Visa VAMP explained: key changes and their impact on merchants and payment businesses

In 2025, Visa launched the Visa Acquirer Monitoring Program (VAMP) – a unified global framework to tackle fraud, chargebacks, and enumeration attacks.

VAMP reshapes how performance is measured across the payments ecosystem. It directly impacts costs, compliance risk, and even acquirers' ability to maintain banking relationships.

Here’s what changed, why it matters, and how to stay compliant.

Its goal is clear: make acquirers accountable for managing fraud and dispute levels in their portfolios. Merchants, PSPs, and processors all contribute to these metrics.

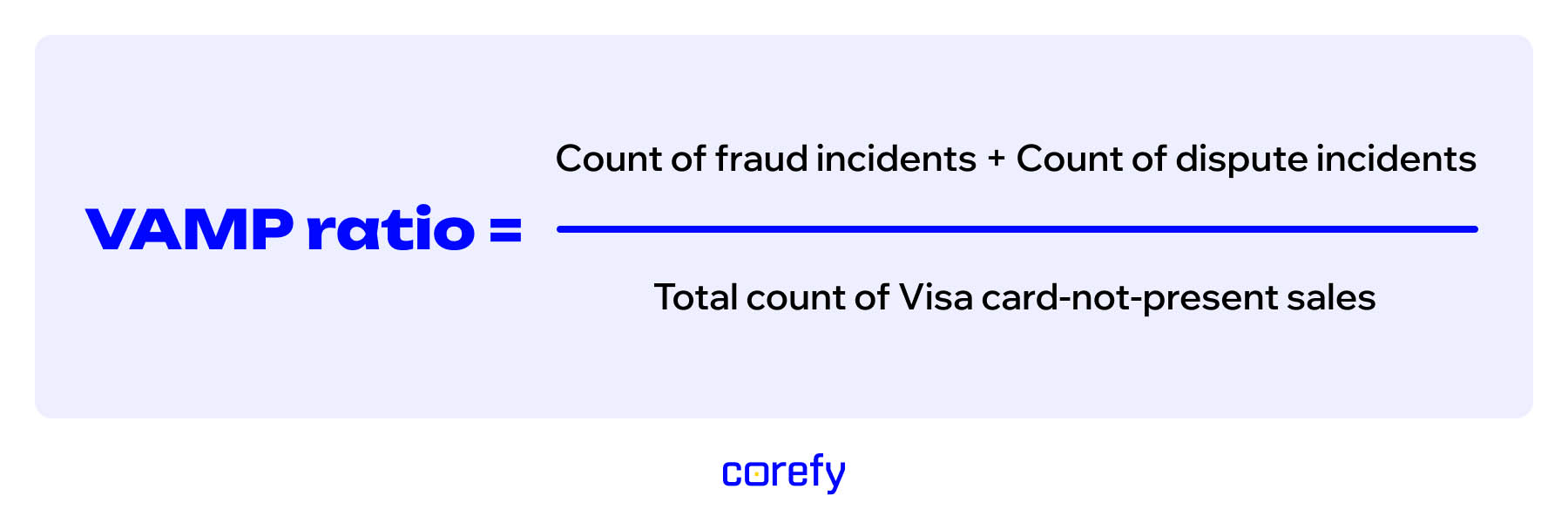

A cornerstone of VAMP is its unified risk metric, the VAMP ratio, which combines fraud and dispute counts. This is a shift from prior programs that tracked fraud and chargebacks separately.

The VAMP ratio is calculated as:

Under VAMP, Visa reviews each acquirer's performance monthly. Those that cross certain thresholds are placed into one of two categories:

Merchants are not directly enrolled in VAMP, but because their fraud and dispute activity is aggregated into their acquirer’s portfolio, it can push the acquirer over Visa’s thresholds, making the acquirer liable for fines and driving them to pressure, penalise, or even terminate high-risk merchants.

For merchants, being flagged as Excessive means crossing a 1.5% threshold.

Visa introduced VAMP in early 2025 with a phased rollout to give acquirers and merchants time to adjust. For the first six months, the program operated in an advisory mode. As of October 1, 2025, Visa transitioned VAMP into full enforcement.

Here’s a look at the changes already live and the ones you should prepare for.

| Date | Before | After |

|---|---|---|

| April 1, 2025 | Multiple legacy programs; fraud/disputes tracked separately | Launch of VAMP, single ratio, enumeration monitoring introduced |

| April–September 2025 | Advisory only; no financial penalties | Acquirers received warnings and “shadow” compliance reports |

| June 1, 2025 | Lower volume thresholds (1000 incidents) and older ratio levels (~0.3%) | Thresholds raised: 1500+ incidents required; Above Standard ≥0.5%, Excessive ≥0.7% |

| October 1, 2025 | Advisory phase, no fines | Enforcement begins for “Excessive” acquirers/merchants; $10 per incident |

| January 1, 2026 | No fees for Above Standard status | Enforcement begins for “Above Standard” acquirers; $5 per incident |

| April 1, 2026 | Excessive Merchant threshold = 2.2% in most regions | Threshold tightened globally to 1.5% |

From October 1, 2025, Visa began enforcing penalties under VAMP. This marks the first time financial consequences are systematically applied across the network – a significant shift toward active risk governance.

Fines are calculated per incident:

Visa’s Acquirer Monitoring Program reshapes responsibility across the payments ecosystem. Each stakeholder group is affected in distinct ways.

Acquirers now bear full responsibility for the fraud and dispute performance of their portfolios. With monthly monitoring based on the VAMP ratio, any breach of thresholds triggers mandatory investigation, remediation, and formal reporting within tight deadlines.

Despite the pressure, consistent low ratios bring clear rewards: stronger issuer trust, reduced losses, and potentially better treatment within the network.

Visa places liability on acquirers, but the effects cascade to merchants. Acquirers may introduce stricter requirements, increase costs, or exit high-risk relationships.

Sitting between acquirers and merchants, processors and payment facilitators must take ownership of overall performance.

With VAMP enforcement now live, proactive monitoring and rapid response are the only safe strategy. Corefy's chargeback management service is designed with this in mind, helping businesses keep ratios under control and avoid costly penalties.

The system facilitates immediate communication between merchants and card issuers, providing clear transaction details that reduce the chances of disputes escalating. Disputes intercepted and resolved at this stage don't count toward the VAMP ratio, which makes proactive management one of the most effective compliance levers.

The result is not just reduced financial exposure, but a stronger compliance posture that supports healthier banking relationships and higher approval rates.