Today, probably, there is no person left who hasn’t heard about cryptocurrency. In the days when all this hype started, Bitcoin was the hero of all headlines. No wonder because it was the very first cryptocurrency that burst into the financial world and changed it forever.

There are now over 19,000 cryptocurrencies in the world, but Bitcoin still rules the industry, being the most valuable and desired virtual currency. Each of its rises or sharp falls will surely become a subject of discussion.

If you’re new to cryptocurrencies and have not studied how bitcoin transactions work, it’s not too late to catch the wave. Let us be your guides on this hot and challenging subject. We will tell you how cryptocurrency works, what role bitcoin plays here, and how you can become the proud owner of the world's most popular virtual currency. Sit back, there’s a lot to learn.

What is cryptocurrency?

At its core, a cryptocurrency is a decentralised digital asset that circulates over the internet. It has no physical form and no fiat money behind it. Cryptocurrency exists in virtual form, uses cryptography to secure transactions, and is stored in a digital wallet. In fact, it’s a set of mathematical operations.

The cryptocurrency payment system is entirely decentralised and cannot be controlled or regulated by any state. Instead of a central authority regulating the issuance of cryptocurrencies, there is a decentralised system for recording and verifying crypto transactions – blockchain. How does it work?

Blockchain comes into play

Blockchain is an open, decentralised ledger that records transactions in a digital code. Transactions are recorded in "blocks", and blocks are grouped into “chains” that are protected by cryptographic keys. If you add a new block, the entire chain will change.

Unlike a paper book, you can't "pull" pages out of the blockchain. It stores information about each crypto transaction for an unlimited time, and you cannot change or delete any record. Everyone who uses cryptocurrency has a copy of the distributed ledger on their device, the information in which is updated every time a new transaction is recorded. This approach virtually eliminates the possibility of data loss since identical and up-to-date transaction information is stored on thousands of computers.

And now it's time to talk about the very first and most popular cryptocurrency – Bitcoin.

What is bitcoin?

Bitcoin is the world's first known digital currency based on blockchain technology. For the first time, the principle of operation of Bitcoin was described by its mysterious creator (or even creators) under the pseudonym Satoshi Nakamoto back in 2008. He is also the creator of the eponymous peer-to-peer electronic payment system through which bitcoin transactions are carried out.

With its decentralised architecture, Bitcoin became the world's first fully open financial network. To create a new financial service in the traditional banking system, you must cooperate with banks and follow many complex rules. The Bitcoin system has no such restrictions as it isn’t pegged to any fiat currency and isn’t backed by banks or governments. The only ones who can influence Bitcoin are its users.

How does BTC work?

Currently, Bitcoin performs all the same functions as fiat money, but on a decentralised basis, without being tied to any government or central bank. Any BTC user is free to buy, sell and hold bitcoins as they see fit. Unlike traditional currencies, bitcoins are strictly limited in their issuance – there can be no more than 21 million. Most of the BTC has already been mined and is in circulation. Part of the coins is lost irretrievably, or rather about 30% of the total bitcoin volume (this is because some owners of bitcoin wallets forgot their password).

Like traditional money, bitcoin can be owned and transferred to other users. Let’s explore how Bitcoin transactions work.

Bitcoin transaction process explained

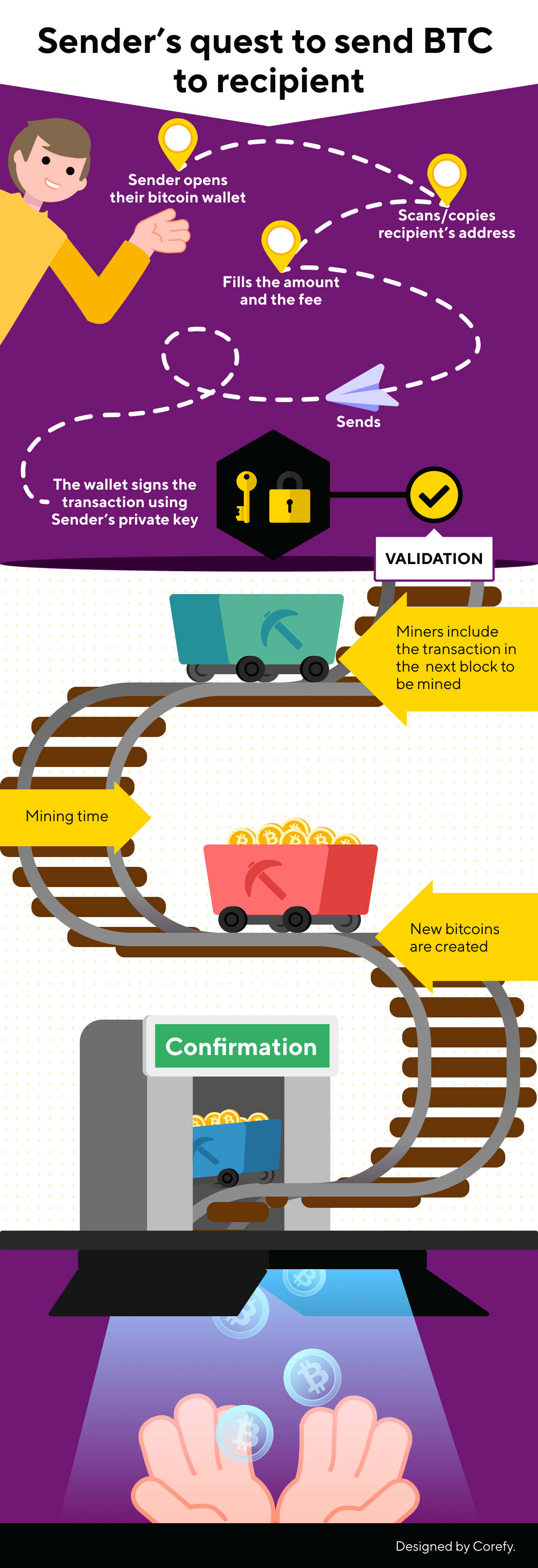

Every bitcoin transaction involves the sender's wallet, the recipient's wallet and the blockchain. The sender and recipient have a pair of public/private keys used to direct and validate transactions.

The public key or address is a set of letters and numbers that the user shares to get the bitcoin to their wallet. In contrast, the private key is a secret piece of data that acts as a signature to each transaction, confirming the value transfer to a new owner. It prevents the transaction from being altered once it has been issued.

Every time a person sends a bitcoin to someone, they create a transaction, attach the recipient's public key to it, and sign the transaction with their private key. Then the transaction is broadcast to the blockchain and confirmed by miners within 10-20 minutes. Here’s how it all works.

What is a Bitcoin wallet, and how does it work

Since cryptocurrencies don’t have a physical expression (notes, coins, checks), you can only store them virtually. But how is this possible? This is where Bitcoin wallets come into play.

Bitcoin wallets are very similar to regular leather wallets, where you hold banknotes. Instead of storing physical money, a BTC wallet stores the cryptographic information needed to access user addresses and send transactions. Noteworthy is that the wallet doesn’t keep the coins themselves – they’re in the blockchain. It stores only private key pairings, allowing you to sync your wallet across multiple devices to send and receive cryptocurrency.

BTC wallets come in either software or hardware forms. It can be in the form of a mobile app or look like a flash drive. They also vary in terms of security, convenience, and functionality.

Bitcoin wallet has already become a trendy payment method in e-commerce and a widely used way to make cross-border transactions. Not only because it is something new, but also because of the benefits that distinguish the Bitcoin system from the traditional one. Let's find out what makes this currency so attractive to users.

Why is bitcoin so popular?

- Protected from inflation. Central banks can issue fiat currency indefinitely, which can lead to inflation. Its creators included halving in the system’s operation protocol to prevent this from happening with BTC. This occurs when the miners’ reward halves every 210,000 blocks they have mined. Generally, Bitcoin halving occurs approximately every four years.

- 24/7 network action. Cryptocurrency exchanges and wallets operate 24/7, seven days a week. Bitcoin owners can send and exchange any amount of crypto coins at any time without restrictions.

- Lower fees. The absence of intermediaries makes bitcoin transactions relatively cheap, especially in the case of cross-border payments.

- Easy way to invest. You don't need any special licences to start trading Bitcoin. It’s enough to go through the registration procedure on a crypto exchange or download a BTC wallet. But remember that trading is a risky procedure that requires careful study. Don't waste more than you can afford to lose.

- Tight security. Cryptocurrency involves strong public and private encryption keys for transaction identification and verification. The system built on mathematical calculations protects the digital currency from counterfeiting or hacking.

Are there any cons?

Of course, cryptocurrency has its downsides. Here they are:

- Volatility. Cryptocurrency rates are unstable and depend on many factors: media coverage, liquidity, supply and demand, trading volume, etc. The price of BTC can collapse sharply at any moment and rise just as rapidly.

- Lack of safety. If the bitcoin owner forgets or loses their username and password, they won’t be able to recover them. The irreversible loss of coins will also occur if the user sends them to the wrong address because it’s impossible to cancel the transaction in the blockchain.

- No law protection. The decentralised cryptocurrency nature practically leaves BTC users without judicial protection. Since crypto has no legal status, law enforcement agencies are unlikely to be able to help you if you become a victim of crypto scammers.

Like any digital asset, bitcoin has its risks. However, even some shortcomings don’t prevent the crypto market from developing rapidly. Thousands of people worldwide wonder, "How can I become a happy owner of Bitcoin?".

Bitcoin can be earned in many ways: you can buy it on the open market, start crypto staking, or earn it on freelance exchanges that pay with cryptocurrency. But the original way to get Bitcoin is mining.

How does Bitcoin mining work?

Bitcoin units are generated through mining. This process involves creating new crypto coins and verifying new transactions in the blockchain. People who mine cryptocurrency are called miners.

The primary goal of mining is to maintain the blockchain's functionality and security. To do this, miners use sophisticated hardware that performs complex calculations to validate and record each transaction. Thus, the whole mining system is based on solving complex mathematical problems with the help of computing power.

What motivates miners to keep the blockchain going all the time? One of the motivations is the reward system. Every computer on the network fights to be the first to guess the 64-digit number known as the hash. The correct combination of numbers and letters will be included in the new blockchain. The faster the computer can generate guesses, the more likely the miner will earn a reward.

Is it possible to earn from bitcoin mining?

Ten years ago, anyone with a computer could become a miner. But as the blockchain constantly evolves, the computing power to support it is also growing. In 2019, mining one BTC took 12 trillion times more computing power than mining the first blocks in 2009. Now it’s almost impossible to make money from mining without investing in powerful, expensive equipment. That’s why almost all bitcoin mining volume is concentrated among specialised companies or groups of miners who pool their resources.

At first glance, it may seem that mining is a form of entertainment that yields rewards. However, in fact, mining underlies the entire Bitcoin system, and miners are compensated for verifying the legitimacy of BTC transactions. Without miners’ jobs, new transactions won’t be added to the blockchain, and the whole decentralised mechanism will stop working.

Bitcoin as a payment method

Accepting crypto as payment for goods or services isn’t new for business owners. This payment method has proven to be safe and convenient for both merchants and their clients. Fast and low-cost transactions without intermediaries, enhanced security, and no chargebacks – what could be better?

Crypto owners are increasingly using their digital assets to purchase online and in-store. Thus, 40% aged between 18 and 35 said they plan to pay with cryptocurrency in 2022. Well-known companies such as Microsoft, Rakuten, Twitch, and Home Depot, not to mention smaller companies worldwide, have already successfully adopted bitcoin payments. We don’t doubt that merchants who crave to expand globally will follow suit.

Accepting bitcoin is now as easy as pie for a business owner. At Corefy, we're here to help. Our robust payment orchestration platform supports 500+ payment methods, including Bitcoin, so that you can keep up with ever-changing customer needs. Contact us to book a demo and see our platform in action.

.png)

.png)

.png)