On one side, vendor websites, industry reports, and conference talks all position payment orchestration as the logical next step as your business scales. On the other side, many teams feel a disconnect between the promise and their current reality. Payments are working, revenue is flowing, and declines exist, but nothing is on fire. So why add another layer?

Payment orchestration is often recommended too early, before operational complexity actually demands it. In those cases, it risks becoming an expensive add-on rather than a solution. At the same time, teams that wait too long often end up with brittle integrations, slow provider changes, and limited control when issues arise.

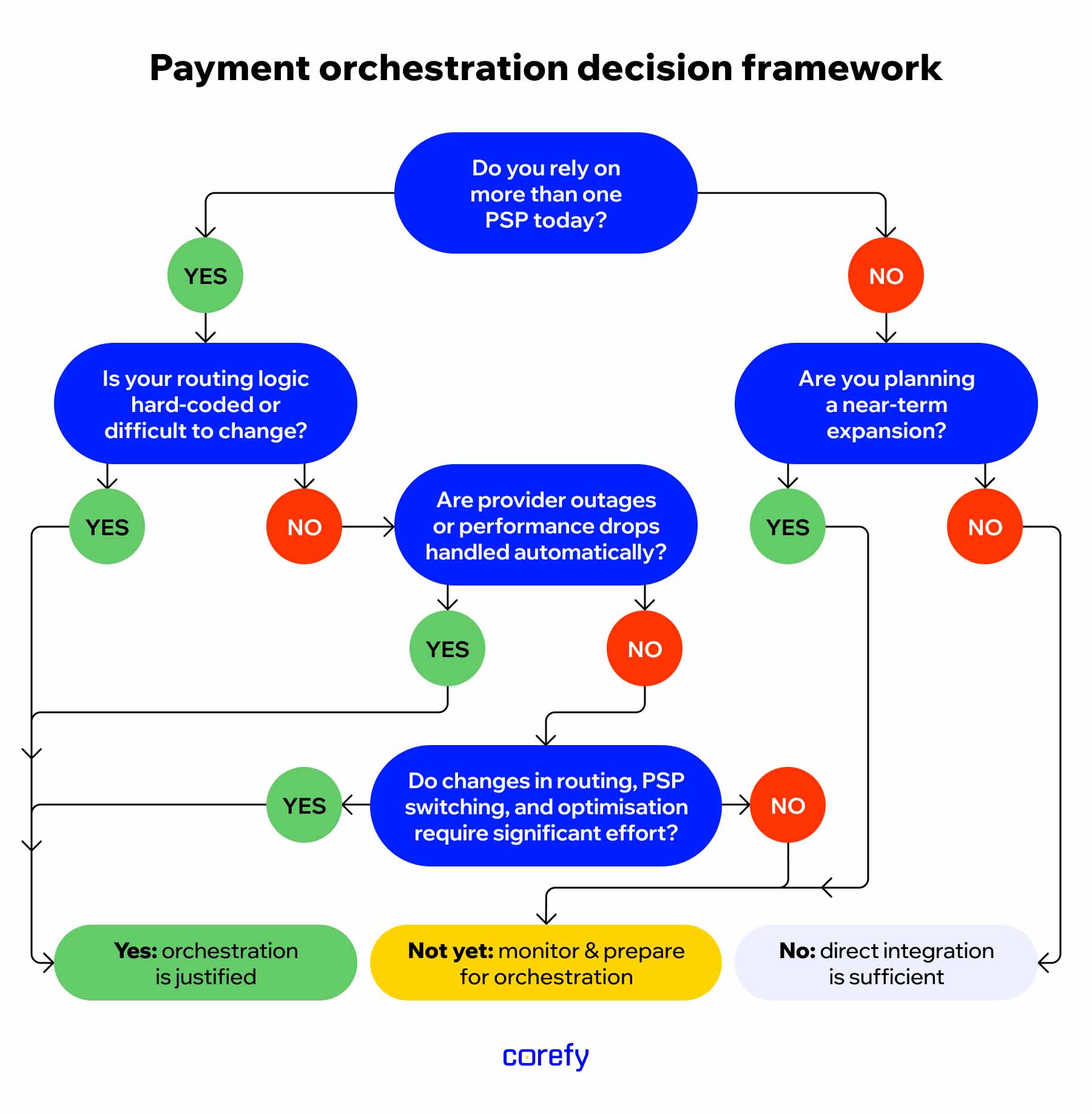

This article is designed to cut through that noise. It offers a decision framework to help you evaluate whether payment orchestration is clearly justified, not yet necessary but approaching it, or overkill for your current setup.

Why is payment orchestration important

Payment orchestration helps businesses maintain control over their payments when they become too complex for direct, one-to-one integrations. In practice, orchestration becomes valuable when teams need to:

- Control routing logic across multiple PSPs. Not just select providers, but define how transactions flow based on geography, payment method, issuer response, cost, or risk profile.

- Reduce dependency on individual providers. When one PSP dictates uptime, acceptance rates, or expansion timelines, orchestration introduces optionality – providers become interchangeable components due to smart routing and cascading.

- Manage change without re-engineering the stack. With payment orchestration, adding a new acquirer, replacing a failing one, or adjusting fallback logic does not require weeks of development and QA.

- Centralise visibility and decision-making. Without orchestration, reporting across PSP dashboards becomes fragmented, making it difficult to understand true performance, costs, or failure points until it's too late to act.

If none of these are active problems yet, payment orchestration may feel theoretical. But when they are, it shifts from nice-to-have to operational infrastructure.

7 signals you're starting to need payment orchestration

The need for payment orchestration usually reveals itself through recurring friction. Below are seven signals that often appear before payment experts actively search for answers, such as 'do I need payment orchestration' or 'when to use payment orchestration.'

- Adding or switching PSPs takes weeks or months. Each new provider introduces new logic, edge cases, and a longer testing cycle. What should be a commercial decision turns into a technical bottleneck.

- Routing logic is hard-coded and brittle. Rules live in application code, small changes require deployments, temporary workarounds become permanent, and nobody wants to touch routing because too much depends on it.

- Provider outages require manual intervention. When a PSP goes down or degrades, teams scramble. Traffic is manually rerouted only if rerouting is possible, and recovery depends on human response time.

- Payment performance issues are discovered too late. Declines, issuer changes, or cost spikes show up in reports days or weeks later. By then, revenue is already lost, and optimisation is reactive.

- Expansion means duplicating work. New markets or payment methods require repeating the same integration effort, even when the logic is conceptually identical.

- You're moving toward white-label or multi-merchant models. Supporting multiple merchants, brands, or clients introduces complexity that direct integrations were never designed to handle cleanly.

- Payment decisions depend on a few key people. Knowledge about providers, routing, and failure scenarios lives in heads, not systems. That's manageable — until it isn't.

Seeing one or two of these doesn't automatically require orchestration. But seeing several at once usually means you're already paying for not having it.

When payment orchestration is probably overkill

There are several scenarios in which the answer to 'Do you really need payment orchestration?' is simply no. For example:

- Single-market, single-PSP setups. If one provider reliably covers your geography, payment methods, and volumes, orchestration adds little immediate value.

- Early-stage products with stable flows. When volumes are predictable and change is minimal, direct integrations are often faster and easier to manage.

- Teams without internal payment ownership. If payments are fully outsourced and no one internally is responsible for optimisation, orchestration won't magically create clarity.

- Low operational variance. Few outages, limited routing logic, and no near-term expansion plans reduce the need for an orchestration layer.

Choosing not to orchestrate in these cases means aligning tooling with reality. If you're still unsure where your setup fits, the decision framework in the next section will help you step by step.

Do I need payment orchestration: a practical decision framework for payment managers

If you're asking 'is payment orchestration worth it?', this framework helps answer that without assumptions. Use it as a step-by-step filter to determine whether payment orchestration is a good fit for your current setup.

Outcome interpretation:

- Yes: orchestration is justified. Complexity already exceeds what direct integrations handle efficiently.

- Not yet: Signals are emerging. Preparation matters more than rushing.

- No: Direct integrations are still sufficient. Focus on stability, clarity, and readiness instead.

Getting ready for payment orchestration: what you need first

Starting preparations early helps you avoid rushed vendor decisions later and makes your payment setup easier to scale as complexity increases.

Focus on these foundations:

- Clarify internal ownership of payments. Assign a clear owner or small group responsible for payment performance, provider relationships, incident response, and change decisions. When ownership is unclear, optimisation becomes ad hoc, and small issues (declines, outages, rising fees) become recurring revenue leaks.

- Document routing logic and dependencies. Write down how transactions are processed today: which PSP handles which flows, what happens on failures, where 3D Secure is triggered, which risk rules apply, and what exceptions exist. This documentation serves as your baseline for improvement and prevents critical knowledge from residing in a single engineer's head.

- Centralise reporting where possible. You don't need a full orchestration layer to improve visibility. Start by consolidating key metrics in one place: approval rates by provider, reasons for decline, latency, chargeback rates, and effective processing costs. When you can see performance clearly, you can prioritise fixes based on impact.

- Design integrations with change in mind. Even if you keep direct integrations, structure them so that providers are replaceable. Use a thin internal payments layer, consistent request/response formats, and configuration-driven routing where possible. The goal is to reduce the amount of code you need to touch when a provider changes.

These steps improve control immediately, and if you later decide that payment orchestration is worth it, you'll be able to implement it faster, with fewer surprises and a cleaner business case.

Final takeaway

Payment orchestration is a response to complexity. If your team can still control providers, routing, and change through direct integrations, orchestration may be premature. If that control is slipping through scale, expansion, or operational strain, orchestration becomes essential infrastructure.

Corefy is built for the moment when complexity becomes unavoidable. If you're still weighing your options, we're ready to help you assess your setup and decide on next steps.

.png)

.png)

.png)