captured.

Capturing the same hold twice or trying to capture after expiry can cause duplicate charges. Payment systems should include safeguards like idempotency checks, clear logging, and automated expiry handling to prevent these errors.

Under PSD2, Strong Customer Authentication (SCA) applies at the authorisation stage unless an exemption is valid. Make sure your setup meets SCA rules, or transactions may be declined.

Visa, Mastercard, and other card networks define strict rules for pre-authorisation timeframes, adjustments, and completion procedures. Merchants who don’t comply — for example, by capturing after expiry or failing to release holds promptly — risk disputes, fines, or chargebacks.

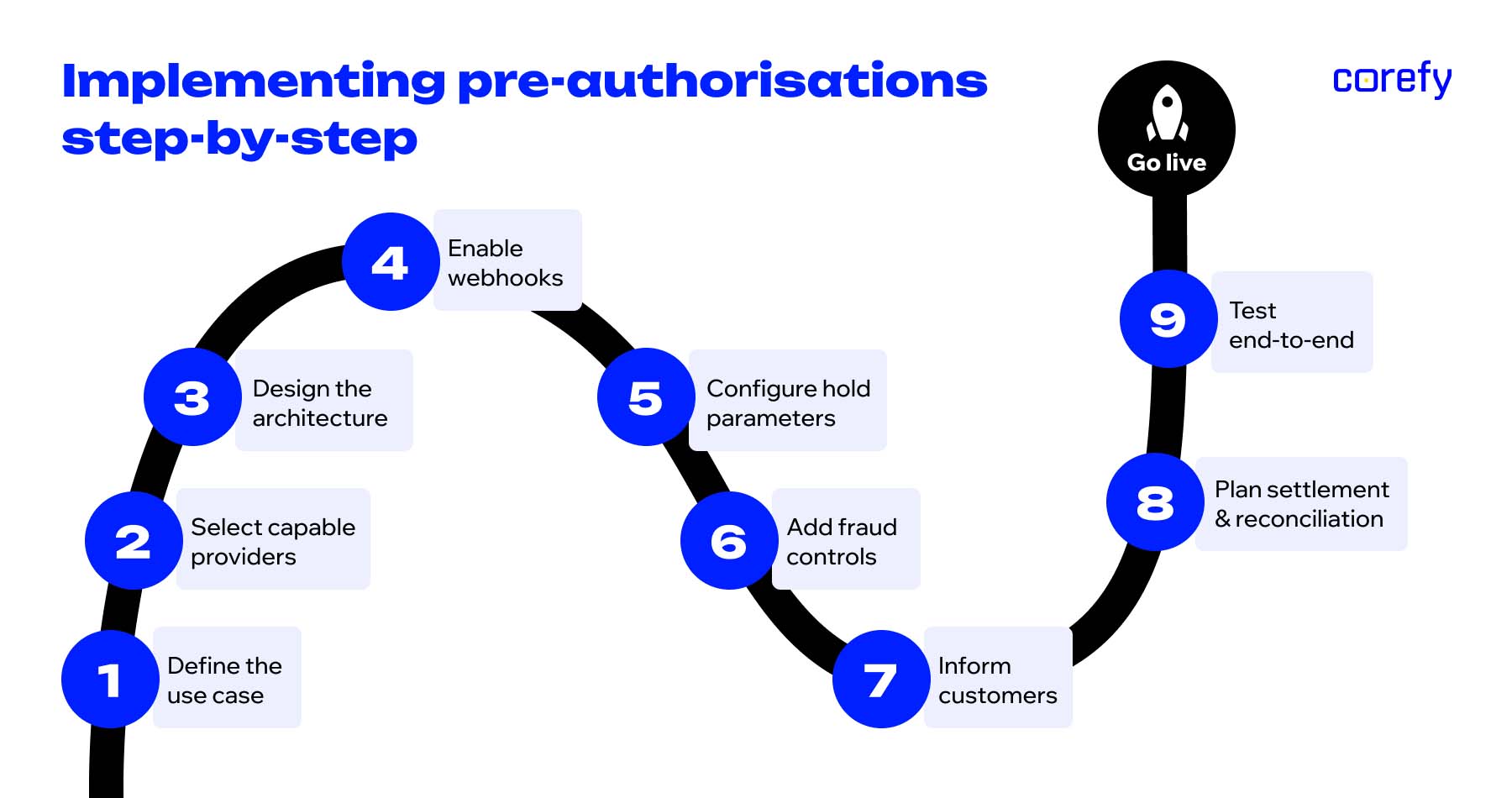

Setting up and managing pre-authorisations it’s about designing a flow that’s reliable, compliant, and clear for both your team and your customers. Here’s how to do it right.

Start by mapping where in your customer journey pre-authorisation adds value. It’s ideal when you need to confirm funds before delivering a service or when the final cost isn’t known upfront — for example, rentals, marketplaces, or any order fulfilled later.

Not every payment processor or acquiring bank supports pre-authorised transactions and delayed capture. Check that your provider can:

The most popular PSPs that support pre-authorisations are Stripe, Adyen, Worldpay, and Braintree.

Design your system to manage the full pre-authorisation lifecycle. At a minimum, this includes:

Set up secure webhook endpoints to receive real-time updates on authorisation events. These should cover key scenarios such as successful or failed authorisations, expiration warnings, adjustment confirmations, and capture completions. To protect your system and data, implement strong webhook security measures, including HTTPS endpoints, signature validation, retry logic for failed deliveries, and event logging for audit purposes.

Set the appropriate hold duration based on your merchant category code (MCC) and operational needs. Standard pre-authorisations typically last 5-7 days, but certain industries can extend holds up to 30-31 days.

Also, define sensible minimum and maximum authorisation amounts. Monitor expiration windows so you can either capture or extend before expiry – expired holds can’t be captured, and funds return to the customer.

Implement fraud checks specifically tailored to pre-authorisation. Use device fingerprinting to detect anomalies, velocity checks to flag unusually frequent transactions, and behavioural analytics to identify suspicious patterns. Maintain blocklists and allowlists to filter known bad actors.

Transparent communication reduces confusion and chargebacks. Inform customers:

Share this information during checkout, in confirmation emails, or verbally if applicable.

Decide whether to use automatic capture with a configurable delay or manual capture that requires staff approval. Configure settlement intervals that align with your risk tolerance — 120 hours is a common benchmark that balances cash flow needs against chargeback exposure.

Also, build reconciliation workflows to track the gap between authorised and captured amounts, monitor expired authorisations, and manage partial captures or refunds.

Thoroughly test the entire flow — from initial authorisation to final capture. Validate adjustment scenarios, simulate authorisation expirations, and ensure your system handles failures and declines gracefully. Use a variety of card types and transaction amounts to verify card network and issuer compatibility.

A well-orchestrated pre-authorisation flow combines technical precision, automation, and customer empathy. The best practices are:

Some providers support multi-step authorisations natively, while others simulate the flow. To maximise approval rates and reliability:

Manual captures are prone to delays and human error, especially at scale. Automating this logic helps your team stay compliant and efficient.

Each pre-authorisation has a defined validity period, typically between 5 to 30 days depending on the card scheme or acquirer. Once expired, it can’t be captured — leading to lost revenue or customer frustration.

To avoid that:

Even the smoothest backend logic can’t offset poor user experience. Customers need clarity about when and why funds are held.

(1).jpg)

Yes. Pre-authorised payments are considered safe because no money is transferred until the merchant captures the transaction. During the pre-authorisation stage, the customer’s bank or card issuer verifies the payment method, places a temporary hold, and keeps control of the funds until capture or expiry. When handled by PCI DSS-compliant providers, the process is secure for both merchants and customers.

The main difference lies in how pre-authorisations work in terms of where funds are reserved:

In both cases, the pre-authorisation charge on a credit or debit card doesn’t actually move money – it simply ensures that the specified amount is available when the final charge is made.

Yes. If the merchant hasn’t yet captured the payment, the customer can request cancellation. The pre-authorisation amount will then be released, and no money will be charged. Once the capture occurs, the transaction is processed like a normal payment, and standard refund procedures apply. Holds also expire automatically after the card network’s set timeframe if not captured.

Pre-authorisation is common wherever the final amount or fulfilment isn’t confirmed at the time of booking. This includes hospitality, car rentals, e-commerce, logistics, travel, and service marketplaces. In these industries, merchants rely on debit or credit card pre-authorisation to secure deposits, verify funds, or manage variable charges without committing to a full payment upfront.

A total debit pre-auth hold is the full amount temporarily reserved on a customer’s account when a transaction is authorised but not yet settled. It reduces the available balance (or credit) by that amount but doesn’t actually withdraw the funds. Once the transaction is captured or voided, the hold is cleared – either converting into a charge or releasing the money back to the customer.