Mobile checkout UI: principles, best practices & optimisation tips

Mobile checkout UI is where online sales are won or lost. On a small screen, every extra tap, field, or delay is amplified, and so is the impact on conversion. The good news is that checkout performance is highly design-sensitive – even modest UI improvements can increase checkout conversion quickly.

Below is a practical guide to designing mobile checkout interfaces that reduce friction and increase payment completion rates with expert advice from our UX/UI Designer.

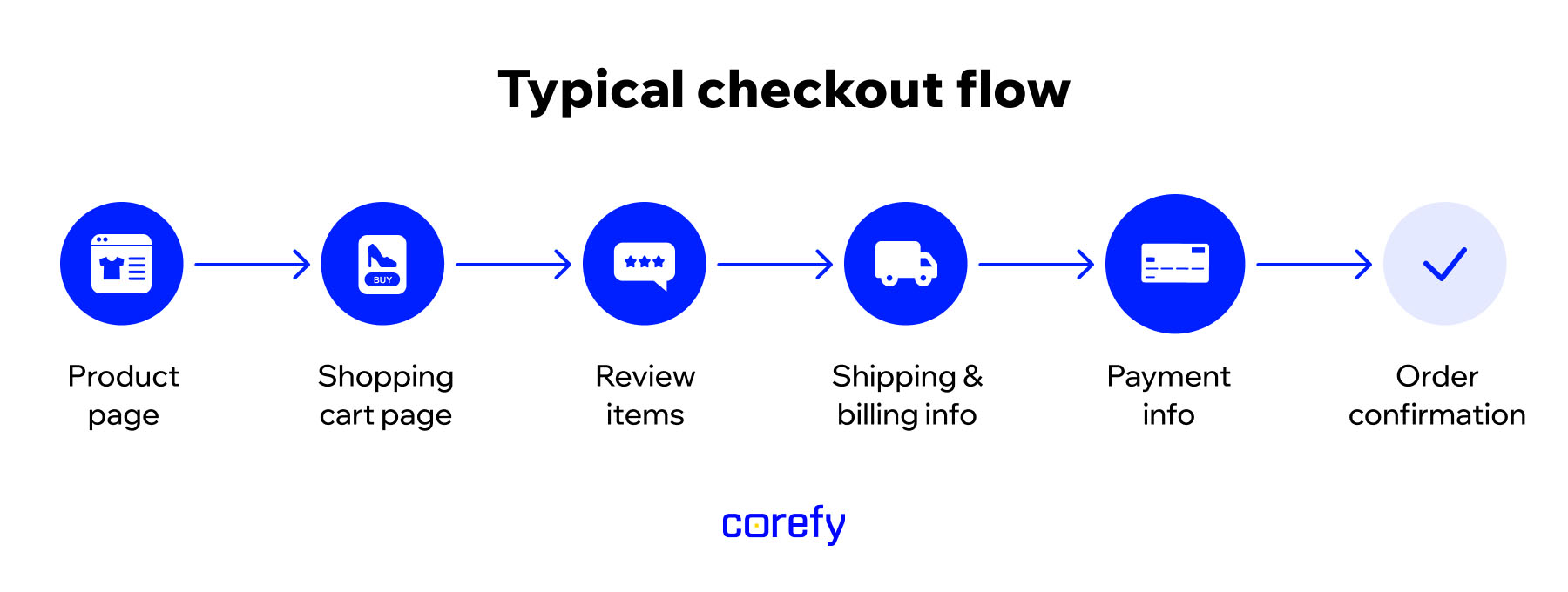

Mobile checkout UI is the set of screens, layouts, and interactive elements on a mobile website or app that guide a customer through paying on a smartphone or tablet. It's everything the user sees and touches during checkout — from the order summary and input fields to payment method selection, error messages, progress indicators, and trust cues — all designed to make payment fast, clear, and low-effort on a small screen.

Mobile checkout itself is the full process that runs behind that interface. It includes order and invoice creation, payment processing, authentication such as 3D Secure (3DS), integrations with payment providers, and post-payment actions once the user taps 'Pay'.

A simple way to think about it:

Mobile checkout = what needs to happen for a payment to succeed

Mobile checkout UI = how that process is presented to the user

You can have a technically sound mobile checkout that still converts poorly if the UI creates friction. And you can have a great UI that underperforms if the checkout logic or payment stack behind it is rigid or unreliable. High-converting mobile checkout requires both to work together.

Mobile is the primary channel for browsing, comparing, and buying. It makes the mobile checkout user interface a vital revenue lever for businesses. It directly controls how much of your mobile demand turns into real revenue.

Here's the practical breakdown of why mobile checkout optimisation makes sense:

Across sectors such as e-commerce, SaaS, and high-frequency mobile services, mobile checkout is the point where intent turns into revenue. If the UI adds friction, you lose sales you already paid to acquire; if it feels fast and effortless, you capture more first-time purchases and make repeat buying a habit.

Mobile checkout user interface design centres on creating a payment experience that prioritises user efficiency and security. The core elements work together to guide users from cart to confirmation, and the most effective checkout solutions often share the building blocks we listed below. Your layout can vary, but each element must clearly perform its role.

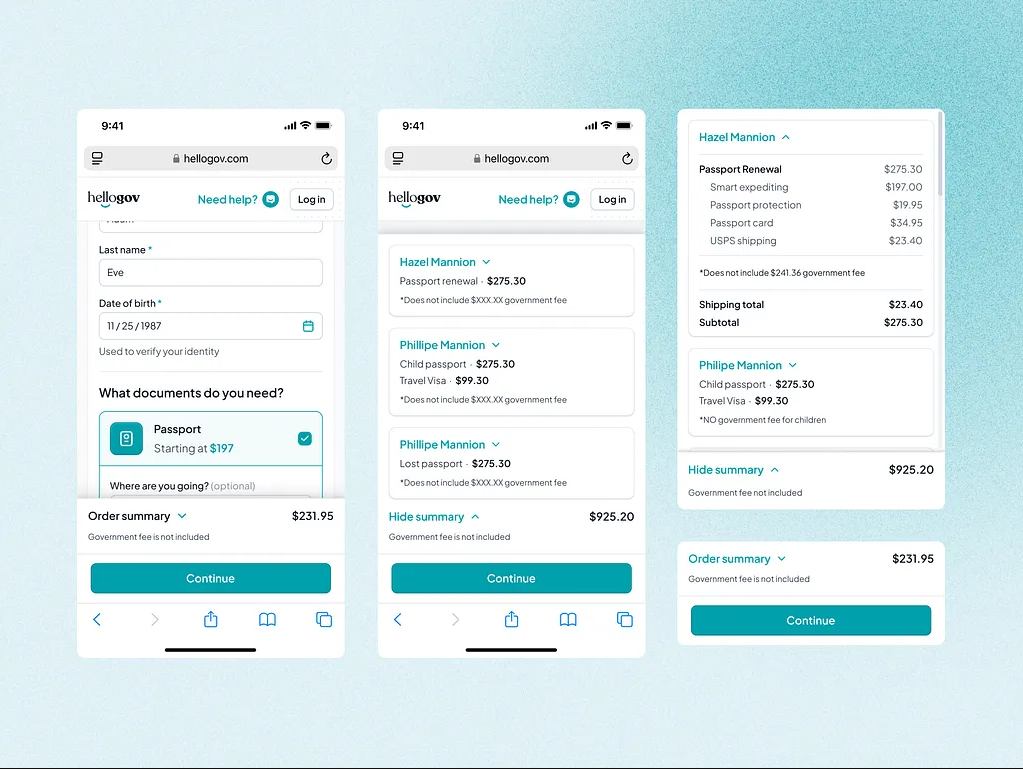

Pin it to the top of the page, make it expandable or collapsible, and display product names, prices, quantities, and the final total. Pricing should be transparent and upfront, including itemised costs, shipping charges, and taxes to prevent checkout surprises. If anything feels hidden or unclear, users pause and pausing on mobile often means leaving.

Let users enter only the essentials, such as name, phone/email, address, and notes, with minimal typing through autofill, address lookup, and smart defaults. Then allow them to pick from a clearly differentiated list of shipping options by cost and speed, with the best choice labelled and explained; and finally, show a clear estimated delivery date or range so they know what to expect.

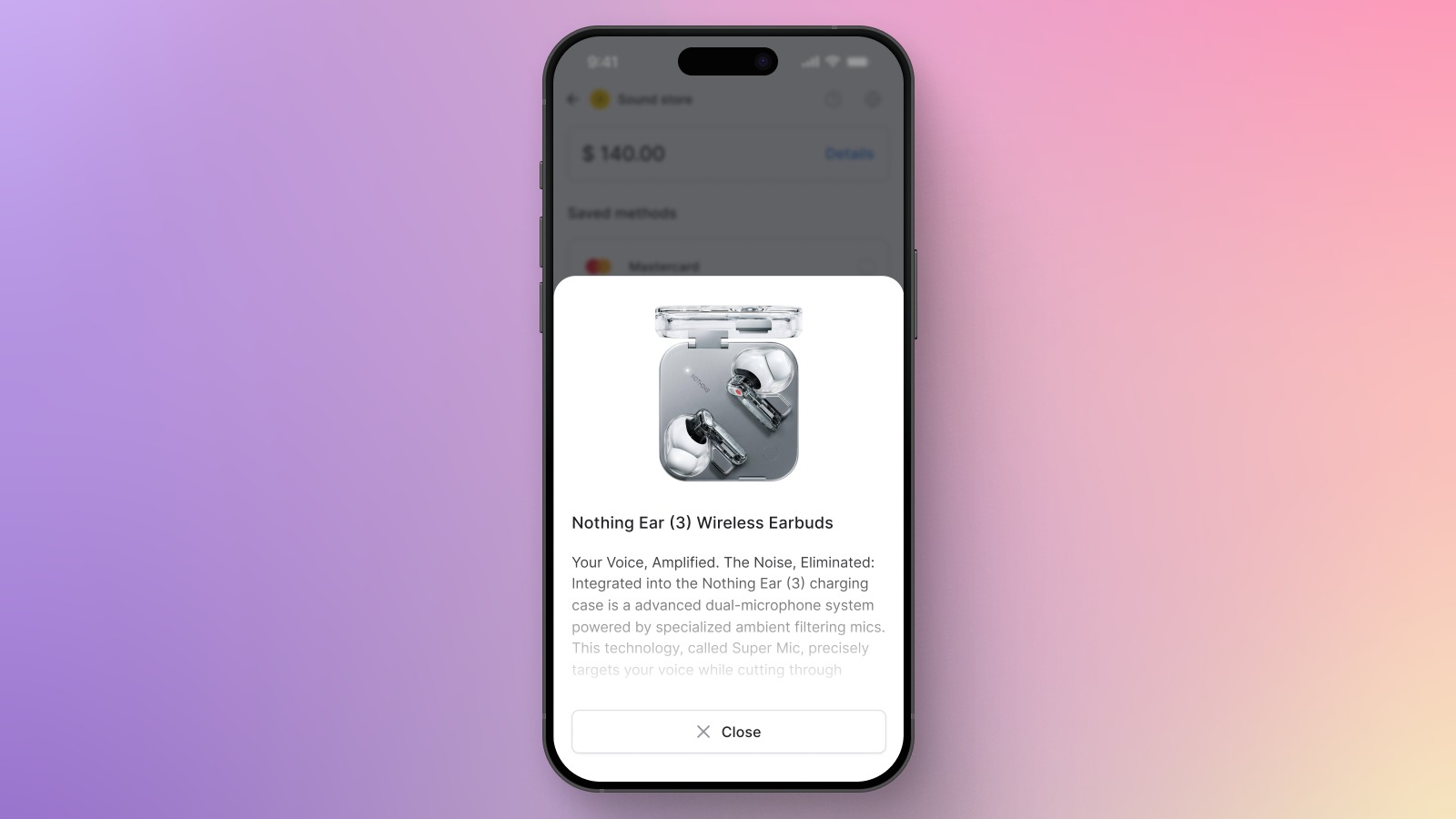

Breaking the checkout flow by requiring users to navigate back to the cart page creates friction and increases the risk of drop-offs. Each step away from the checkout destination increases the likelihood of cart abandonment. Allow users to review product details, change quantities, remove items, apply discount codes, or go back a step without losing progress.

Use recognised payment logos (Visa, Mastercard, Apple Pay, Google Pay, PayPal), a brief 'Secure checkout' or PCI-compliance message, and an HTTPS/lock icon. Also, offer help where doubts appear: quick access to returns/refunds and delivery policies, concise FAQs, and a visible way to contact support or open live chat without leaving the flow.

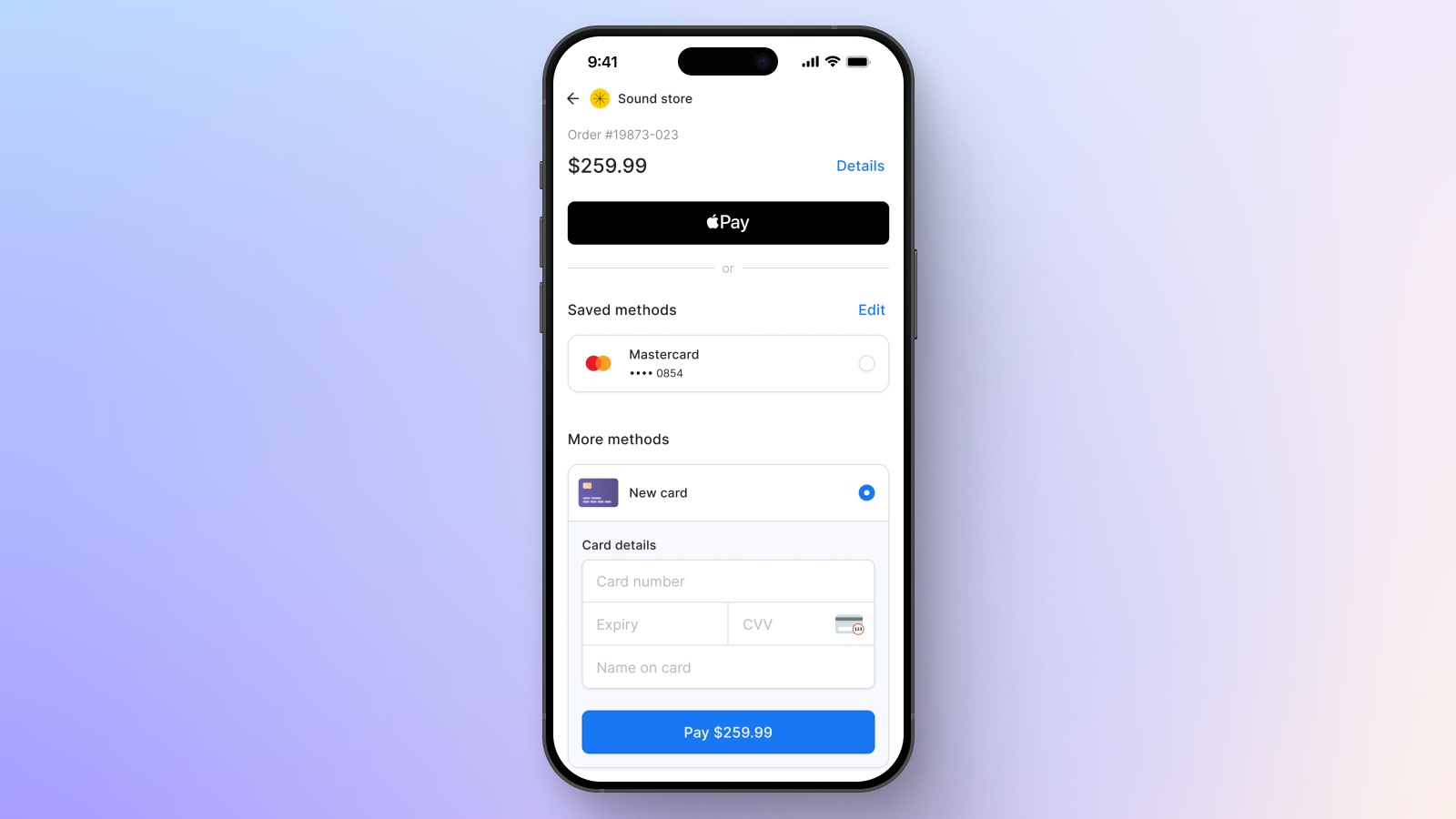

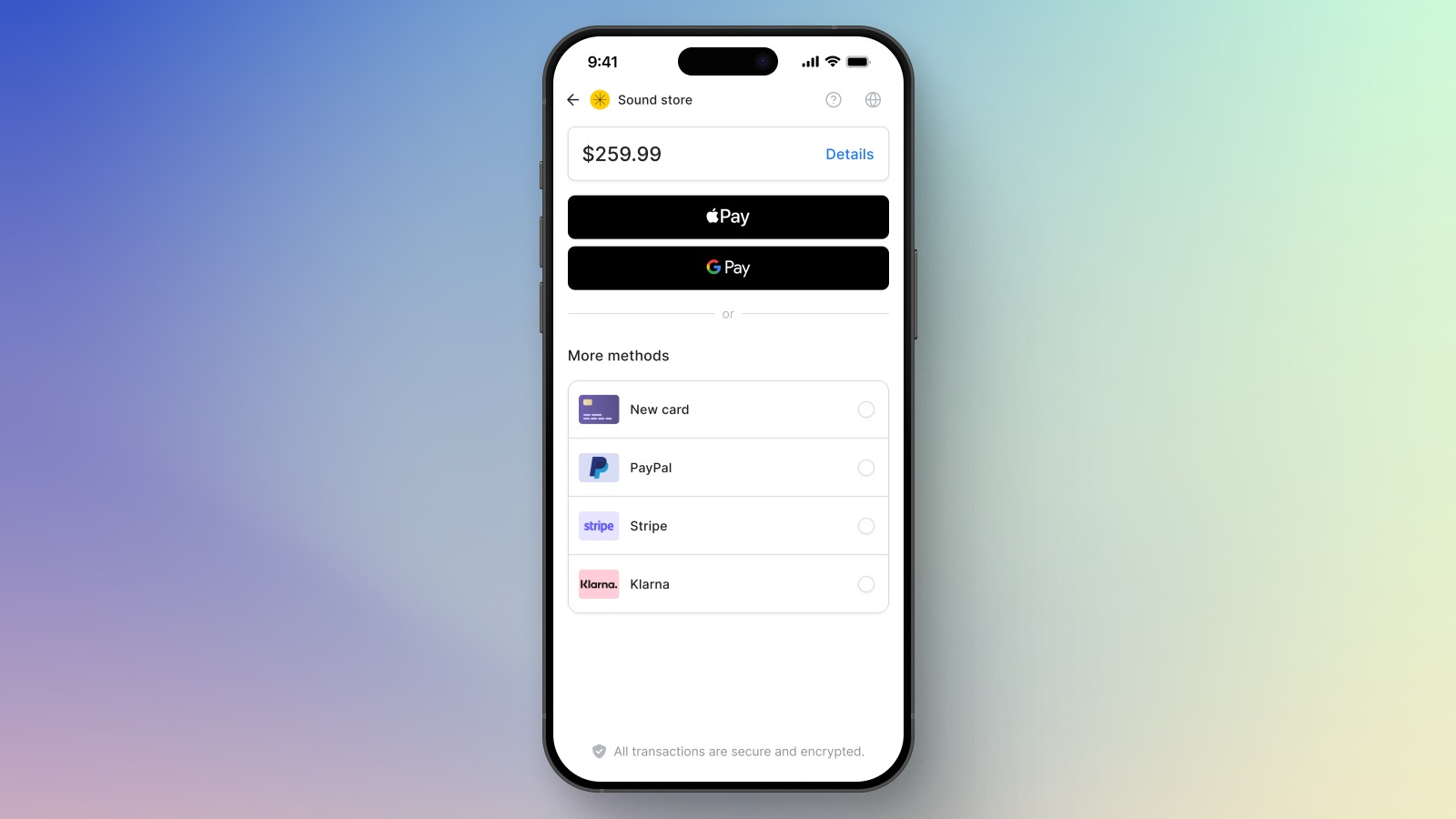

The UI must present the most relevant options first and clearly indicate how to pay with the selected option. Feature express checkout methods such as Apple Pay, Google Pay, PayPal, and 1-2 regional options (e.g., Klarna and buy-now-pay-later services) with clearly visible, recognisable icons, ideally before traditional card entry forms.

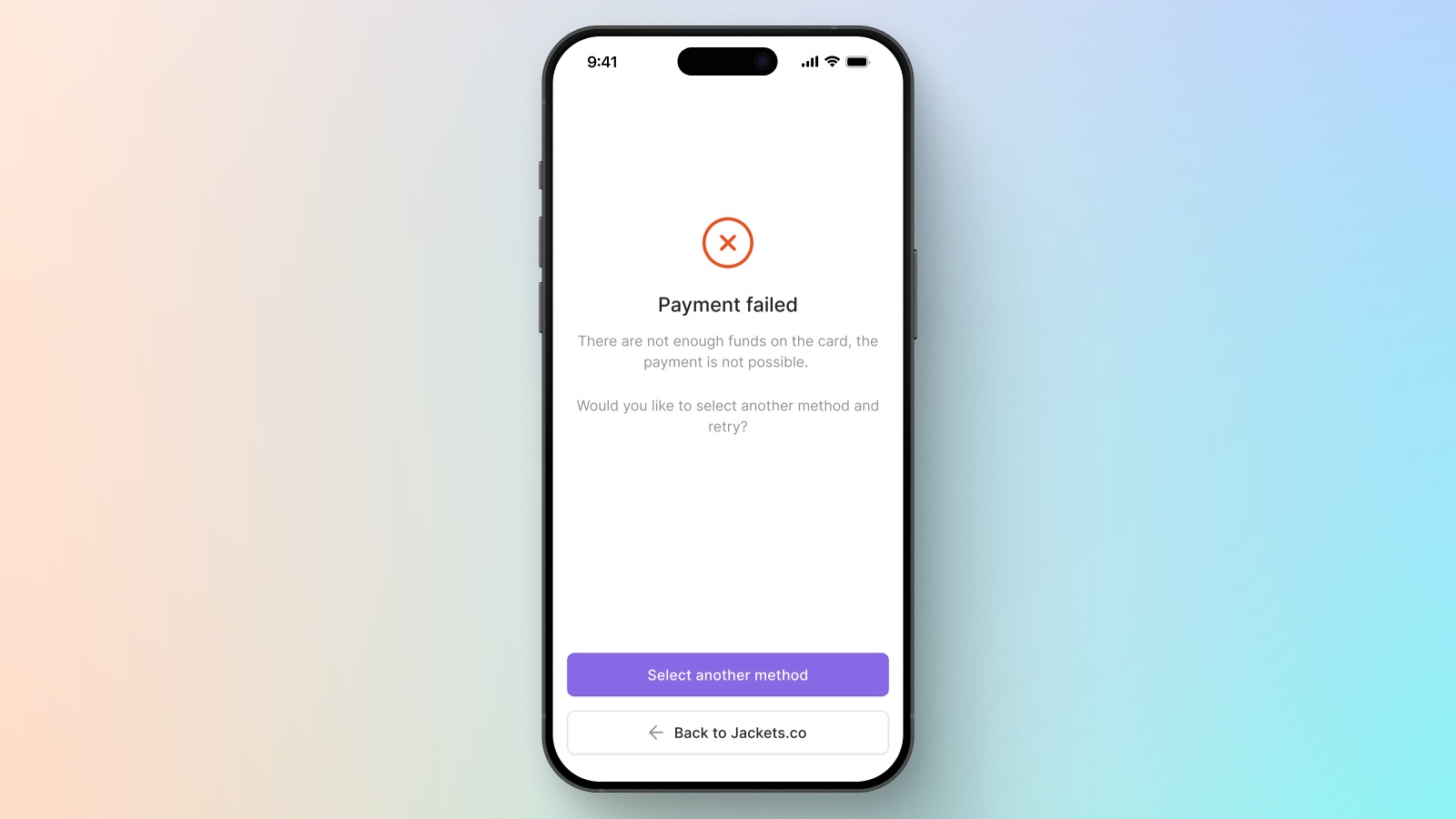

Errors often happen on mobile, but what matters is how they are recovered. Validate inputs inline, explain issues in plain language, and keep already entered data. 'Card declined' without a hint is a dead end, but 'Your bank rejected this card, try another card or wallet' gives a path forward.

A fixed 'Continue' or 'Pay now' button anchored near the bottom of the screen keeps the next step visible at all times, even as users scroll through their order or forms. The CTA should be large enough for a quick thumb tap within the natural reach zone for one-handed use and clearly indicate the next step (e.g., 'Continue to payment' or 'Pay $42.90').

Mobile checkout challenges are rarely unique to a single product or industry and often share the same constraints: small screens, awkward input, distracted users, and third-party payment steps. When these constraints aren't accounted for, even motivated customers may fall out of the flow.

The patterns below are the issues most teams encounter first and the ones worth fixing before you optimise anything else:

The mobile checkout best practices below target the most significant sources of mobile checkout drop-off.

Every field must earn its place. Strip checkout down to what's needed to fulfil the order and secure the payment, then make the path feel linear and predictable. Combine steps to reduce repetition, set the default billing method to shipping unless the user changes it, and avoid 'nice-to-have' questions that can wait until after purchase.

Enable the phone's OS automatically fill in common fields using the information the user has already saved on their device – contact details, addresses, and saved cards. Support helpers such as postcode/city lookups, card scanning, and input masks that format data as users type. The key is speed without loss of control: autofill should feel like a shortcut, not a trap. Always allow manual edits, as a single incorrect default can cost the entire order.

If Apple Pay, Google Pay, PayPal, Shop Pay, or another express option is available, display it at the top of the payment options. These methods remove most typing and build trust through familiar UI. Don't hide fast options behind a 'More methods' accordion unless you have a strong reason.

The primary action should stay visible and easy to tap. A sticky-bottom CTA keeps the next step visible as users scroll and makes one-handed checkout realistic. Keep it large enough for easy thumb taps, use only one CTA per screen, and label it with a clear outcome rather than a vague 'Next'. When users always know what will happen after a tap, they move faster.

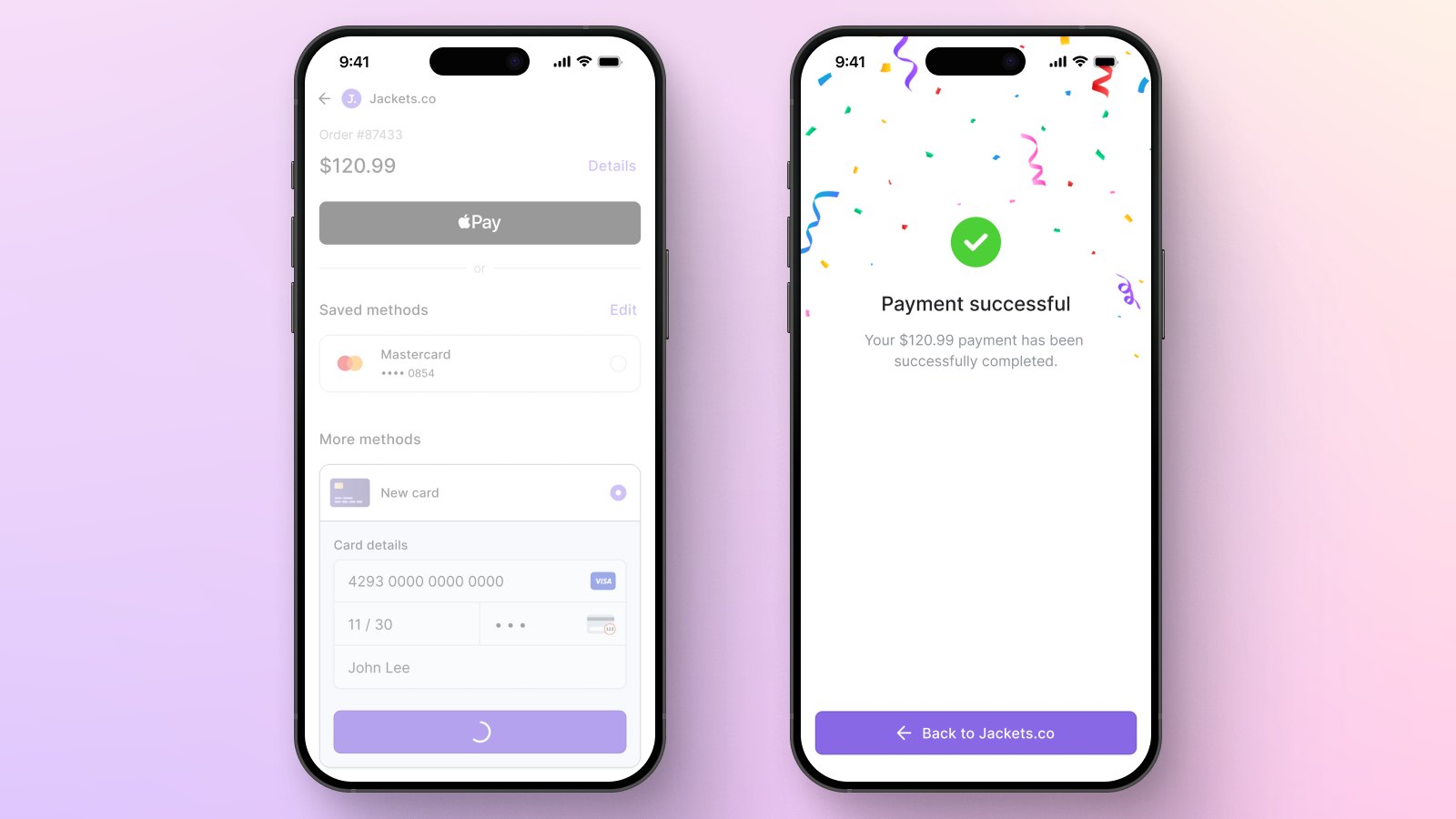

Mobile checkout happens in short, distracted bursts, so the interface must constantly confirm that it's responding. Validate fields in real time, acknowledge taps immediately, show clear loading and authentication states, and confirm the payment is successful. This prevents confusion that leads to double-taps, second-guessing, and drop-offs.

Let people buy first. Requiring registration before payment adds a decision step and extra effort for users who want to proceed. Default to guest checkout, then offer account creation after purchase with a concrete benefit, such as order tracking, faster re-orders, or saved details.

When something fails, users should know what happened and what to do next. Highlight the problem field, keep everything else intact, and offer a fix. If the issue is outside the user's control (e.g., issuer decline or network error), state this clearly and offer a next step.

Assume one-handed use, small screens, weak Wi-Fi, and interruptions. Use large tap targets (at least 44px), one-column layouts, light pages, and local state saving so a notification or app switch doesn't wipe progress.

Accessibility is conversion protection. Support OS text scaling, use real labels (not placeholders), maintain strong contrast in bright environments, and make focus states visible. These improvements help users with disabilities, older shoppers, tired users, and anyone checking out in motion or poor lighting, which accounts for a large share of mobile commerce.

These three major shifts are already shaping how the next generation of mobile checkouts will look and feel.

Wallets already account for around half or more of e-commerce transaction value worldwide, with Europe expected to pass 40% of e-commerce payments via wallets in 2025. As wallets absorb identity, shipping details, and biometric confirmation, manual card entry feels increasingly outdated. This also ties into passwordless authentication: people activate passkeys, and major platforms now support them at scale, which is pushing checkout toward 'tap + biometrics' rather than 'tap + OTP'.

The best mobile-friendly checkouts adapt to the user and context, recognising returning vs. new customers, offering region-preferred methods first, and adjusting the flow based on cart size or risk profile.

Here are a few examples:

Fraud controls aren't going away, but they're becoming more streamlined. 3D Secure 2.2 is rolling out widely in 2025, with features such as delegated and decoupled authentication, which enable more checks to occur in the background or via familiar biometric prompts instead of clunky redirects. Combined with improved risk scoring and routing, this moves checkout toward 'frictionless unless needed,' and when a challenge is required, users will see an in-flow step that feels like part of the app, not a jump to an unknown destination.

The mobile checkout examples demonstrate how modern mobile checkouts reduce effort, keep users oriented, and make payments feel secure.

Express wallet sheets (Apple Pay, Google Pay) remain the fastest mobile checkout option because they consolidate identity, address, and payment into a single, familiar, biometric-verified step. The best wallet-first designs make this path the default, with manual card entry as the backup, not the other way around.

Here's an example of this approach at Corefy's mobile checkout, where the interface keeps the order review short and then hands off to popular wallet solutions for a one-tap finish.

Why it works: minimal typing, high trust from native UI, and a clear moment of confirmation.

One of the smartest mobile patterns is keeping pricing visible while users fill in details. Instead of forcing users to scroll back up to check totals, the UI uses a collapsed summary bar that expands on tap. The HelloGov – Mobile Checkout Order Summary Exploration shows this nicely: a persistent bottom summary keeps the total in view, with an expand/collapse sheet for item and fee details.

Why it works: reduces anxiety about 'what am I paying?', prevents late price shocks, and supports quick in-flow edits.

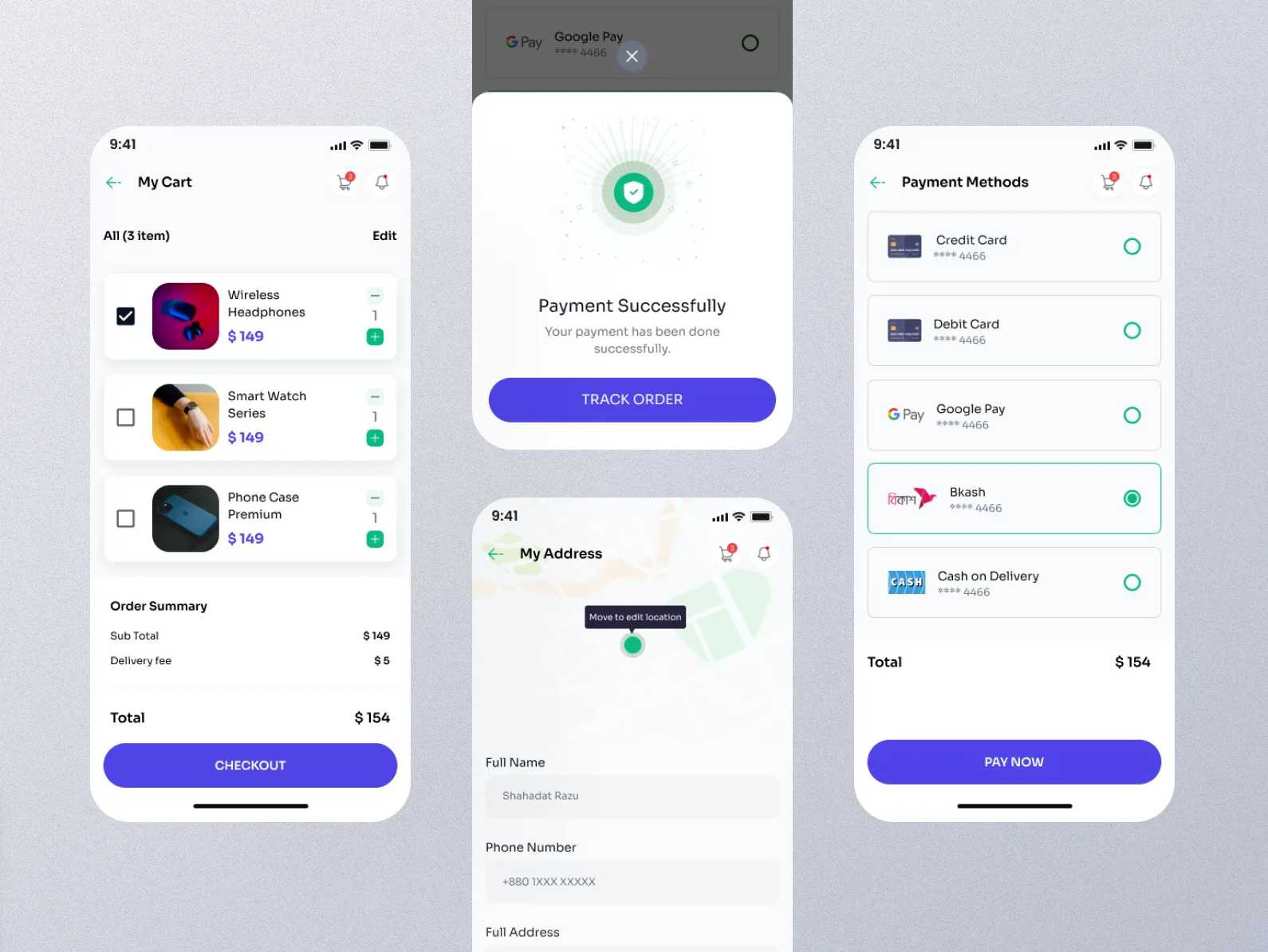

Some baskets require multiple steps, but the flow feels long only when users can't see progress. The Checkout Process Mobile App Design concept offers a crisp example of a guided, multi-step path from cart to confirmation. Each screen has one job, and the user always knows what's next.

Why it works: predictable sequencing, low cognitive load per step, and a clear sense of completion.

Even a well-designed mobile checkout can underperform if the payment layer is rigid. With a flexible white-label payment gateway behind your UI, you can eliminate many of the hidden issues that quietly drain revenue.

Corefy removes that friction behind the scenes, so your checkout stays fast and clear for users.

What you gain with Corefy:

Mobile checkout is often the most significant factor between 'added to cart' and 'paid'. If the flow is long, unclear, or unstable, users abandon even when the intent is strong. When you streamline the number of steps, show clear totals early, surface the proper payment methods, and handle errors, you increase checkout conversion without changing your product, traffic, or pricing. For merchants with a high share of mobile traffic, optimising this last mile usually delivers faster gains than almost any other funnel improvement.

The most effective methods are those that feel native, fast, and familiar on a phone:

Corefy, as a white-label payment gateway and orchestration platform, lets you plug these methods in once and then prioritise them per country, currency, or device. So mobile users always see the options most likely to convert.

Think in terms of less typing, fewer decisions, clearer next steps:

On the payment side, Corefy helps by routing transactions through the most reliable paths and unifying 3DS behaviour, so users spend less time dealing with failed attempts and confusing authentication screens.

It depends on complexity and context:

A good rule: default to the shortest possible flow, then break it into steps only when it helps users focus. With Corefy, you can keep your front-end flow flexible while the payment logic sits in one place.

Trust comes from clarity, familiarity, and control:

Corefy reinforces this by providing consistent, branded payment flows across providers. Even when a transaction is routed differently under the hood, the user sees one coherent, trustworthy experience.

At minimum, track:

Corefy can help you break these metrics down across PSPs, payment methods, and geographies in one place, so you can see exactly where to act next.