Making online payments seems quite clear for a payer – just enter the card data and press “pay”. But in practice, each payment made via different payment methods goes through a complicated digital payment lifecycle until it is finalised.

You can monitor the specific transaction statuses and resolutions provided by its stakeholders to understand the transaction's lifecycle stages.

What stages and transaction statuses does a payment lifecycle usually comprise? Let’s peek under the hood.

Who are the stakeholders of a payment?

It’s essential to understand who is involved in the whole process of money movement. You might have heard of a four-party operation model – some payment networks, like Visa and Mastercard, usually use it. The four parties are a cardholder, an issuing bank, an acquiring bank, and a merchant. All of them are indispensable contributors to payment processing.

How does money get to a merchant?

Each transaction type's path is quite complex and not evident to laypeople. For customers, a payment’s complete after they press “PAY”, see their payment confirmation or when their money leaves their account. But it isn’t the same for a merchant, and the original payment isn't at once settled in the seller’s account. Money transfers undergo a whole payment lifecycle:

Stage 1. Payment initiation. After deciding to purchase some product or service, a purchaser goes to a checkout page to fill in their payment details and press “PAY”. At this stage, a transaction or a money transfer is initiated, and payment processing starts.

Stage 2. Payment authentication. In the second stage, a payment platform becomes engaged. The service checks the payment information and available funds in the payer's account.

Stage 3. Payment processing. After checking, the transactional data is sent to the acquiring bank, and the payment is pending until confirmation. The transaction status at this stage is usually called "pending."

Stage 4. Approval & completion. The transaction will remain "pending" until the seller’s bank gives it the green light. Then, the status changes, and the payment is approved. That is, the sum is finally deposited into the account at the acquiring bank. After rambling from one bank to another, the transaction ends up in the recipient’s account.

These four stages usually happen to the money between initiating a transaction and its finalisation. But at every stage, there is a range of transaction statuses that differ across payment providers and platforms.

Types of transaction statuses at Corefy

When accepting payments or making payouts, you can track their progress by paying attention to the specific transaction statuses. This chapter is intended to help you understand what each transaction status at Corefy means.

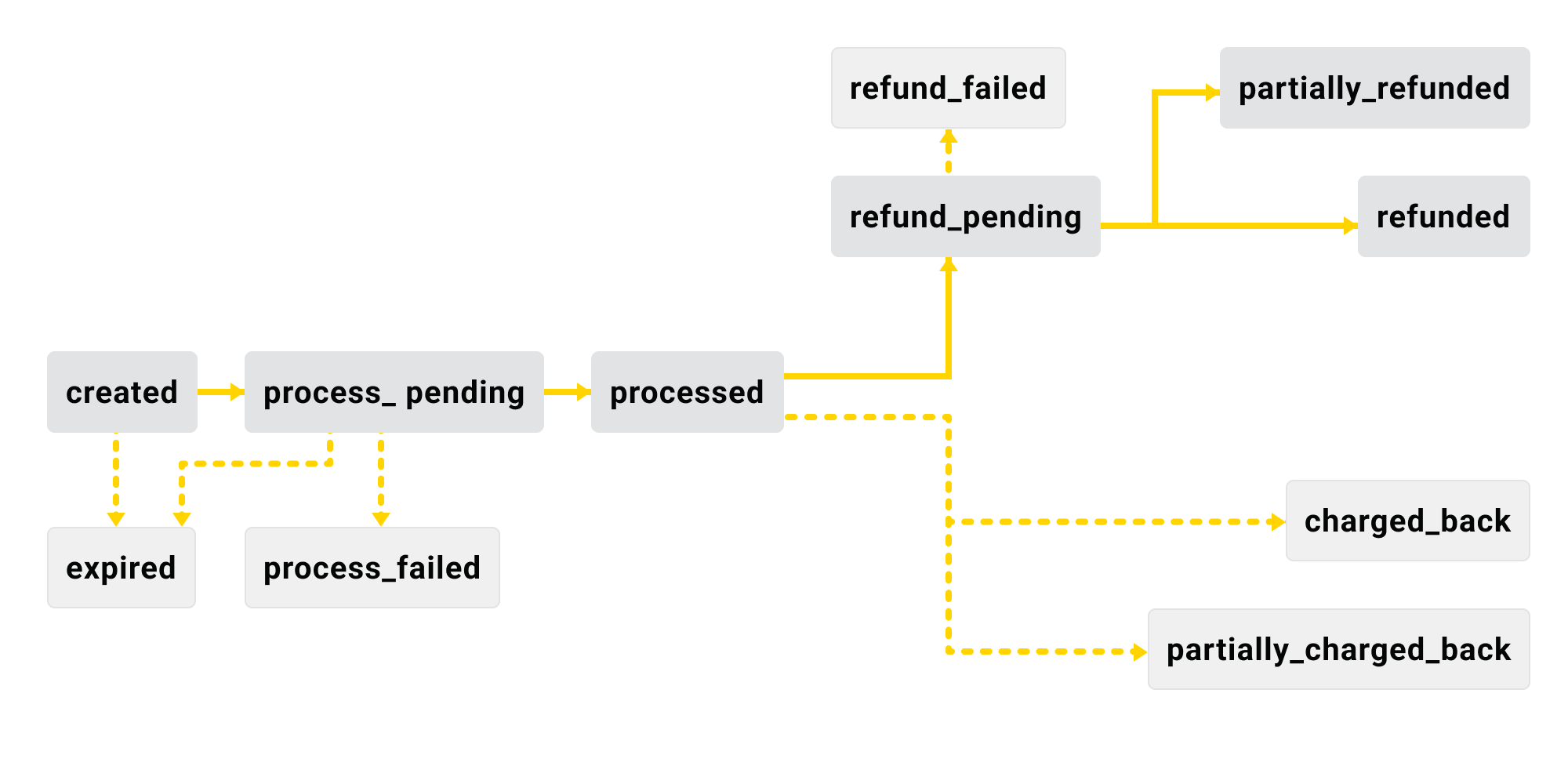

So, each payment stage passing through our platform is accompanied by a certain transaction status. All of them are divided into two groups – transitional or final. Below, we’ll state all of them, with the code ‘F’ for those considered the final ones.

- created: an invoice has been created, but the processing itself has not yet started

- expired: the transaction hit the lifetime limit without successful processing (F)

- process_pending: processing of a transaction has begun and is in progress

- processed: the transaction is successfully processed (it is final, but can also be transitional in case of a refund or chargeback)

- process_failed: there was some error, and the request for processing failed (F)

- refund_pending: there was a request for a refund, and the request for the latter is in progress

- partially_refunded: the refund has been made, but the sum is less than in an initial invoice (F)

- refunded: the refund of the entire sum has been made (F)

- refund_failed: the process of refunding failed or cannot be completed due to some reason (F)

- charged_back: transaction with this status has been claimed as a chargeback (F)

- partially_charged_back: the transaction was claimed as a chargeback, but in a less amount than the initial invoice (F)

What can go wrong during payment processing?

Each transaction type can change its path at any of the above-mentioned stages. Every possible situation is accompanied by a specific transaction status that can vary from one payment processor to another.

- 'Failed' – transactions can fail due to various reasons on any participant’s side, be it a payment processor, the payer, or the payee.

- 'Declined' – payments can be rejected by a bank in case of insufficient funds or limits.

- 'Void' – a merchant can cancel the transaction before settling down.

- 'Expired' – a payment wasn’t authorised until the allowed deadline.

- 'Refund' – a payer received the wrong product or just changed their mind, requested a return, and asked to turn the money back to their account.

- 'Chargeback' – a forced return of money to a payer, mostly unwanted by businesses, but still happens quite often, mainly when fraud schemes occur.

Our customers can monitor the payment resolutions to get a transaction status clarification and understand the reason for each specific failed status.

Conclusion

Summing up all the above, a payment doesn’t happen at once after pressing pay at the checkout. Instead, it’s the beginning of payment processing, a request for payment authentication. A few hours to even days can pass before a bank that deals with the original payment transfers your money to a merchant and settles the transaction with a payment processor's help. On the merchant’s side, specialists usually tackle reconciliation to monitor the payment data and ensure all the expected payments and payouts have been made and successfully finalised.

Most times, transactions move successfully until the settlement, but issues happen. We at Corefy know how to maximise conversion and increase payment success rates. Contact our sales department to book a demo and see our platform in action.

.png)

.png)

.png)