Even a slight drop in your payment conversion rate can result in thousands of lost revenue, frustrated customers, and declining trust.

In this article, you'll discover proven ways to boost conversions that we’ve drawn from our hands-on experience with clients across various industries and backed by insights from our payment experts.

Proven strategies from real client cases

Improving payment conversion isn’t just about theory — it’s about real-world solutions that actually work. In this section, we'll walk you through practical strategies that helped our clients across industries boost their success rates. Each case highlights a specific challenge and the approach we used to overcome it.

Adapting to regional payment habits

Your clients' geographical location has a profound impact on payment conversion rates due to differences in financial infrastructure, banking penetration, and cultural payment habits.

To increase conversion across all your target markets, it's vital to support local payment habits and provide fallback options tailored to each region and currency. That's why we offer a list of 500+ integrated PSPs and continually add new ones. Connect any of them, enter your credentials, and you're ready to go. Also, if the necessary provider is not yet on our list, we can integrate it on your request.

We added one more provider as a fallback and configured the cascading rule for dollar payments: if the first provider is experiencing downtime, the system reroutes the transaction to the second one. Having an alternative is a must to hedge your transactions.

Fixing hidden checkout UX issues

Your payment page design, speed, and functionality are key to achieving high payment conversion rates. Even if a customer has a strong intent to buy from you, friction at checkout can cause them to abandon the payment process.

A confusing, slow, or cluttered checkout experience increases the likelihood that users drop off before submitting their payment, meaning their transaction never even reaches the authorisation stage.

Since a new payment invoice was created each time a client clicked the 'Pay' button, only one out of many payment invoices was paid. We brought the issue to the client's attention and explained how to fix it. As a result, the conversion rate has levelled out.

A well-designed payment page strikes a balance between usability and security. It should be fast, intuitive, and flexible to ensure more customers complete their transactions and more payments successfully go through authorisation.

Eliminating invisible blockers in high-risk payments

While monitoring one of our major gambling clients' payment performance, their Customer Success Manager noticed a sharp decline in payment approval rates. After analysing all possible causes, they confirmed that everything was functioning correctly on both the client's and our sides. However, if we identify any issues, we always step in to provide assistance and investigate the reasons.

This case illustrates how minor details can lead to significant payment issues, impacting conversion rates, and how proactive monitoring helps identify and resolve hidden roadblocks.

Tools and features to increase payment conversion rates

Based on years of experience, we have developed a suite of features that work together to enhance your payment approval rates and improve the efficiency of your revenue streams.

Smart payment routing & cascading

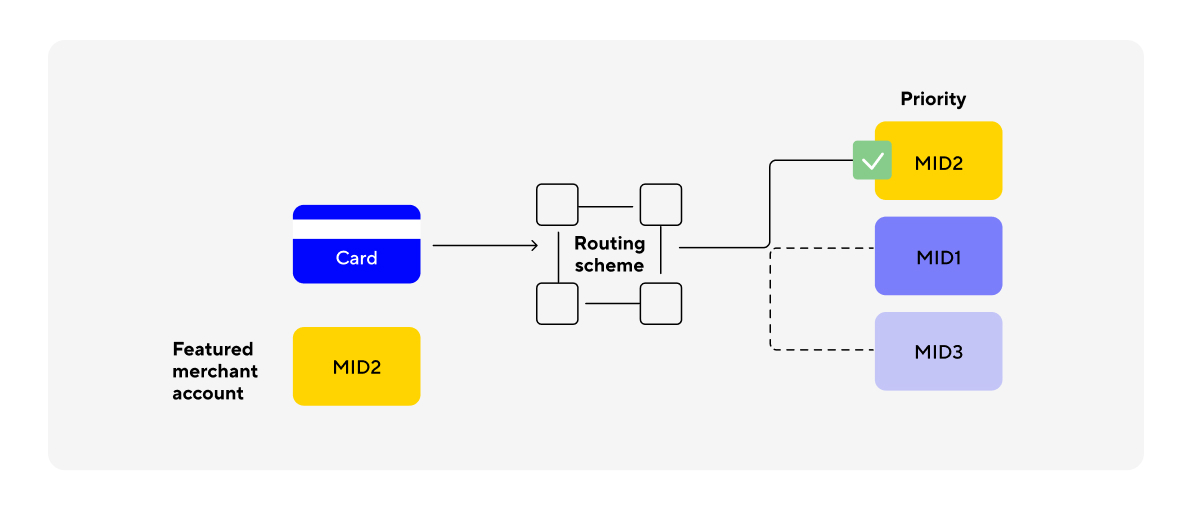

Our payment routing and cascading engine helps process transactions through the most efficient providers, increasing approval rates and minimising declines. The system dynamically selects the most suitable payment provider based on location, currency, past success rates, and other factors. While cascading automatically retries declined transactions through alternative providers to maximise approvals instead of letting payments fail outright.

Card bindings

We created card bindings explicitly for the needs of high-risk businesses, including those in the gaming industry. Payment processors often have stricter requirements for high-risk projects, resulting in a higher rate of declined card transactions.

Card bindings help by linking customer cards to the most successful MID based on previous transactions. This means that every time a returning customer makes a payment, their transaction is routed through the best-performing payment provider, resulting in fewer declines and higher conversion rates.

Customisable checkout

With us, you can offer your clients a seamless, branded checkout experience with custom design and fields that enhance customer trust, minimise drop-offs, and reduce payment failures.

Our hosted payment page supports full visual and functional customisation, so it feels like a natural extension of your product, not a third-party redirect. You can tailor payment flows by region, device, or customer type, ensuring every user gets the smoothest path to payment.

Bonus strategy: get practical help from a dedicated payment team

Managing payment performance on your own can be overwhelming, especially when working with multiple providers. It takes time and experience to determine what to track, where issues are likely to hide, and how to optimise conversion.

From the moment you onboard with Corefy, we assign you a dedicated Customer Success Manager, whose role goes beyond simple support. They act as experienced payment partners, helping you track and enhance your payment performance and conversion rates across all providers and projects.

Here's how they help:

- Set up your payment dashboard. A manager will assist you in configuring your Corefy Dashboard, which allows you to monitor all payment performance metrics in one unified space.

- Manage provider communication. They keep in touch with your payment providers to stay updated on parameter changes, restrictions, transaction limits, and compliance updates, ensuring your setup remains fully optimised.

- Help configure and optimise your payment routing & cascading schemes to reduce failures, safeguard against provider downtimes, and adapt to regional limitations.

- Advise on payment page UX improvements that potentially influence conversion. Your manager analyses your checkout flow efficiency and helps optimise it to eliminate friction points that may be causing drop-offs and spoil success rate metrics.

- Help protect your transactions from fraud-related declines. By setting up custom routing filters (e.g., blocking a user after three unsuccessful attempts to pay for 24 hours), your dedicated manager will block fraudulent attempts that could inflate failed transaction rates.

- Continuously monitor and resolve issues. They detect issues before they start impacting your revenue and offer strategies to improve based on their findings.

Why businesses experience different results

Payment conversion success isn't about hitting an industry average. Each business has its own ceiling, shaped by unique factors. With some, we’ve achieved 30+% conversion growth, while with others, even a 5% improvement made a noticeable difference. Why so? The results depend on the industry, region, existing setup, and specific challenges:

- Different starting points. Some businesses have critical issues to address, while others are already nearing their optimal performance. As a result, the highest attainable payment conversion rate will always vary, depending on the existing setup, context, and potential for growth.

- Varied industry challenges. High-risk industries, regional regulations, and customer behaviour all impact payment conversion rates differently. If your business operates in a high-risk sector or regions with low banking and internet penetration, conversion rates may be naturally lower.

- Checkout quality and business-side factors. Factors like checkout UX/UI, security protocols, and your technical setup also impact conversion rates. Our experienced account managers provide expert tips on improving these elements to help you enhance overall success.

We take the hassle out of payment monitoring and optimisation, ensuring higher success rates and smoother transactions for your business.

Key takeaways

Reaching a high payment conversion rate is tough. Keeping it high over time is even tougher. With 15+ years of experience working across various industries and business sizes, we understand what it takes to achieve and sustain strong results, and we’re here to help you.

Here’s how we can support you:

- Help spot and fix hidden UX problems that silently hurt conversion.

- Improve payment success rates by choosing better-matching payment providers.

- Set up smart routing and cascading to recover failed transactions automatically.

- Tailor checkout flows to local user habits and reduce drop-offs.

- Prevent avoidable declines with custom fraud detection and retry logic.

Book a quick call to find out how we can help you spot growth opportunities and fine-tune your setup.

.png)

.png)

.png)

.png)