Payment routing is a crucial element of a multi-PSP processing setup. Your conversion and approval rates directly depend on how you route your transactions. In this article, we’ll look at dynamic and static payment routing as two basic concepts and explore how they work, where they differ, and when businesses should rely on one, the other, or a combination of both.

Static vs. dynamic routing: the general concept

In multi-provider setups, routing usually sits behind the checkout layer — and if you run multiple brands, a white-label payment interface can help keep the customer experience consistent while routing logic optimises approvals in the background.

The concept of routing comes from network engineering. The fintech industry adopted the term decades later, so before looking specifically at payment routing, it helps to understand how routing works in general computing and networking systems. The difference between static and dynamic routing comes down to how routes are created, updated, and optimised when data needs to move from point A to point B.

What is static routing?

Static routing relies on manually defined, fixed paths. An administrator pre-configures a specific route, and traffic always follows this path unless someone updates it. Because nothing changes automatically, static routing is:

- predictable and fully controlled

- resource-efficient

- suitable for small or stable environments

The downside is that if something goes wrong — like a link failure — static routes don’t adapt on their own. Someone has to step in and reconfigure the route.

What is dynamic routing?

Dynamic routing uses protocols that automatically discover and update the best path based on real-time conditions. Routers continuously exchange information and can reroute traffic if something changes — like congestion or a node going offline. This approach:

- scales well for large or frequently changing systems

- provides automatic failover and faster recovery

- adapts to network performance in real time

Compared to static routing, it requires more resources, as devices must constantly process and share routing updates.

Key differences between static and dynamic routing

| Aspect | Static routing | Dynamic routing |

|---|---|---|

| Route changes | Manual | Automatic, real-time |

| Failover | No automatic rerouting | Detects failures and reroutes |

| Scalability | Best for small or simple setups | Suitable for large or complex networks |

| Resource usage | Low | Higher (processing + communication) |

| Control | Full control, predictable paths | Optimises for speed and performance |

Now that we’ve covered the core idea behind static and dynamic routing, let’s see how this concept works in payment routing — and how choosing the right approach influences approval rates, costs, and performance.

What is static payment routing?

Think of yourself as a logistics operator. Your freight is your transactions. If you pick a map, draw a route for your cargo to be delivered, and follow it strictly no matter what, that will be static routing. A tree topples onto your road, and you can’t make the delivery anymore.

Static payment routing implies sending transactions to payment providers through manually configured routes. These paths remain fixed and unresponsive to changes. If the predefined provider goes offline or starts failing, transactions simply can’t be processed, and sales are lost.

How static payment routing works

A merchant or payment team selects one PSP, acquirer, or MID for a specific type of traffic (e.g., all Visa transactions, a certain country, or a particular merchant group) and hard-codes the route. Every relevant transaction goes to that provider until someone manually replaces or reconfigures the route.

Pros

- Predictable and fully controlled

- Simple to configure

- No performance overhead or complex logic

Cons

- No automatic failover

- High downtime risk if the provider experiences issues

- Requires manual monitoring and constant supervision

When to use static payment routing

Static routing works only when traffic volumes are low, the infrastructure is stable, and the chosen provider is highly reliable. It can also be used as a fallback path for specific flows where deterministic routing is more important than flexibility.

What is dynamic payment routing?

Let’s return to our logistics fantasy that helped us understand static routing in payments. Imagine you now have an advanced GPS navigation system that selects the optimal route to deliver your freight, accounting for traffic, weather, and road conditions. Once the system detects a car accident on your way, it will choose an alternative route to complete freight delivery.

This is how dynamic routing in payments works. Unlike static routing, it adapts to changes in real time and selects the most efficient way to ensure the successful completion of each transaction.

Setting up dynamic routing rules ensures business continuity and helps increase approval ratios. For instance, our intelligent routing engine can select the best route based on multiple parameters, such as card issuer, type, brand, country, currency, amount, date, and time.

How dynamic payment routing works

A dynamic payment router continuously evaluates multiple available PSPs and acquirers. When a transaction arrives, the system checks predefined rules and real-time performance signals (e.g., provider downtime, high decline rates, regional changes) and routes the payment to the provider most likely to approve it.

Pros

- Automatic failover and resilience

- Higher approval rates and better checkout conversion

- Optimises cost and performance across providers

- Scales easily with additional traffic, markets, or PSPs

Cons

- More complex configuration

- Requires monitoring and rule maintenance

- May involve higher infrastructure costs compared to a static setup

When to use dynamic payment routing

Dynamic transaction routing is best for medium and high-volume merchants, companies operating in multiple regions or currencies, and any business where uptime, approval rates, and payment performance directly affect revenue.

The differences between static and dynamic payment routing

The table below summarises the main characteristics and difference between static and dynamic payment routing, showing how each approach affects payment performance, stability, and scalability.

| Aspect | Static payment routing | Dynamic payment routing |

|---|---|---|

| Routing logic | Fixed paths, manually configured | Rules are predefined, and the system applies them in real time |

| Provider selection | One pre-defined PSP/acquirer per flow | Chooses the best available provider per transaction based on rules and performance signals |

| Reaction to issues | No automatic failover — downtime stops payments | Automatic rerouting and cascading when a provider fails or declines |

| Scalability | Hard to maintain as volumes and geographies grow | Designed for multi-PSP, multi-market processing |

| Impact on conversion | Limited — relies on a single provider | Optimises approval rates by leveraging multiple providers |

| Operational effort | Requires manual monitoring and updates | Reduces manual work through automation and failover |

Static payment routing is often seen as too limiting for modern payment operations. It can still be useful when a business needs strict, predefined rules — for example, sending a specific category of transactions to one merchant account only. However, static payment routing becomes difficult to scale. As volumes grow, rules multiply, and every change requires manual intervention, increasing the risk of outages and lost revenue.

With dynamic payment routing, each transaction is evaluated in real time and sent to the provider most likely to approve it. Combined with tools like cascading and automatic failover, dynamic payment routing reduces the impact of PSP downtime, issuer-side issues, and regional performance fluctuations. The result is a more seamless customer experience and improved conversion, especially for businesses operating in multiple countries or with multiple PSPs.

Why dynamic payment routing outperforms static routing

Static payment routing locks every transaction to a single provider. If that provider slows down, declines increase, or goes offline, payments start failing — and revenue follows. Dynamic payment routing solves this by evaluating each transaction in real time and selecting the provider with the highest chance of approval at that moment.

Dynamic payment routing delivers measurable benefits:

- Higher approval rates. The system can bypass failing or underperforming providers and route traffic to those performing better at that time.

- Fewer outages and lost sales. Automatic failover and cascading keep transactions flowing even during PSP downtime or issuer-side issues.

- Better geographic and currency coverage. Multiple providers can serve different markets, cards, and payment methods, ensuring global reach without manual intervention.

- Optimised processing costs. Businesses can route high-value or cross-border payments to lower-cost acquirers, reducing total fees.

- Scalability. As transaction volumes and geographies grow, dynamic routing expands simply by connecting more providers — not by rewriting rules manually.

In short, static payment routing is fixed and fragile, while dynamic routing continuously adapts to keep payments approved, customers satisfied, and revenue protected.

Optimise operations with Corefy’s smart routing

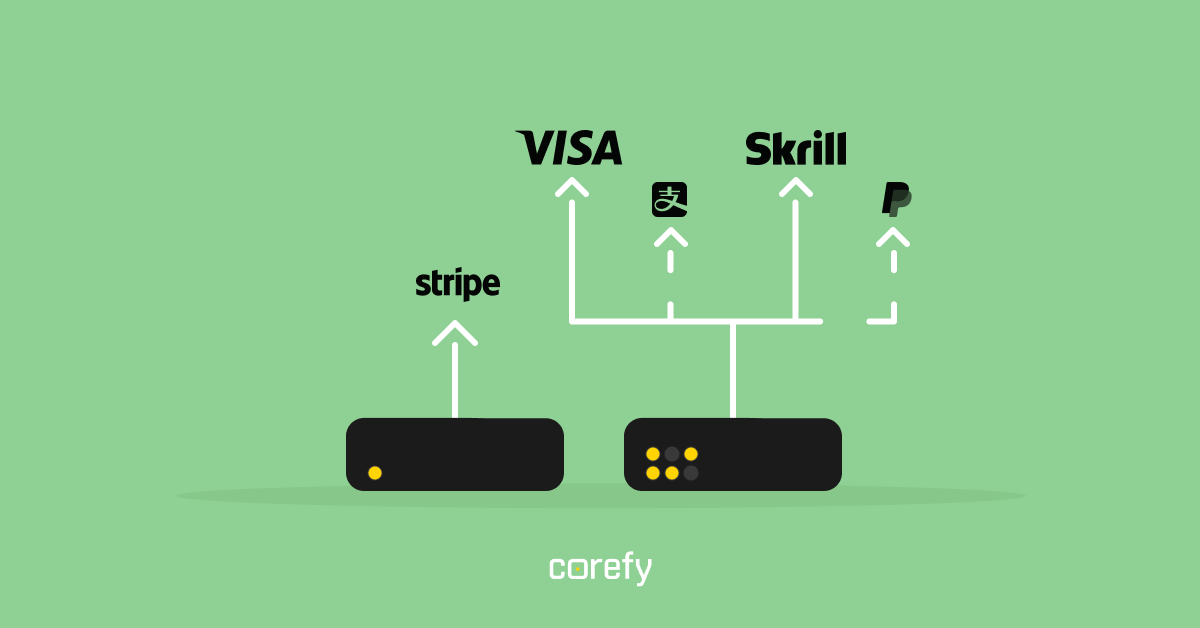

Corefy brings dynamic routing to life. Our smart payment routing engine evaluates every transaction in real time and selects the best route based on more than 100 attributes — including card issuer, brand, country, currency, amount, and any custom metadata you choose to pass. That means you can route discounted purchases through lower-cost acquirers, send high-risk traffic to 3DS-enabled MIDs, or prioritise providers with the highest approval rates at that moment.

Routing strategies are flexible: direct traffic to a specific merchant account, distribute it by priority or weight, or build complex decision-tree logic with cascading and automatic failover. Modifiers let you adjust processing options — like enabling or bypassing 3DS — when certain conditions are met.

If you don’t want to manage hundreds of rules manually, Corefy can apply provider limitations automatically in the background, keeping payments flowing without touching the routing scheme.

In short, Corefy’s smart routing engine helps you increase approvals, reduce costs, and stay resilient even when providers fluctuate — the key advantages of dynamic payment routing.

.png)

.png)

.png)