‘How has our revenue changed over time?’, ‘What’s our cost per transaction?’, ‘What are the main reasons for declines?’ – we bet every business owner has asked these questions at some point.

Having a clear and detailed view of your payment activities is crucial for ensuring transparency, meeting regulatory requirements, and making smart business decisions. Without it, you might struggle with cash flow issues, face compliance headaches, or miss out on opportunities for growth.

Whether you're a large organisation overseeing multiple merchants or a solo merchant trying to stay organised, this payment reporting guide will provide you with handy strategies for keeping things smooth. Dive in!

What is payment reporting and why you need it

Payment reporting provides a comprehensive view of a company's financial health and helps in maintaining accurate records for accounting, compliance, and strategic decision-making.

Producing reports is a time and effort-consuming activity. But there are analytics & reporting solutions that streamline this process, allowing you to save valuable resources and focus on analysing the data instead.

Our white-label payment platform offers a range of reporting options tailored to meet the diverse needs of small merchants and large multi-project organisations. From the basic to the pro-level, let's explore each payment reporting strategy in detail.

Basic reporting: export from the Dashboard

Most businesses with merchant balance management needs rely on auto-generated reports from their dashboards. These reports are based on accounting data, meaning each transaction operation is recorded as a separate entry in the report.

Thus, reports from the Dashboard provide a detailed history of accounting transactions rather than focusing on payment or payout invoices.

What types of reports can I get?

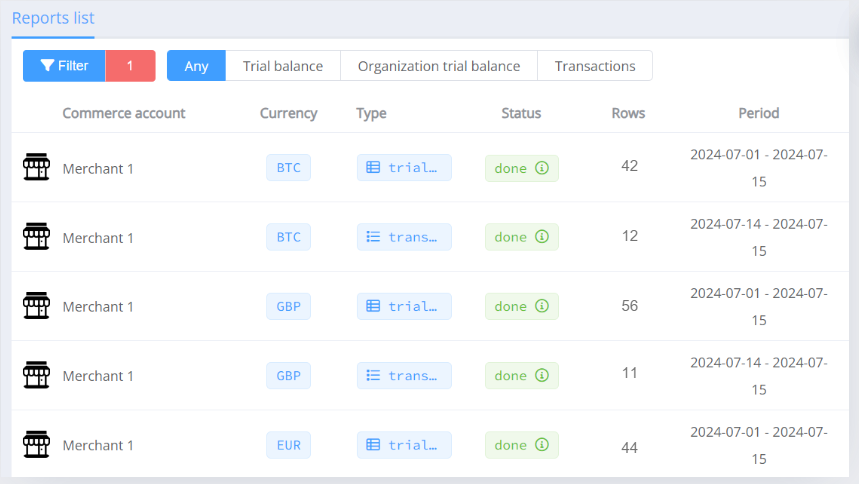

There are several types of reports available for export, each tailored to provide specific insights into your financial operations.

- Transaction reports. These reports offer a detailed history of changes in transactions that impact the merchant balance, such as settlements, fees, refunds, rolling reserves, and more. They can be generated on a daily or monthly basis, ensuring you have up-to-date information on your financial activities.

- Trial balance reports. These reports provide a clear snapshot of a merchant’s daily financial health. They show the balances at the start of the day, the total amount of money received and spent (including incoming fees, payments, outgoing fees, payouts, and transfers), and the closing balances.

- Organisation trial balance reports. While individual merchants can track their own financial activities, organisations can get aggregated reports covering all their submerchants. These reports show the total balances at the beginning of the day, the total incoming and outgoing amounts, and the closing balances for every merchant, offering a comprehensive overview of the organisation's daily financial status.

Reports for the previous day are automatically created at the beginning of a new day based on your time zone. Your submerchants can download reports on their transactions directly from the merchant portal.

For many merchants, starting with basic reporting is often the best approach. But as your business grows, so do your transaction tracking needs. Let’s dive into the next, more advanced level.

Analytics for organisations

Advanced reporting offers more detailed insights and customisation options for those ready to dive deeper into their financial data. This approach is ideal for organisations that require more granular analysis and have the resources to interpret complex data.

Powered by Redash, our Analytics solution allows you to create custom reports based on any specific data you want to include.

A wide selection of visualisations allows you to have a set of key metrics in front of your eyes.

Whether it's understanding chargebacks, tracking transaction trends, or gaining deeper insights into your finances, Analytics gives you all the tools for risk management and ultimate control.

Pro level: direct database access

At this level, you gain direct access to our database. By importing this data into your data warehouse, you can generate any reports you need, customise them, create graphs, and set up monitoring and alerts based on your specific requirements.

For organisations with sophisticated needs, pro-level reporting offers the highest degree of customisation and control. This strategy is ideal for businesses that require extensive data manipulation and have the technical capabilities to manage complex reporting systems.

To sum up

By providing both pre-configured reports and the ability to access raw data, we empower clients to make informed decisions and maintain robust financial control. Start with the basics, explore advanced options as you grow, and move to pro-level reporting when you need maximum control and customisation. With the right approach, payment reporting can become a powerful tool for your business success.

.png)

.png)