This article explains what payment operations are, why they matter, and how companies can optimise them to improve performance and the customer experience.

What are payment operations?

Payment operations comprise all systems and workflows that move money in and out of an organisation. In simple terms, they include everything that happens after a customer initiates a payment: authorisation, capture, settlement, reconciliation, fraud prevention, chargeback handling, and compliance checks.

Payment gateways, processors, orchestrators, enterprise resource planning (ERP), and reconciliation tools power payment operations management, ensuring funds are processed accurately and on time. Many businesses use a white-label payment gateway as part of their setup to maintain full brand control and a scalable infrastructure.

Importance of payment operations

For high-volume businesses such as SaaS platforms and financial service providers, payment operations determine how quickly and accurately revenue is collected and how smoothly funds circulate across all channels.

Key reasons why they matter:

- Reliable cash flow and revenue. Failed transactions or settlement delays can disrupt cash flow and strain liquidity. A robust payment operations process ensures predictable inflows, helping businesses plan and allocate resources with confidence.

- Exceptional customer experience. Payment friction is one of the fastest ways to lose a customer. Especially for high-volume businesses, every successful payment translates to better customer satisfaction and higher lifetime value. Delays or limited payment options can derail trust. Well-established payment operations directly improve conversion and retention.

- Fraud prevention and risk management. The ability to detect and prevent fraud within payment flows is critical. Modern payment operations integrate machine learning, anomaly detection, and multi-layer authentication (e.g., 3D Secure) to stop fraudulent activity before it occurs, protecting the business and its customers.

- Scalability and global reach. Managing differences in settlement times, exchange rates, local payment methods, and regional compliance requirements can quickly become overwhelming without the proper infrastructure. A unified orchestration layer with automated currency conversion, dynamic routing, and local payment support enables consistent scaling with full visibility and control over every transaction. Meanwhile, a PCI-compliant payment gateway ensures that global scaling doesn't compromise data protection or compliance requirements.

Core components of the payment operations process

Every payment operation consists of interconnected components. Let's break them down.

(1).jpg)

Payment initiation

It's a step when a customer submits payment details at checkout or when a business triggers a payout or recurring charge. At this stage, key information — such as the amount, currency, payment method, and payer credentials — is collected and sent to the payment gateway or processor. Payment initiation sets the tone for the entire flow: a smooth, well-optimised checkout or invoicing process reduces drop-offs and helps prevent authorisation or settlement errors.

Payment authorisation

Before funds move, authorisation verifies the payer's credentials and checks for sufficient balance or credit. It's a critical step for reducing fraud and ensuring legitimate transactions. Advanced systems use AI-driven risk scoring to approve valid payments faster while blocking suspicious ones.

Payment capture

Once authorised, a payment is captured, meaning funds are secured for settlement. In some industries (such as SaaS or B2B), authorisation and capture may occur at different times to support pre-authorisation or staged billing.

Payment processing

This is where the transaction actually happens — customer funds are captured and transferred. The payment processor routes data between the merchant, card networks, issuing and acquiring banks, and other intermediaries. Speed and accuracy at this stage define the efficiency of your payment operations.

Settlement

Once the payment is processed and approved, the funds move from the customer's issuing bank to the merchant's acquiring bank. This stage finalises the transaction, ensuring the merchant actually receives the money. Settlement timing can vary by provider, currency, or region, but automated payment operations help track and confirm every payout.

Reconciliation

Reconciliation ensures every transaction recorded in your system matches what's settled in the bank. Automated reconciliation tools identify mismatches, detect revenue leakage, and prevent accounting errors, vital for accuracy and audit readiness.

Chargebacks & refunds

Chargebacks happen when customers dispute a transaction through their bank, while refunds are merchant-initiated reversals processed directly to the customer. Managing both effectively requires clear and timely communication and accurate records. Automated refunds streamline this process by triggering reimbursements through integrated systems, ensuring faster payouts and fewer manual steps. Using chargeback prevention tools, such as real-time alerts, 3D Secure authentication, and smart filters, can help identify potential disputes early and stop unnecessary chargebacks before they impact your bottom line.

Fraud prevention

Multi-layered fraud detection systems, velocity checks, device fingerprinting, and behavioural analytics help businesses minimise fraudulent transactions without adding unnecessary friction for genuine customers.

Compliance

Compliance ties all components together. From Payment Card Industry Data Security Standard (PCI DSS) certification to Know Your Customer (KYC) and Anti-Money Laundering (AML) screening, compliance ensures that payment operations meet legal standards and maintain the integrity of your financial ecosystem.

Common challenges in payment operations

Even the most advanced teams face obstacles when managing modern payment flows. Below are key challenges and what they reveal about the current state of payment operations.

Fragmented systems

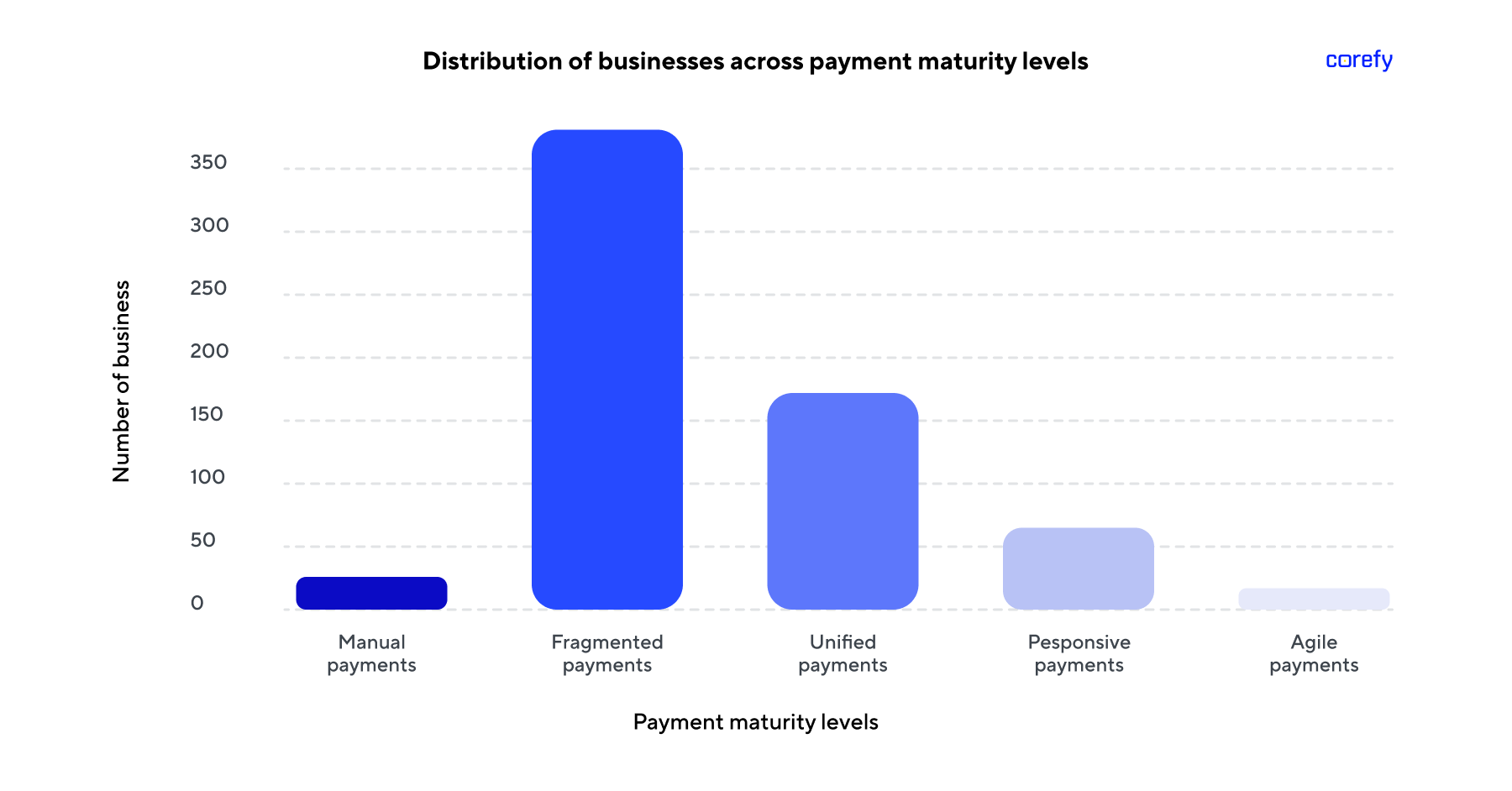

Our Payment maturity research revealed that 59.1% of businesses still operate in the 'Fragmented payments' stage, meaning their payment infrastructure consists of disconnected gateways, PSPs, acquirers, and banking partners.

This fragmentation leads to:

- Data silos and inconsistent reporting that hinder a clear view of total performance.

- Time-consuming manual reconciliation and exports, which introduce human error.

- Limited control and slower decision-making, as data lives in multiple systems and dashboards.

Fragmentation may seem manageable at lower volumes, but as transaction counts and markets grow, it becomes a significant barrier to scalability. Companies stuck in this stage face higher decline rates, more frequent payment disruptions, and slower provider integrations.

Manual errors and operational inefficiency

Human intervention in payment workflows remains a major risk, leading to duplicate entries, mismatched settlement amounts, delayed refunds, or chargebacks.

According to our research of 793 merchants, payment maturity remains strongly correlated with lower failure rates and fewer operational incidents. In other words, organisations that invest in automation and unified systems experience fewer transaction errors, faster settlements, and better control over their cash flow.

Fraud, security threats & escalating risk

McKinsey projections indicate that global payment card fraud losses could exceed $400 billion over the next decade, reflecting not only the expanding volume of digital transactions but also the sophistication of fraud tactics. These risks reach far beyond direct financial losses. Each fraudulent transaction erodes customer trust, inflates chargeback rates, and increases the compliance and reputational pressure on businesses.

Fee and cost optimisation

Processing costs can quietly eat into margins. Between interchange fees, provider commissions, and currency conversion costs, even small inefficiencies can add up to significant losses. Businesses must constantly optimise their payment routing and fee structures — for example, by dynamically selecting acquirers with the lowest fees or the highest success rates in each region.

Multi-currency and cross-border challenges

Handling different currencies, settlement times, and exchange rates adds complexity. Without automated FX management and smart reconciliation, minor rate mismatches can snowball into accounting issues. Businesses also need local acquirers to offer regional payment methods, but connecting and maintaining them manually is resource-heavy.

Conversion and local payment preferences

Failing to support local payment methods like iDEAL, PIX, or digital wallets can immediately reduce conversion rates. The challenge isn't just adding these methods but maintaining cost efficiency, compliance, and consistent reporting across them. To succeed, businesses continuously optimise their payment mix using data to balance cost and success rates.

Chargebacks and dispute management

Disputes and chargebacks pull resources into investigations, evidence submission, and fund reversals, impact merchant fees, and degrade the customer experience. Without monitoring and resolving disputes, businesses face leakage and reputational damage.

Scalability issues as volume grows

For businesses handling high-volume transactions or expanding globally, manual or semi-automated operations can quickly become bottlenecks. Reconciliation backlogs, reporting delays, settlement variation across geographies and currency layers all slow growth. Another way to say it: your payment operations stack must be ready to scale as fast as your business.

Operational risk and downtime

When a payment provider fails, an integration breaks, or settlement is delayed, the business sees tangible revenue impact. And as the global payments ecosystem becomes increasingly interconnected, an issue in one part of the chain can cascade across multiple providers. Payment operations automation plays a key role in reducing downtime risk. Automated monitoring, smart failover routing, and real-time alerts help detect issues instantly and reroute transactions without manual intervention.

Best practices to optimise and automate payment operations

Now, businesses are moving from reactive, manual management to proactive, automated workflows. Here's how to get there.

Automate workflows

By removing manual tasks such as data entry and reconciliation, you reduce errors, improve speed, and save costs. Straight-through processing (STP) enables payments to move from initiation to settlement without human touch, allowing teams to focus on analysis rather than on administration.

Implement payment orchestration

If you work with multiple PSPs or acquirers, payment orchestration is your strategic choice. It streamlines payment operations and eliminates complexity by centralising all payment activities into a single intelligent layer.

Instead of juggling separate integrations, logins, and reports, orchestration gives you a unified system to route, monitor, and optimise every transaction in real time. It allows you to build flexible routing rules that send each transaction through the provider with the best performance, lowest fees, or highest approval rate. When one processor experiences downtime, payments automatically reroute to another, ensuring continuity and customer satisfaction.

In short, payment orchestration turns a fragmented infrastructure into a coordinated ecosystem, empowering your team with greater visibility and control.

Diversify payment methods

Support your customers' preferred payment methods — cards, digital wallets, bank transfers, and local alternatives. For example, by integrating Corefy, you gain access to 550+ ready-made connections with payment providers and methods without having to build or maintain them yourself. If you already have active accounts with these providers, you simply link them in the dashboard and start accepting payments. This approach reduces significant development effort for your teams, freeing them to focus on innovation rather than integration.

Strengthen fraud defence, data security, and compliance

Combine fraud detection tools with clear internal policies to create a strong foundation of trust. Use tokenisation, encryption, and 3D Secure authentication, and regularly review compliance with PCI DSS, AML, and GDPR to ensure your operations stay secure and transparent. Thus, you will reinforce your credibility with customers and partners.

Once your security and compliance layers are in place, focus on operational visibility. Automated reconciliations ensure every transaction is verified daily, while real-time dashboards help you monitor approval rates, settlement times, and refund ratios. By combining automation with continuous monitoring, you can detect anomalies early, prevent issues before they escalate, and continually improve your payment operations with data-backed decisions.

Choose reliable partners

Your providers determine your reliability. Prioritise uptime, regional coverage, support quality, and integration flexibility over price alone. A strong partner ecosystem helps reduce operational risk.

The future of payment operations

Here's a look at the key trends shaping payment operations through 2026 and beyond.

- AI, automation & data intelligence. AI and machine learning can spot suspicious behaviour long before humans, help predict and prevent fraud, and even make automatic decisions about routing and reconciliation. For teams, this means fewer manual tasks, fewer errors, and faster payments overall. As these technologies evolve, they'll take on more complex tasks, including chargeback management, fraud monitoring, predictive reconciliation, and smart payment routing.

- Blockchain & cross-border transformation. Blockchain and distributed ledger technologies (DLT) cut processing times from days to seconds and create tamper-proof transaction records that enhance trust and transparency. We'll see more businesses use decentralised systems and smart contracts to settle transactions securely and automatically across borders — a leap toward instant, low-cost global payments.

- Open banking & API-driven ecosystems. Open banking and APIs facilitate connecting financial systems with the rest of the digital world. Businesses can instantly plug directly into payment providers, banks, and apps. This means new ways to pay, new revenue streams, and smoother customer experiences. For payment teams, it's also less time spent on technical integrations and more time focusing on performance.

- Real-time payments become the norm. The move toward real-time payments (RTP) continues to accelerate. Markets such as India, Brazil, and the UK are leading the way, proving that 24/7 instant payment systems can scale securely. By 2028, analysts expect the number of instant payments to grow to almost 30 billion, offering businesses and consumers faster access to funds and improved cash flow visibility.

- Biometric security & RegTech. Biometric authentication, such as fingerprint, face, or voice recognition, is making payments safer and easier for users. At the same time, RegTech tools are helping businesses stay compliant automatically by monitoring transactions, flagging risks, and adapting to regulatory changes on the fly.

Optimise your payment operations with Corefy

Efficient payment operations management is a necessity for growth. With that in mind, our platform brings all your payment data, methods, and partners into a single dashboard, giving you complete visibility and control. Partnering with us, you connect to hundreds of payment providers and methods, and automate every stage of the payment lifecycle from routing to reconciliation.

With Corefy, you can:

- Optimise payment routing for higher success rates and lower fees.

- Automate reconciliation and settlement across PSPs and currencies.

- Reduce fraud through built-in risk management and compliance tools.

- Scale globally with faster integrations and multi-provider support.

Whether you're scaling a SaaS product, managing a high-volume marketplace, or expanding into new markets, with the right systems and partners, your business can turn payment complexity into clarity, building a foundation for sustainable growth and better customer experiences.

.png)

.png)

.png)