Payment stacks are getting bigger: more providers, more markets, more payment methods, and more operational load. The question is no longer ‘can you connect?’ but ‘can you manage change without chaos?’

To put real numbers behind that shift, we pulled out 6 key payment stats that reveal how payment setups are evolving, and which capabilities separate scalable setups from fragile ones.

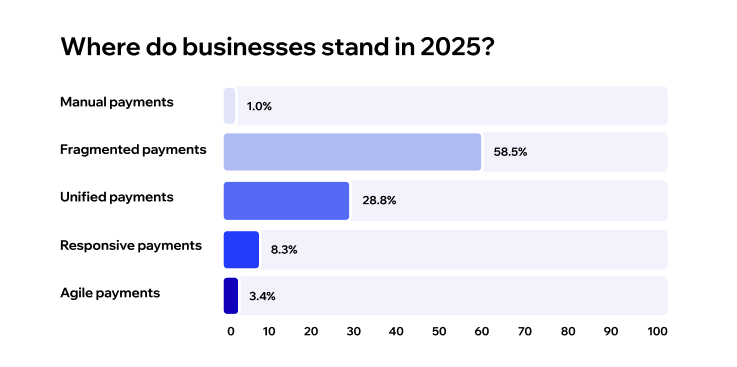

58.5% of businesses still run fragmented payment setups

Despite years of payment stack innovation, fragmentation remains the default. According to 'The state of payment maturity 2025' report by Corefy, nearly 6 in 10 still rely on disconnected payment providers and workflows.

Fragmented setups typically mean:

- Separate logic per provider

- Inconsistent reporting and reconciliation

- Slower changes and higher operational overhead

Why it matters: fragmentation in payment processing can create technical debt and limit optimisation. Businesses struggle to improve approval rates, launch new payment methods, or react quickly to provider issues.

Only 11.7% of businesses have reached truly adaptive or agile payments

The same Corefy’s research found that true adaptability remains rare:

- 8.3% operate responsive payment systems

- 3.4% have reached agile payments

That means fewer than 1 in 8 businesses can actively adapt routing, optimise acceptance, and iterate on payment performance without heavy engineering effort.

Why it matters: in 2025, stability comes from adaptability. If every improvement needs engineering and long lead times, you’ll be slower to react, and your approval rate will reflect it.

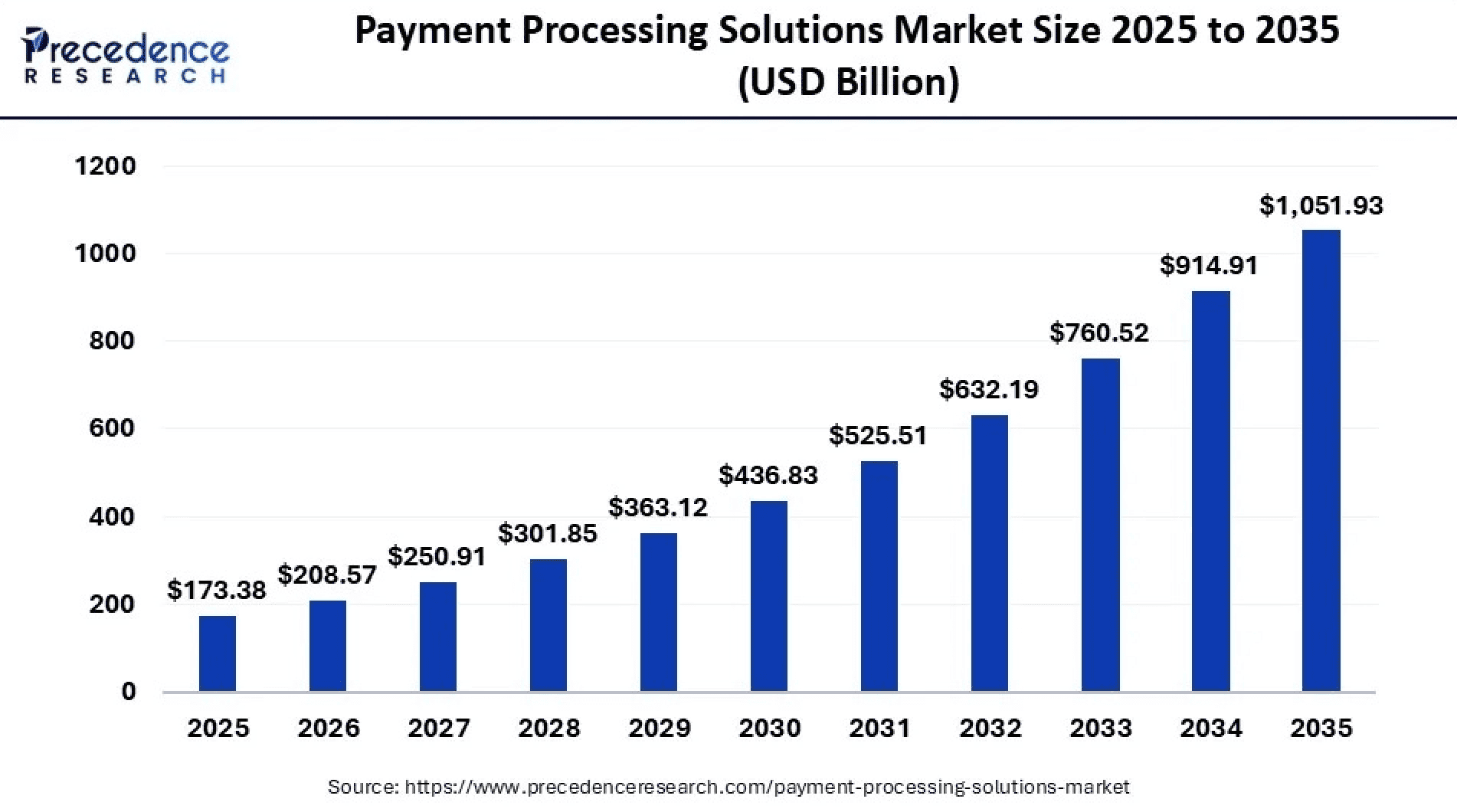

The payment processing market is set to grow at 19.76% CAGR (2026–2035)

According to market estimates, the global payment processing solutions market is entering a rapid growth phase. It was valued at $173.38 billion in 2025 and is projected to reach $208.57 billion in 2026.

By 2035, it’s expected to reach approximately $1,051.93 billion, with a projected 19.76% CAGR.

Why it matters: the payment processing market is scaling faster than most internal payment stacks can handle on their own. As volumes grow and payment ecosystems expand, how payments are managed becomes just as important as how much is processed.

Basic payment acceptance fell from 46.7% to 38.5% in 2025

One of the clearest shifts in online payment stacks is the steady decline of basic, one-step payment acceptance. Based on Corefy's survey of 672 businesses, only 38.5% of companies relied on basic acceptance alone in 2025, down from 46.7% in 2024 — a drop of 8.2 percentage points, signalling a move toward more advanced payment capabilities.

Why it matters: As volumes grow, basic payment acceptance becomes a limiting factor. Teams that rely on it struggle with revenue leakage, operational friction, and slower optimisation, while more mature setups treat payments as a full transaction lifecycle — from authorisation to refunds and chargebacks.

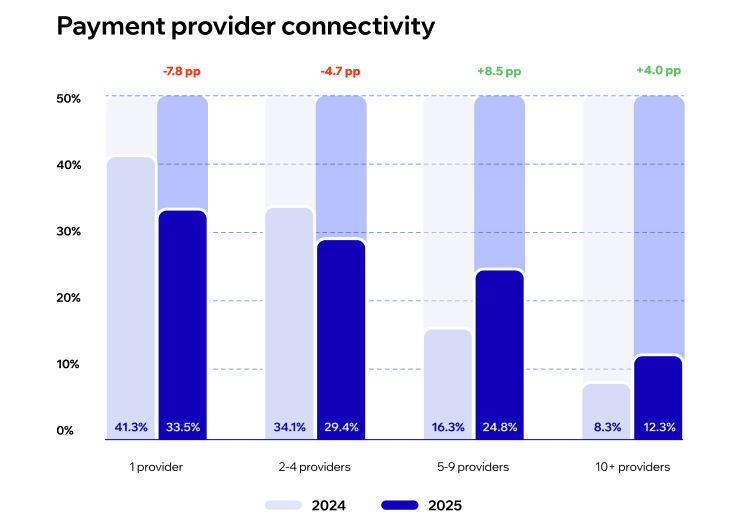

Single-provider dependency dropped to 33.5% in 2025

One of the clearest digital payment trends in 2025 is the decline of single-provider setups. Corefy’s research on payment maturity revealed:

- 33.5% rely on just one payment provider (down from 41.3%)

- 37.1% now operate with 5 or more providers

Why it matters: Businesses are moving beyond basic redundancy. Multi-provider strategies are increasingly used for geographic coverage, performance optimisation, and risk control — not just backup.

Wallets are becoming the default: +35% users by 2030

Juniper Research projects a 35% increase in global digital wallet users over five years — from 4.4B in 2025 to 6B+ by 2030, surpassing three-quarters of the world’s population.

Why it matters: wallets often outperform cards in specific markets and use cases. As adoption increases, offering the right wallets and optimising their performance becomes a direct lever for improving checkout conversion.

For payments ops, this is a signal that wallets must be handled as first-class rails: integration speed, routing logic, monitoring, and failure handling need to keep up.

More than 27% of businesses need months to integrate new payment providers

Integration speed remains one of the strongest indicators of payment maturity. Based on unique statistics collected by Corefy:

- 28.3% of businesses need weeks to add a new payment provider or method

- 27.8% require major projects or several months

Why it matters: long cycles are usually a symptom of fragmentation: inconsistent states, custom flows per provider, and scattered reporting. That combination slows every improvement you want to make.

Get the full picture behind the 2025 payment trends

Based on 672 real-world business responses, The state of payment maturity 2025 combines payments data with digital payment trends to reveal how teams are running and scaling their setups.

It includes 100+ data points, clear visual breakdowns, and expert takeaways that explain how payment stacks evolve as volume, provider count, and market reach increase. You’ll see where most businesses struggle, which capabilities signal real maturity, and how leading teams manage payment complexity without slowing down.

.jpg)