Payment infrastructure is the foundation for every digital transaction. For merchants, it directly affects approval rates, checkout experience, operating costs, and revenue. This guide breaks down the core components, flows, failure points, and best practices to build for scale and control.

What is payment infrastructure?

When your payment processing infrastructure layer is well‑designed, payments feel invisible. When it's not, you'll probably see declines and operational drag.

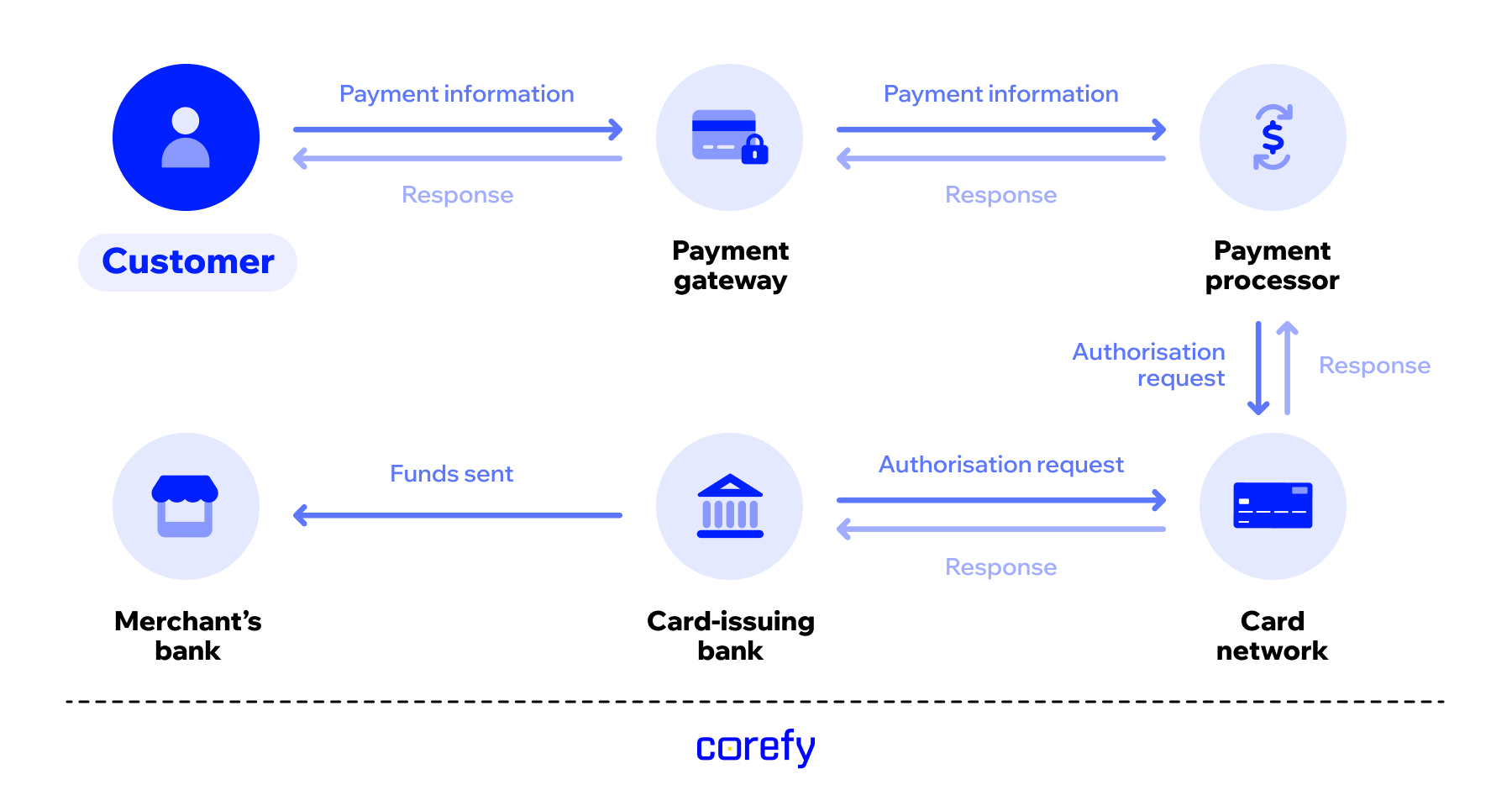

Core components of payment infrastructure

Here's a breakdown of the payment infrastructure components that power every transaction.

Payment gateways

A payment gateway is the digital equivalent of a point-of-sale terminal. It captures customer payment details at checkout and transmits them to processors. Gateways also handle tokenisation, fraud checks, and support for multiple payment types, making them indispensable for merchants who want to accept payments safely.

Payment processors

Behind the scenes, processors are the messengers. They route transaction details from gateways to the right networks and issuing banks, handle authorisations, and ensure funds move into merchant accounts. A reliable processor can mean the difference between smooth sales and painful transaction downtime.

Merchant account

This is an account provided by an acquirer or PSP where card payments are settled before being transferred to your main business account. In dedicated setups, the account is unique to your business. In aggregated setups – common among payment facilitators (PayFacs) – multiple merchants share a master account under a PSP.

Issuing bank

These are the customer's banks – the ones that issued their card or manage their account. Issuers approve or decline transactions based on available funds, fraud detection rules, and account status.

Acquiring bank

Acquirers are the merchant's banks. They receive funds from issuers (minus fees) and deposit them into merchant accounts. They also manage risk on the merchant's behalf, ensuring compliance and security.

Card network

Card networks, such as Visa and Mastercard, create the rails that connect issuers and acquirers. They define the rules of engagement, move authorisation requests back and forth, and orchestrate clearing and settlement between banks.

Key processes in the payment infrastructure

Behind each payment is a well-timed sequence that moves data and money through several systems. Here's how it works:

1. Payment initiation

A card swipe, wallet tap, or checkout click starts the journey. At this stage, the payment data is collected but hasn't yet been approved by the bank.

2. Authorisation request

The gateway encrypts the data and passes it to the processor. The processor forwards it to the relevant payment network, which routes it to the issuing bank.

3. Verification by issuer

The issuing bank checks:

- Are funds available?

- Does the transaction align with the cardholder's typical behaviour?

- Does it pass fraud filters?

The issuer sends back ‘approved’ or ‘declined.’

4. Merchant notification

The result travels back through the chain network → processor → gateway → merchant website or POS. The customer sees ‘Transaction approved’.

5. Clearing and settlement

Approval is just the green light. The actual movement of money happens during clearing and settlement, where funds transfer from the issuing bank through the acquirer into your merchant account. This can take 24–48 hours, depending on providers.

Common pitfalls in building payment infrastructure

Even smart, fast-growing businesses can trip up when setting up their payment infrastructure. Knowing the most common pitfalls can save you a lot of headaches.

Poor integration between systems

Using multiple gateways, acquirers, or processors without proper integration leads to fragmentation. This can cause reporting issues, slower transaction routing, and operational inefficiencies. Imagine having to log into three different dashboards just to reconcile yesterday's sales – a time-consuming and error-prone process.

Lack of redundancy

Relying on a single provider is risky. If that provider goes down for even an hour, it can result in thousands or even millions of dollars in lost revenue. Think about an online gambling operator. If they route all payments through just one PSP and it suddenly blocks transactions or suffers an outage, the business could instantly lose deposits and frustrate players. Building redundancy into your infrastructure ensures you always have a backup route.

Overlooking customer experience

The payment journey is often the last step before conversion, but businesses sometimes neglect it. Long checkout forms, a lack of local payment options, or clunky mobile experiences lead to abandoned carts. For example, customers in Brazil often prefer Boleto Bancário or PIX; if your infrastructure only supports credit cards, you'll miss a large share of the market.

Best practices for payment infrastructure implementation

Think of these as the basics that every growing business should keep in mind:

Plug in new payment methods without rebuilding

Payment methods come and go. What's hot this year may not be the same next year. Instead of rebuilding for each one, a white-label payment gateway or payment orchestrator provides pre-integrated connectors that you can activate without custom development or replatforming. Just configure the method, map routing rules, and go live.

Adopt payment orchestration

Managing multiple gateways and providers on your own may work at the start, but it quickly becomes a balancing act that eats up time and resources.

If any of the following apply, it's likely time to consider orchestration:

- You use multiple payment providers – managing 2 or more integrations adds complexity and makes routing harder to optimise manually.

- You operate in 3+ regions or currencies – each market adds local methods, rules, and compliance needs that are hard to manage without orchestration.

- You plan to add or switch PSPs soon – orchestration makes provider changes easier and faster – no need to rebuild your stack.

- You’ve experienced a provider outage recently – without failover support, even short disruptions can impact revenue and user trust.

A payment orchestration platform acts as a unifying layer to manage routing, tokenisation, 3DS, and failover logic across providers. Instead of fragmented integrations, you get a single control point to optimise approval rates and launch new payment methods without rebuilding the whole stack.

(1).png)

Invest in the customer journey

18% of online shoppers will abandon their carts if checkout is complex. The best way to spot weak points? Step into your customer's shoes and walk through the journey yourself. Is your site intuitive to navigate? Does checkout feel fast and frustration-free?

Invest in responsive design, intuitive UX/UI, and mobile optimisation to ensure a smooth customer journey from start to finish. A frictionless checkout flow equals more completed transactions.

Want to see how flexible checkout design can be? Click through our interactive editor to test layouts, fields, and localisation options – no sign-up needed.

Commit to constant optimisation

Even the best payment infrastructure needs ongoing tuning. Treat payments like a living system: track segmented KPIs (approval rate, latency, and decline mix) and act on them with smart retries, issuer-aware routing and failover, and domestic routing where possible.

Future trends in payment infrastructure

Localisation at scale

Global companies are getting local with payments. That means offering the proper local methods, domestic acquiring to reduce cross-border costs, and pricing in local currencies.

According to our Payment Maturity Report, 45% of companies operating internationally use 10+ payment providers – highlighting the need for broad method coverage and built-in redundancy at scale.

The payoff is tangible: higher approval rates, lower interchange and foreign exchange leakage, faster settlement, and a checkout experience that feels truly local to the customer. In practice, localisation is becoming a default requirement for any brand pursuing international growth.

ISO 20022 goes mainstream

The industry-wide shift to ISO 20022 for cross-border payments and reporting (CBPR+) is accelerating. The payoff: better-structured, richer payment data, smoother interoperability across networks, and higher straight-through processing, which means fewer manual repairs, cleaner sanctions/AML checks, clearer remittance info, and faster investigations and reconciliation.

API-first infrastructure

In 2024, 74% of development teams describe themselves as API-first, showing a clear trend toward modular and flexible architecture.

APIs make it easy to embed payments directly into CRMs, ERPs, and e-commerce platforms with minimal lift. They enable real-time transaction updates, dynamic routing, faster onboarding, and seamless fraud prevention.

For businesses expanding globally or launching new verticals, APIs make the process smoother by abstracting providers and local methods behind consistent endpoints.

AI becomes a core capability

Expect broader AI adoption across:

- Fraud & risk: anomaly detection, pattern recognition, and deep-learning models that power risk-based 3DS, reduce false positives, and spot mule/bonus-abuse patterns.

- Authorisation optimisation: predicting issuer behaviour, choosing the best acquirer in real time, and timing intelligent retries to recover soft declines.

- Disputes & ops automation: auto-assembled chargeback responses, smarter KYC/AML checks, and anomaly alerts on latency or approval drops.

- Personalised checkout: dynamically ordering payment methods and UX elements by device, geography, and past success.

To sum up

How much money you make depends on how well your payment infrastructure runs. Nail three outcomes and you win: conversion, cost, control. Conversion rises with local rails and a frictionless checkout; costs decrease with smart routing and domestic processing; control comes from orchestration and unified analytics.

Corefy is built to help you operate at that standard from day one.

.png)