Top payment statistics that define highly regulated industries in 2025

.png)

.png)

The global high-risk payments market reached $46.2 billion in 2024, and it’s not slowing down. The market is showing strong momentum as more commerce moves online and more sectors fall under stricter oversight, with a 13.5% CAGR projected from 2025 to 2033.

Growth, however, doesn’t automatically mean maturity. To understand what payment operations look like inside this environment, we analysed 147 completed assessment quizzes from businesses running complex payment setups in compliance-heavy sectors. This is proprietary research based on structured quizzes that evaluate provider strategy, routing maturity, localisation, monitoring visibility, and operational resilience. Dive in!

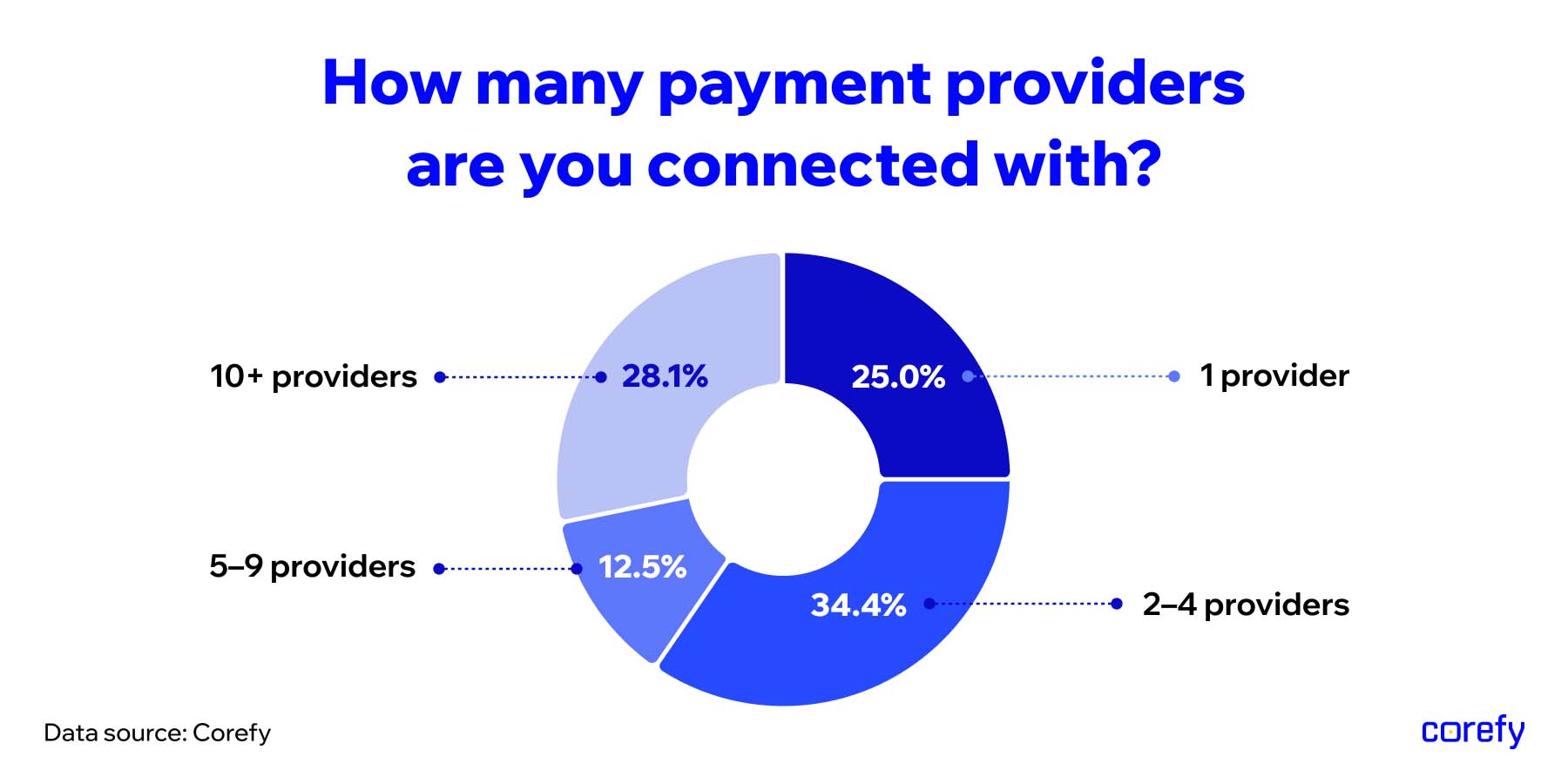

Based on Corefy's survey, 75% have of high-risk businesses have moved beyond single-provider setups, with 28% running 10+ provider stacks. Merchants in regulated sectors often diversify providers to manage regional constraints, reduce exposure to policy changes, and improve approval rates across corridors.

However, as provider portfolios grow, operational complexity increases just as quickly. Without a clear control layer, diversification can lead to fragmentation: separate reporting, inconsistent routing logic, and reactive rather than strategic optimisation.

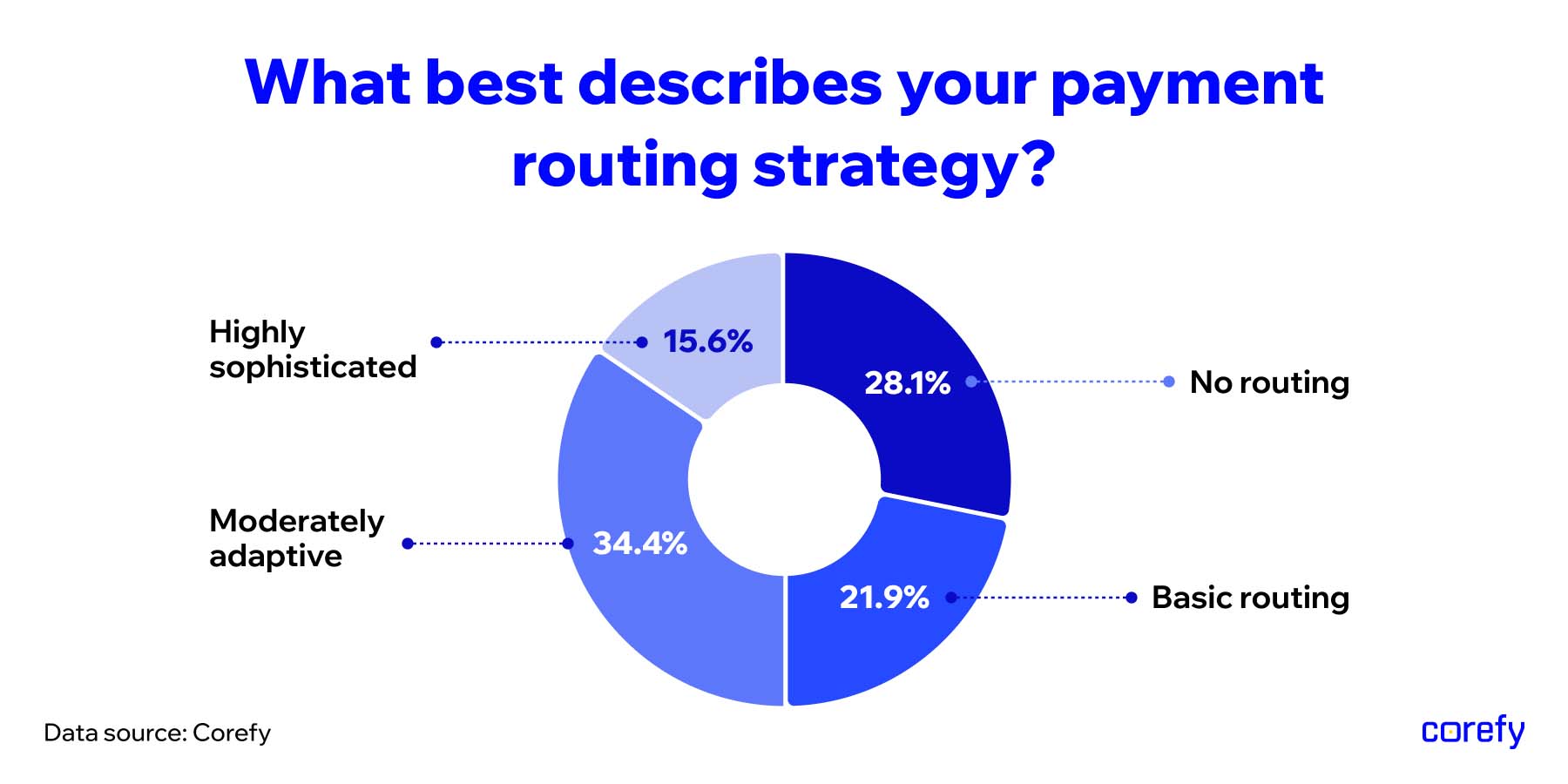

Despite having complex payment setups, routing strategies are often surprisingly basic: 28.1% don’t use routing at all, and only 15.6% have highly sophisticated routing in place.

Many businesses build a large provider set, then still run payments through near-default flows. That means they carry complexity (more integrations, more reporting, more ops) without capturing the upside (better approvals, smarter cost control, faster recovery from issues).

If routing isn’t performance-aware and configurable, multi-provider becomes ‘multiple points of integration’ rather than a controlled optimisation system.

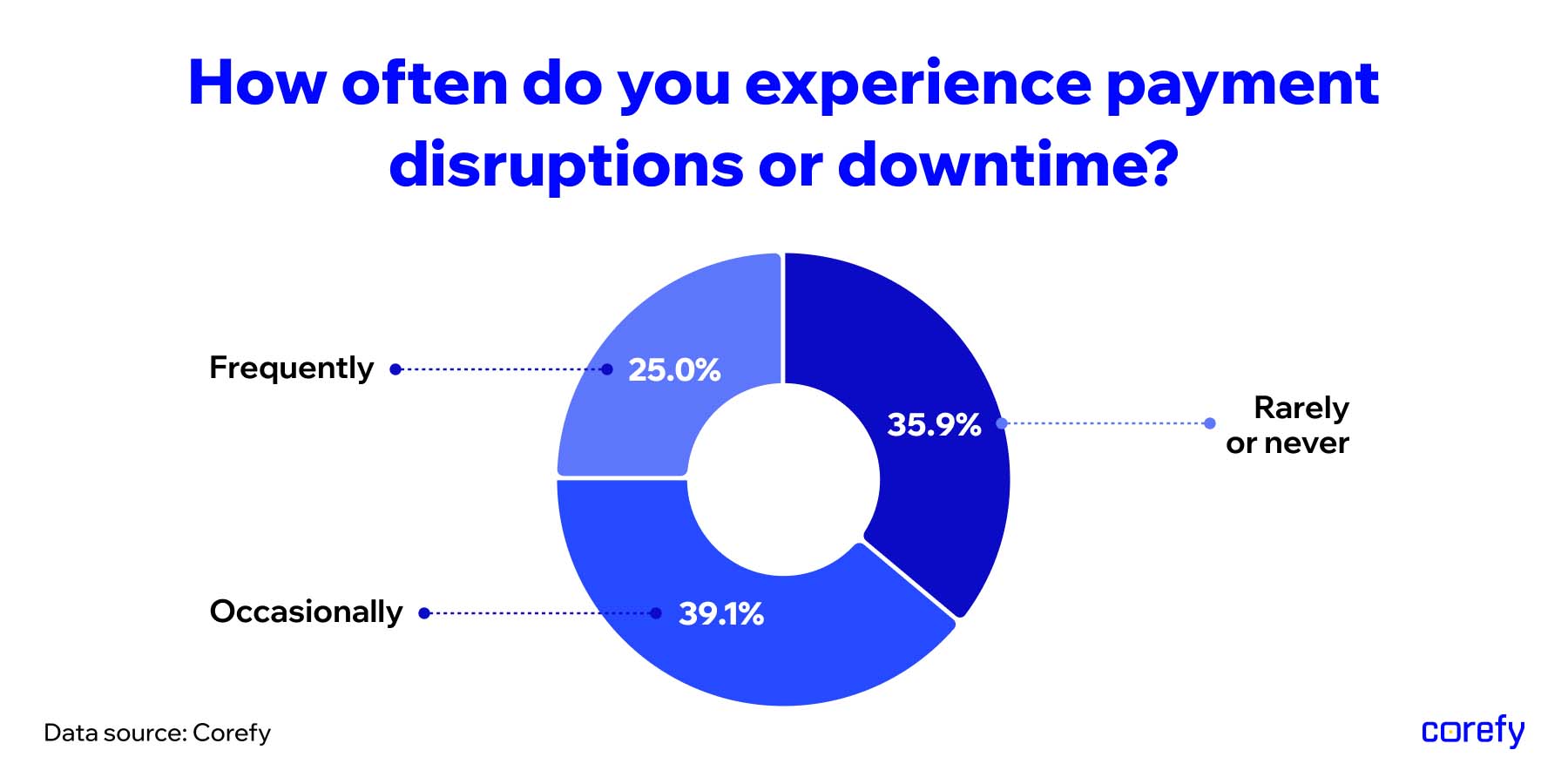

One in four enterprise merchants with complex payment setups reports frequent payment disruptions. It’s a strong reminder that resilience is not guaranteed even with multiple providers.

Downtime is rarely a vendor problem. It’s typically driven by resilience shortcomings: poor visibility into issues, unprepared failover, slow incident response, and relying on a single processing route for each market and payment method.

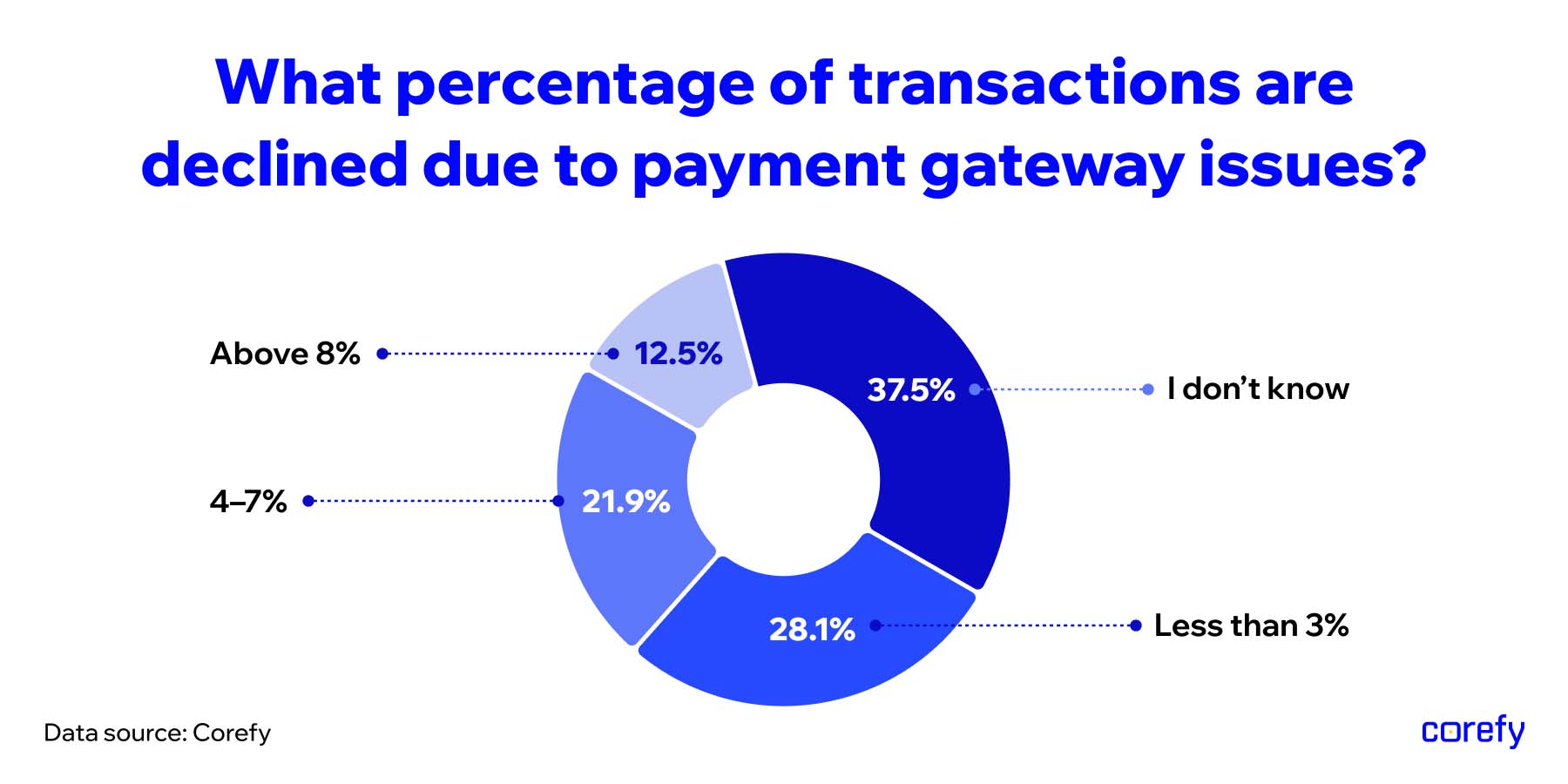

Corefy’s proprietary data shows that visibility is the real warning sign: 37.5% can’t estimate gateway-driven declines. In most cases, that means decline causes aren’t being classified cleanly — whether the failure came from the provider layer, issuer decisions, fraud tooling, or the checkout flow — which makes optimisation reactive instead of measurable.

Among businesses that can quantify it, 12.5% report gateway-related decline rates above 8%, a level that typically warrants dedicated investigation and remediation.

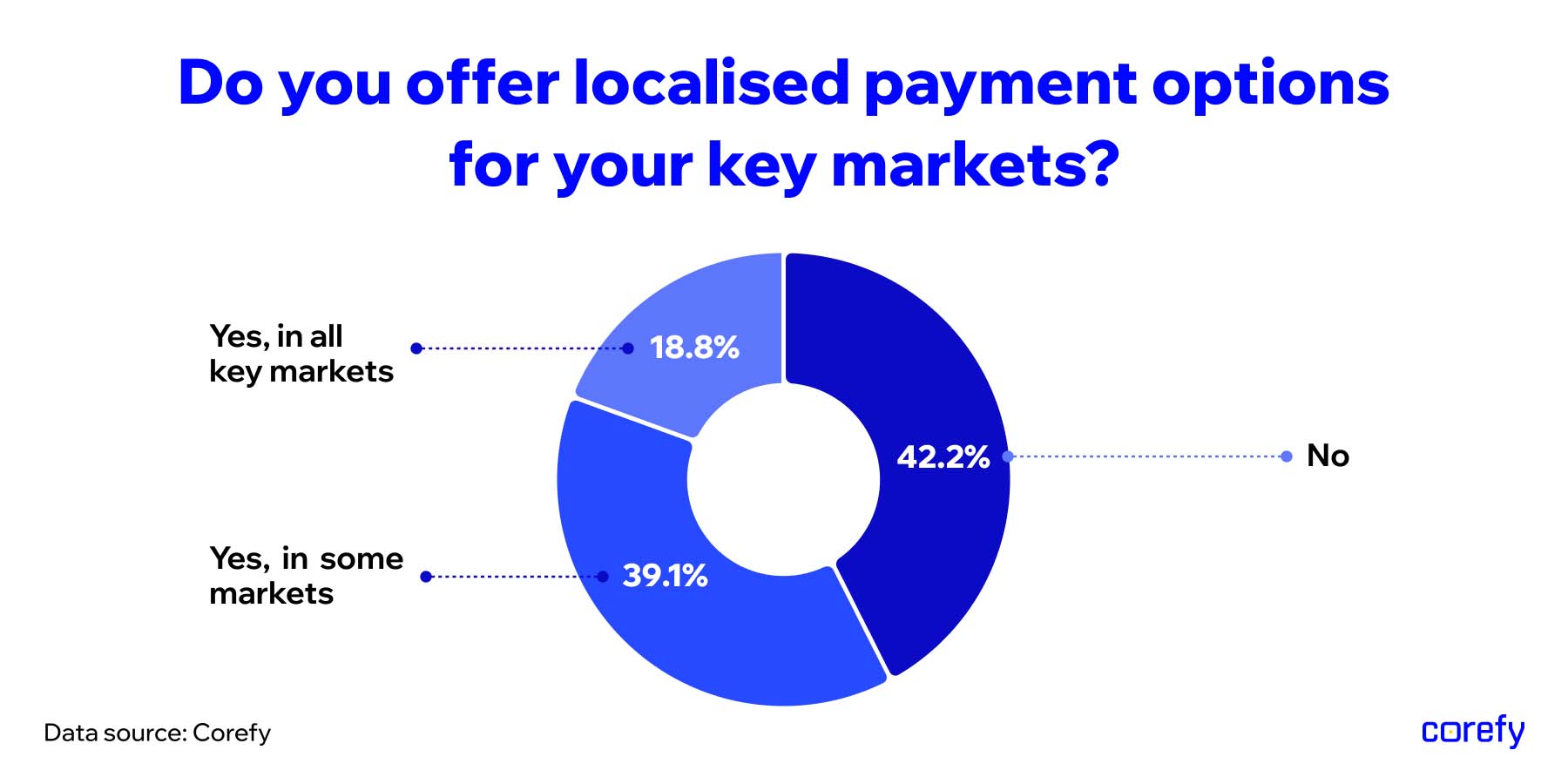

External research is clear: pricing in local currency influences purchase decisions for most consumers. Our data on highly regulated businesses adds an uncomfortable second half: localisation is often missing in practice. Only 18.8% or respondents support local options in all key markets, while 42.2% don’t localise at all.

If you're reviewing routing, redundancy, or provider strategy, the numbers help. In ‘The state of payment maturity 2025’, we analyse 672 global businesses and compile 100+ data points on payment stacks — what teams run, how they manage complexity, and where performance gains are still untapped. Use it to benchmark your current approach and prioritise your next improvements.