Choosing a relevant payment service provider is vital for the proper performance of any business. When it comes to cryptocurrency exchanges, choosing a payment gateway is even more critical. The reason is obvious — exchanges of such a kind won't be able to function properly without a robust white-label crypto payment solution.

With countless options available, finding a reliable and secure crypto PSP becomes paramount.

In this article, we demystify the world of crypto trading and provide you with a comprehensive checklist for evaluating PSPs for crypto exchanges. Whether you're a seasoned trader or a newcomer to the crypto space, having a solid understanding of the fundamentals is crucial for making informed decisions and safeguarding your investments.

What is a crypto exchange?

A crypto exchange concept can also be defined as:

- broker-dealers representing traders and trading on their own behalf;

- private traders who buy and sell currency on their accounts on their own platform;

- holders of large volumes of cryptocurrencies;

- issuers of their own currencies who trade on their own platforms.

How to choose a crypto-friendly PSP for your business

For traders, cryptocurrency exchange looks quite simple: a site with updatable information about rates, charts, and order books for buying and selling coins. Depending on the exchange, it can feature a market depth chart, additional tools, and indicators. The ability to quickly refill the balance and withdraw funds to a personal wallet is a must. Personal accounts with viewing trade statistics and the possibility to contact technical support are at a premium.

But what is needed to ensure a stable and uninterrupted operation of a crypto exchange? And what are the crypto trading basics, and how is the exchange structured and functioning from the inside? Let's figure things out in due order. After all, the interface is only a small component of the exchange.

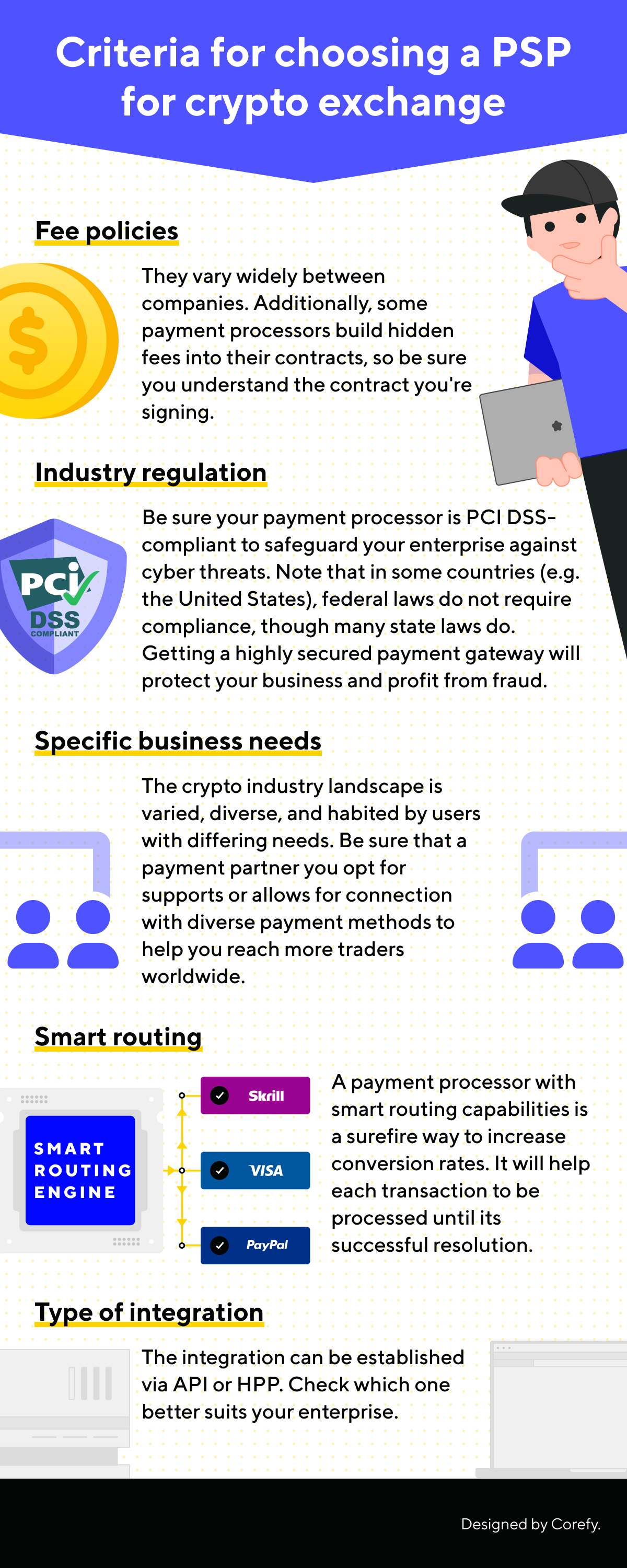

Checklist of essential criteria for choosing a PSP for crypto exchange

If you plan to run your own cryptocurrency exchange but not trade, your primary task is to find a reliable payment gateway for your business. Frictionless payment processing is one of the crucial elements of the whole business scheme. Integrating a reliable payment partner allows for the quick processing of users' funds and helps to avoid fraudulent transactions. However, not all payment processors are equal and suitable for crypto merchant services.

Choosing the right payment partner offers several advantages. In addition to protecting data and funds, you can accept various payment types, including alternative payment options.

Check out the list of vital points to consider when choosing a crypto payment service provider.

There are many factors to consider when choosing a PSP, but the core is:

- countries it operates in;

- its technical aptitude;

- the services it provides.

One more factor appears to be individual for each enterprise: different service price tags. These depend not only on the depth of the services offered but also on security, reliability, and establishment in the market.

Benefits of using a PSP for crypto exchange

Utilising a payment solution for crypto exchange allows you to devote more time to your project development, avoiding technical hassles. Here's a list of benefits you'll get partnering with a reliable PSP for crypto exchange:

Convenienсe & unification

All your incoming & outgoing transactions are tracked in one dashboard. A unified payment dashboard allows you to monitor all transaction data, including statuses, callbacks, declined payment requests, etc. By monitoring the metrics, you can spot certain trends in traders' behaviour and make better decisions on business development.

Reduced processing costs & time on development

Choose a solution with a smart processing engine that routes each transaction to the most relevant provider and helps you save on processing fees. Having a ready-made solution with multiple capabilities allows you to start accepting crypto payments and making payouts without losing time on development.

Dedicated support team

If anything goes wrong or you have a question, a skilled payment team is at your service. They help you find out the reasons and fix the situation. Moreover, if you request a new feature, you can ask them and avoid hiring specialists to develop it on your end.

Corefy's payment gateway for crypto businesses

We know that finding a reliable payment solution is not an easy task. It requires thorough consideration and matching of your needs with the offerings. We are here to help.

Discover how Corefy's innovative payment gateway revolutionises the landscape for crypto businesses, providing seamless integration and enhanced security. We empower businesses to streamline their operations and expand their reach in the digital economy with features like multi-currency support, automated transaction processing and management, and robust fraud prevention mechanisms.

Book a demo today to unlock the full potential of Corefy's payment gateway and elevate your crypto business to new heights.

.png)

.png)

.png)