At year’s end, we like to reflect on what we delivered for the teams relying on Corefy every day. Join us as we dive into the milestones, learnings, and updates that made the biggest difference.

Powered by our clients & partners

We resolved 7,000+ requests, added 20+ Knowledge base videos, and published 3 onboarding guides to support faster, more self-serve adoption.

We also launched automated email reports to give clients ongoing visibility into key metrics, and delivered API recipes — ready-to-use examples that make integrations faster and simpler.

Thank you for the warm feedback and ongoing trust!

Integrations: progress, growth, and results

Our integration list now boasts 595 connections with payment providers and acquirers, including 150 additions made just this year. We also made 837 upgrades and updates to the existing connections.

Throughout the year, we went through certification processes with top acquirers and payment gateways — the kind of work that’s heavy but essential for production readiness. The result: certified integrations with Visa, Worldpay, Paysafe, Shift4, and PayNearMe, strengthening compliance and stability for payments at scale.

Launch of IntegrationsOS

We introduced IntegrationsOS to make integration work more transparent, structured, and scalable. Built on Directus with n8n automations and AI-assisted workflows, it unifies integration records, tracks capabilities in real time, connects to delivery systems, and makes information easy to find.

Even though it’s an internal system, our clients already feel the impact: faster integration delivery, less manual clarification, and consistently up-to-date capability data that can feed provider catalogues, updates, and notifications.

.jpg)

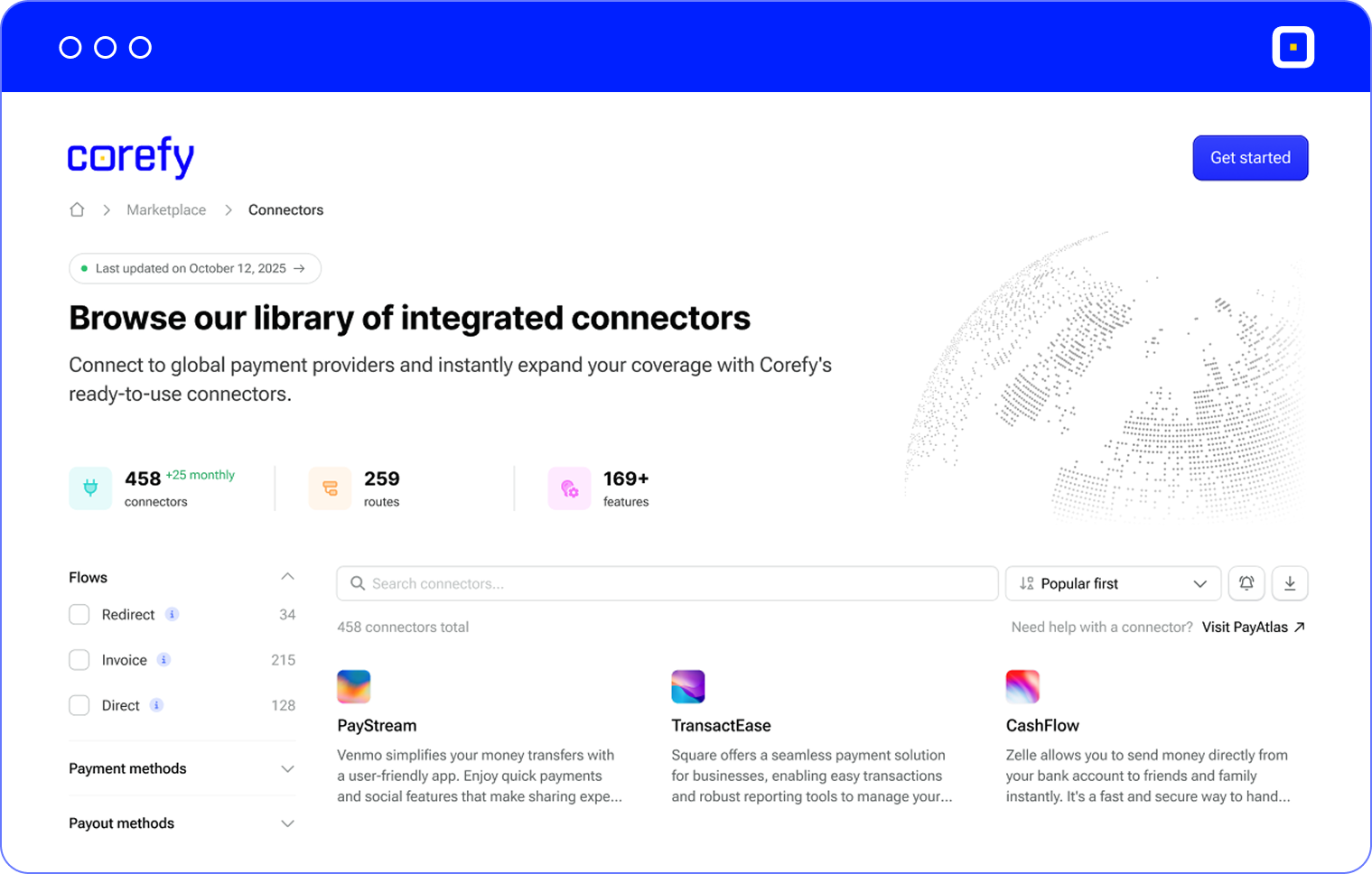

Connectors directory: coming soon

In 2025, we’re launching the Connectors directory — a public catalogue of all integrated payment providers in Corefy — with live, structured capability data.

- Always-current connector details, including supported currencies, methods, flows, and capabilities for every provider

- Robust filtering and sorting that help you quickly find a provider for your exact requirements (e.g., providers that support BRL and this flow type)

- A shared source of truth for clients and partners

The launch is just around the corner — stay tuned!🔔

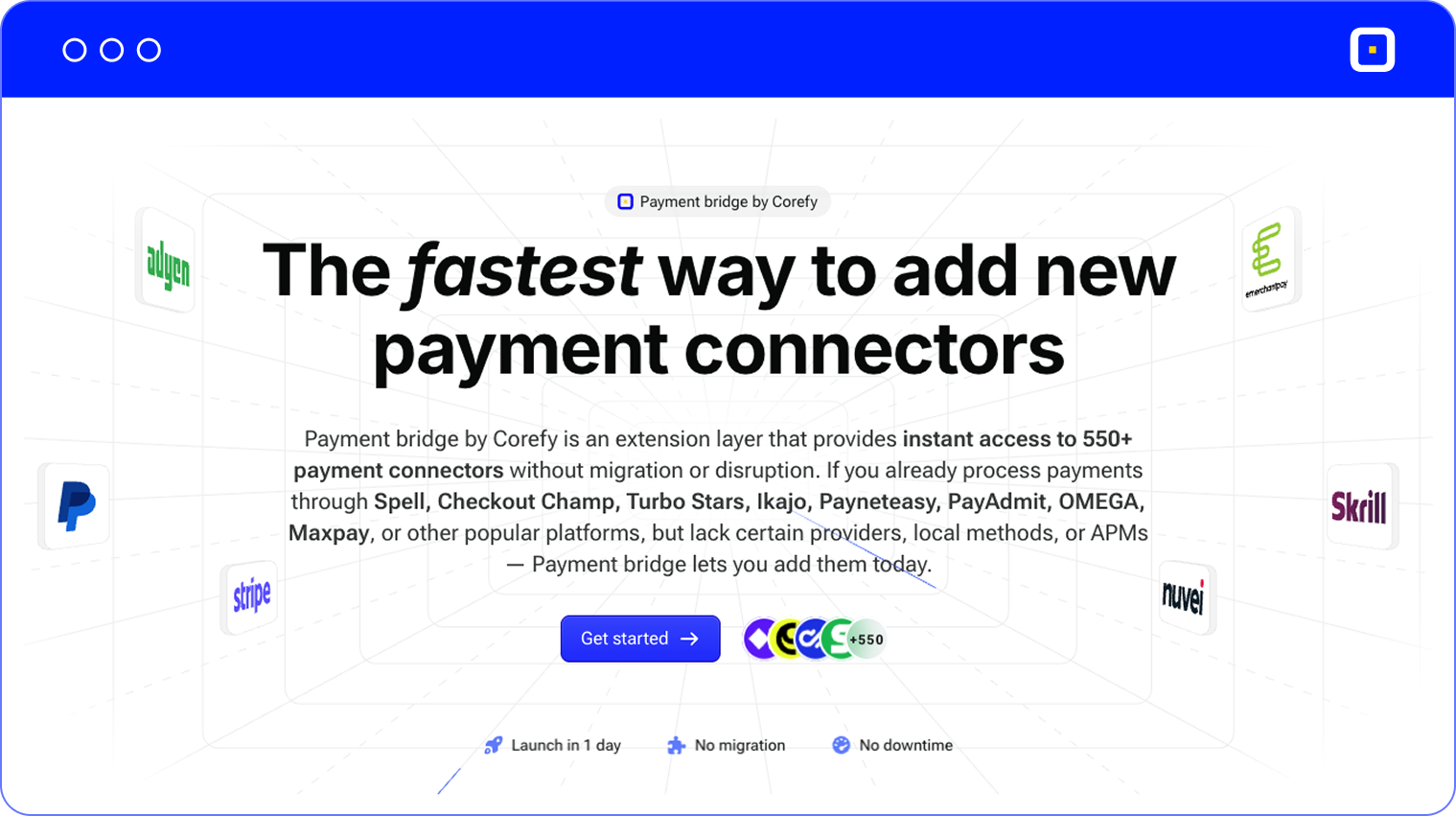

Solution launch: Payment bridge

Meet Payment bridge — a lightweight extension layer that plugs into your existing gateway or orchestration system and unlocks 595 Corefy’s ready-to-use connectors — PSPs, acquirers, and alternative payment methods.

Keep your current processing as is and add the missing providers without migration or downtime. If your platform is among Corefy’s pre-integrated gateways, setup can take as little as 1 day.

Top platform updates

2025 was a big year for building: our Development team shipped dozens of technical improvements that boosted Corefy’s functionality and performance.

Routing enhancements

Routing was one of our top priorities in 2025. We improved transparency and debuggability so teams can see not only that a payment failed, but also exactly why, where, and at which step it failed.

.jpg)

We also added end-to-end routing traceability, so you can immediately see where a transaction stopped and which route was used when it succeeded — speeding up incident resolution and making optimisation more predictable.

To support even deeper diagnostics, we extended the ‘Blank’ routing strategy in the Card gateway and Payout gateway routing schemes with coded mapping, so providers can identify the precise failure trigger and surface it in the Merchant portal.

Digital wallets

We expanded our digital wallet capabilities to reduce checkout friction and unlock more flexible integrations. H2H Google Pay is now available, enabling a direct on-site button experience with no redirects.

We also expanded Apple Pay capabilities. Merchant-side Apple Pay session validation via H2H gives businesses greater control over the payment flow and unlocks a wider range of integration scenarios. Apple Pay coverage was expanded via QR codes, enabling seamless payments on non-Apple devices.

.png)

Merchant portal evolution

The Merchant portal got easier to run day to day: you can now switch languages on or off instantly without extra setup, and benefit from the newly-added Japanese locale to expand smoothly.

We also introduced a dedicated view for payment schemes in the Merchant portal. Where permitted by PSP agreements, merchants can now see routing logic and provider interaction settings, improving clarity and confidence in the setup.

Fees & financial control

Declines are now easier to account for: PSPs can configure fixed fees for failed transactions, fully reflected in balances, invoicing, and reporting for clearer cost control.

We also launched commerce account turnover limits for both payments and payouts, helping merchants stay compliant with acquirer rules while keeping tighter control over volumes.

Platform v2.0: beta phase and key capabilities

Alongside v1.0 upgrades, our v2.0 is already live for beta testing and validation ahead of a broader release.

Here are some of the key capabilities we introduced in 2025:

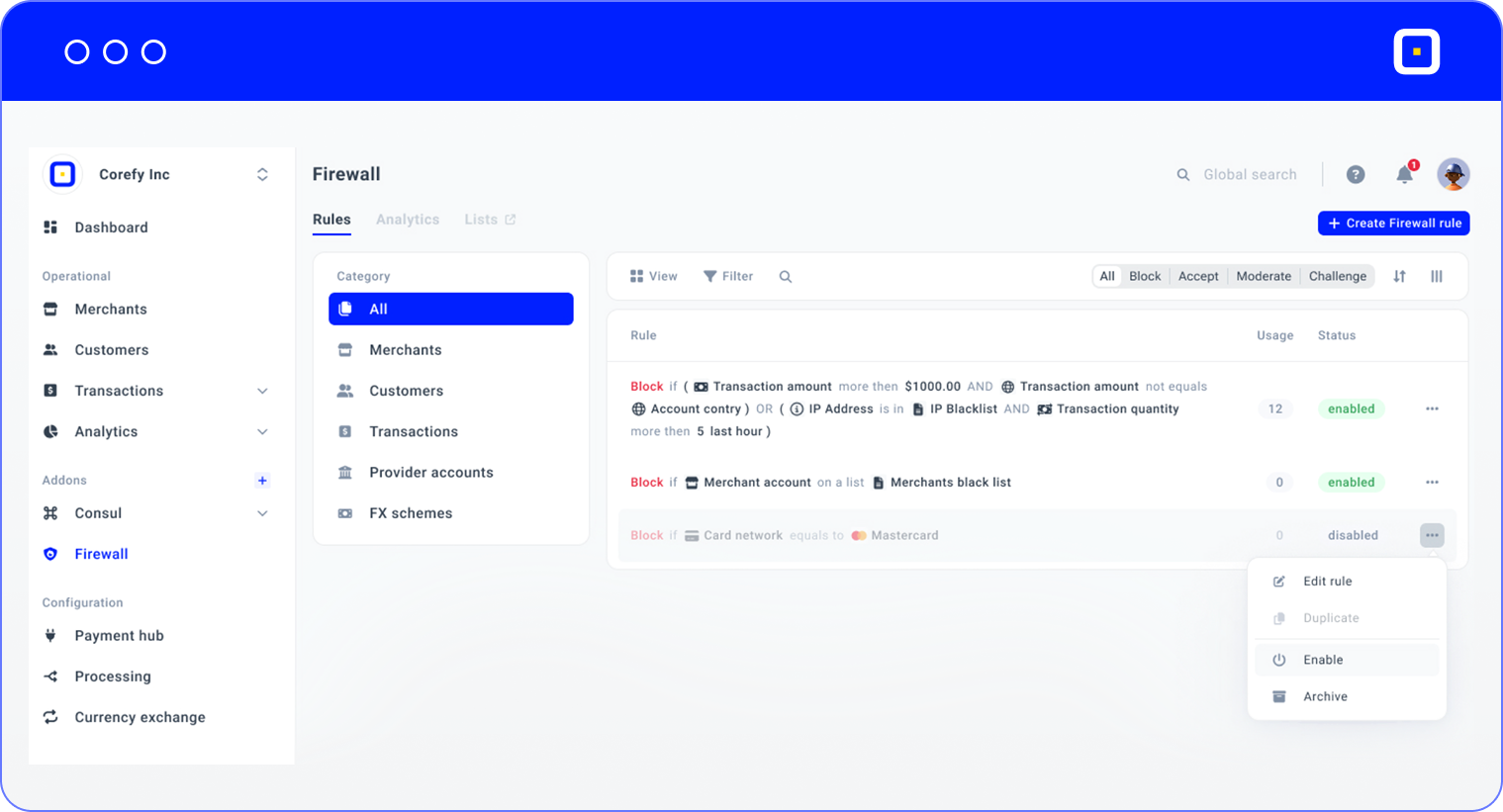

Standalone Firewall layer

We launched a standalone Firewall layer that controls transactions and traffic across multiple system levels. It runs pre-processing checks, applies configurable prevention rules, blocks suspicious patterns, and enables layered protection for payments and payouts — supporting stronger risk management, fraud controls, and operational stability.

Checkout upgrades

If a payment fails due to low funds, the new insufficient amount flow lets shoppers retry with a reduced amount instead of hitting a hard decline — recovering revenue that would’ve been lost.

On top of that, we launched an interactive Checkout editor demo that gives you full visual control over your checkout experience. Test different flows, preview the UX, and tweak details like field order, buttons, and colours — instantly and without commitment.

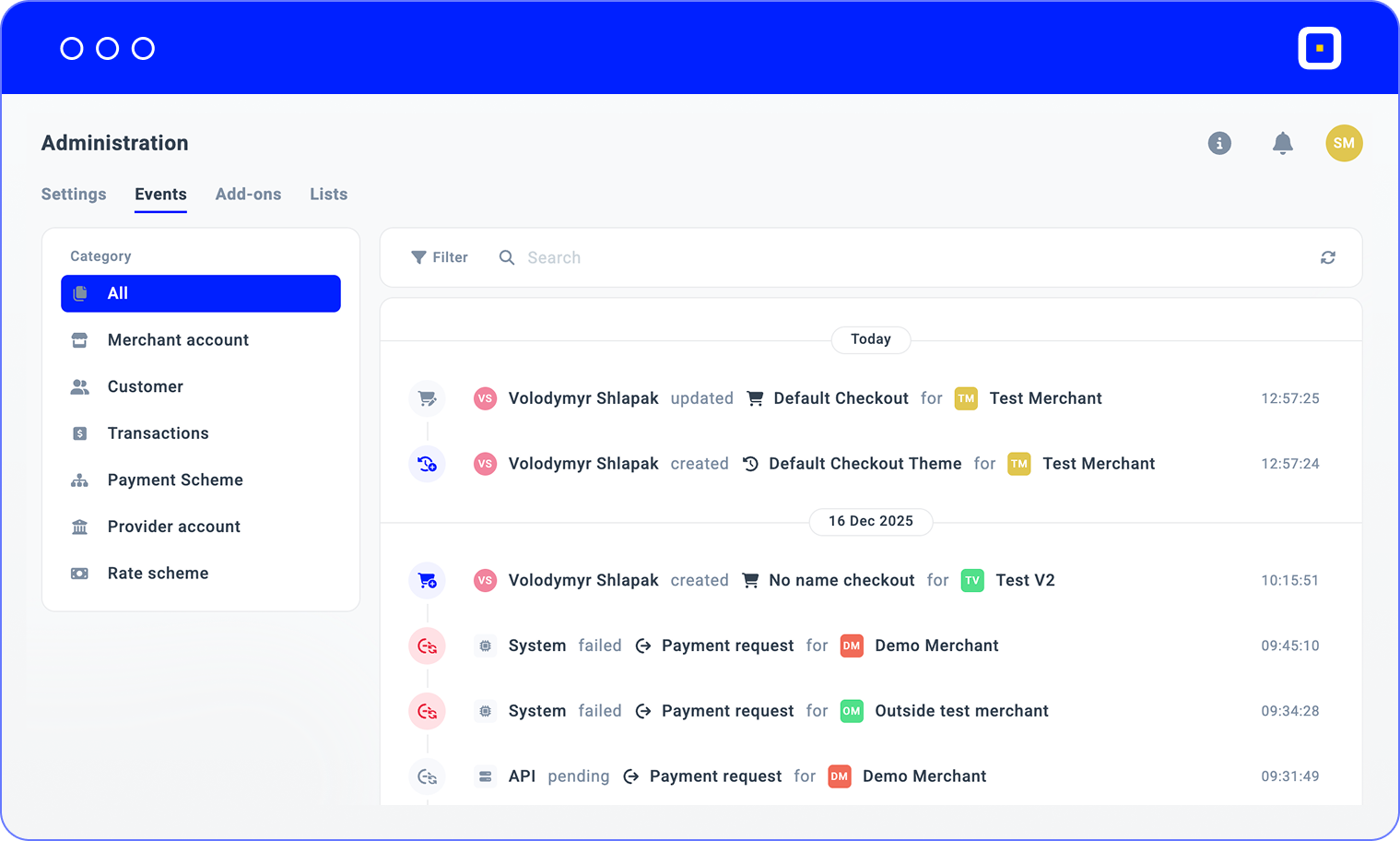

Events service

We launched a unified Events service to capture and organise activity across the entire platform. It tracks system and user events — including configuration changes, user actions, payment, payout, and account operations — giving teams a single source of truth for auditing and investigation.

Beyond these releases, we also introduced a Payout gateway for direct transfers to user accounts (ideal for marketplaces and balance-based products), enabled Google Pay & Apple Pay in a single streamlined flow to reduce checkout drop-offs, and evolved the Merchant portal into a unified workspace for branding, feature access, settings, and analytics.

.jpg)

New tool: ROI calculator

Is payment orchestration worth it? Now you can check. Our new ROI calculator helps you understand the potential impact of Corefy on your business. By entering a few key metrics, you can see potential savings, efficiency gains, and areas of improvement — all in a clear, easy-to-use format.

Networking around the world

2025 was full of meaningful conversations and global meetups. We attended ICE Barcelona, Money20/20, iGB L!VE, SBC Summit, and SiGMA Central Europe.

Next stop: ICE Barcelona, 19–21 January 2026. See you there 👋

Payment maturity report: how businesses are handling payments?

What do the best payment setups do differently behind the scenes? Our Payment maturity report answers that with data from 793 merchants — 130+ statistics and 15+ charts that reveal the trends, trade-offs, and maturity signals behind payment operations. Use it to benchmark your current stack and plan improvements with confidence.

Wishing you calm holidays and a new year filled with momentum and new achievements.

Sincerely, your Corefy Team ❄️

.png)