In the fast-paced world of online businesses, ensuring smooth payment processing is paramount. This is precisely where payment orchestration platforms come into play.

This article delves deep into the intricacies of payment orchestration. You'll gain insights into payment orchestration platforms and their essential features, understand why and how businesses can adopt them and learn the criteria for selecting the optimal solution.

What is payment orchestration?

What is a payment orchestration platform?

A payment orchestration platform or POP is a technology solution that allows businesses to conveniently unify and manage the full cycle of their payment processes in one place. Acting as a central hub connecting merchants with multiple payment service providers, gateways, and acquirers, an orchestrator allows them to offer their customers the most relevant payment methods and comply with payment regulations in different geographies.

Why are payment orchestration platforms called this way?

Imagine you have various musical instruments, like drums, guitars, pianos, and trumpets – each with a different sound and its own way of being played. In terms of online business and payment processing, these instruments are different payment methods, such as credit cards, mobile wallets, bank transfers, and digital currencies. A payment orchestration platform takes all the different payment methods and makes them work together smoothly, just like a conductor brings all the musicians together to play in harmony.

In addition, a payment platform can provide valuable insights and analytics to businesses. It can track and analyse payment data, such as transaction success rates, customer preferences, and fraud detection, helping businesses make informed decisions and improve their payment processes.

Payment orchestration market overview

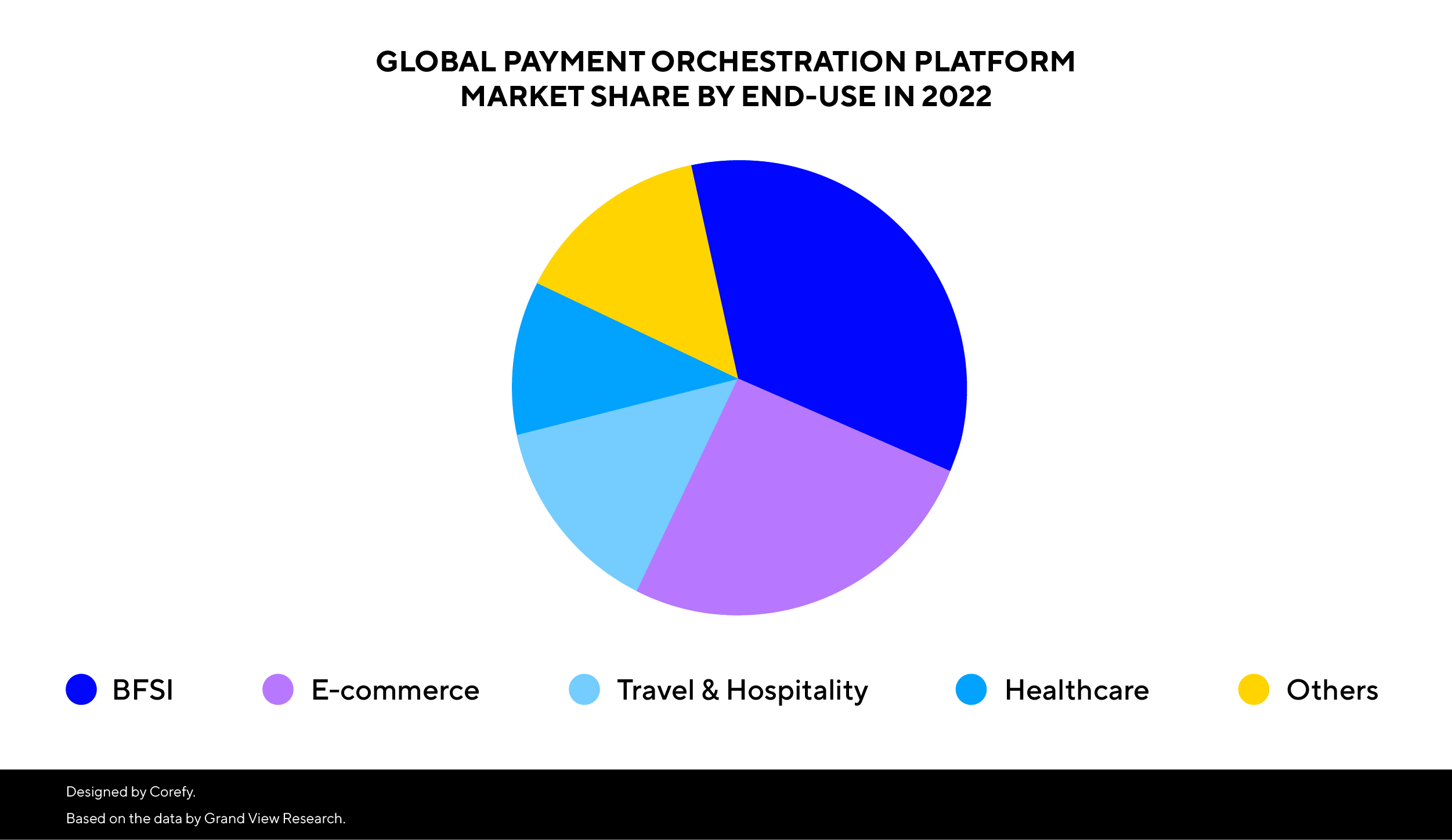

The payment orchestration market has experienced rapid growth in recent years. According to a survey by Grand View Research, the global payment orchestration market was valued at $1.13 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 24.7% from 2023 to 2030.

The increasing demand for seamless payment experiences and the rise of e-commerce keep driving the usage of payment orchestration platforms across various industries.

The dominant shares belong to banking, financial services and insurance (BFSI) and e-commerce industries.

How does a payment orchestration platform work?

Let's pull back the curtain and see how this game-changing technology actually works in real-life payment scenarios.

So, imagine a shopper adding a product to their shopping cart on a website that uses an orchestrator. Proceeding to the checkout page, the shopper picks their preferred payment method from a list of options and presses PAY. And this is where the payment orchestration magic starts.

- The payment gateway collects the customer's payment details, encrypts the card data, and passes it to the next step.

- The platform sends a payment request to a processor. If it doesn’t respond or declines the request, the payment orchestrator sends it to another route until the successful resolution, minimising the chances of payment declines. The rules of payment routing can be configured to fit specific business needs. For example, transactions can be routed to processors with the lowest transaction fees or exchange rates to minimize costs or distributed evenly across multiple processors to prevent overload on any of the providers.

- The acquiring bank receives the payment information and sends a request to the issuing bank. The latter’s task is to verify the transaction and authorise or decline it in case of insufficient funds, for example. In both cases, the acquirer sends a response code to the merchant and the payment gateway.

Thus, smart routing features turn payment orchestration into a shield against false declines, boosting payment acceptance rates. This isn't just about smooth transaction processing – it's about improving the customer experience, growing revenue, and minimising lost sales due to payment hiccups.

Why use a payment orchestration platform?

A payment orchestration platform offers businesses a streamlined and efficient way to manage all their payment processes in one place. It enables them to integrate multiple payment methods and providers and offer their customers freedom of choice, enhancing their overall experience.

Additionally, using an orchestration platform helps optimise transaction routes, ensuring each is sent through the most cost-efficient and reliable channel. Moreover, it provides valuable insights and analytics, helping businesses make data-driven decisions to boost revenue and reduce costs.

Payment orchestration also enhances security measures, safeguarding sensitive financial information and protecting online businesses against fraudulent activities. In sum, a payment orchestrator empowers businesses to offer convenient, secure, and versatile payment solutions to their customers while streamlining their operational processes.

Benefits of payment orchestration for online businesses

As shown in the market report by Grand View Research, the payment orchestration platform market is experiencing steady growth. Businesses from different industries are adopting this technology to make their payment processing run like a clock. Why so? Let’s explore the benefits of using orchestration for online businesses.

Added flexibility & scalability

Running an online business and expanding it to new markets requires adopting new technologies and integrating new payment providers to process cross-border payments – it’s really resource-draining. POPs enable businesses to take an easier route and choose from ready-made integrations without spending time and money on development and support. Moreover, businesses can easily add, remove, or switch payment service providers according to their evolving needs and customer preferences. This agility enables businesses to efficiently adapt to market trends, scale operations, and enter new markets.

Smooth payment experience

Customers who cannot pay via their preferred payment option might leave your website and switch to a competitor. By integrating as many relevant payment methods and gateways as needed, merchants provide customers with a seamless and consistent checkout experience. This boosts customer satisfaction and loyalty and decreases the number of lost sales.

Cost-efficiency

Payment orchestration simplifies transaction management by centralising all processes, reducing technical complexities, and minimising integration efforts. Relying on a POP, businesses don’t need to hire a team of developers to tackle and support integrations with payment service providers. Thus, businesses save lots of time, effort, and resources, focusing on core operations and developing customer relationships.

Payment acceptance optimisation

Payment orchestration platforms offer smart tools to process transactions through the most relevant provider. The payment routing feature analyses transaction data in real time, allowing businesses to route payments to the most suitable acquirer based on various factors and rules like currency, region, fee, time of payment, etc. And these rules can be customised based on specific business needs. This optimisation increases transaction success rates and helps to get armed against payment downtimes.

Risk mitigation

Firstly, a payment orchestrator protects businesses against provider downtimes by routing transactions through alternative channels, ensuring uninterrupted payment processing. In case of a merchant account block, it swiftly reroutes all transactions to another provider, minimising disruptions and potential revenue loss. Also, it allows businesses to optimise transaction volumes, maintaining provider limits without encountering operational hurdles.

Drawbacks of payment orchestration

While payment orchestrators offer numerous benefits, there are a few shortcomings to consider.

First of all, relying on third-party providers always introduces an element of risk. Any technical issues or downtime experienced by the payment orchestrator can impact the business's payment processing. This means businesses should consider several criteria while choosing a reliable orchestrator for their online payments. We’ll dwell on them in one of the following chapters.

Secondly, partnering up with payment orchestration platforms involves additional costs, depending on their pricing model. They usually include integration fees, transaction fees, and monthly subscription fees. These costs must be carefully evaluated to ensure the benefits outweigh them.

What is the difference between a payment gateway and a payment orchestration platform?

While payment orchestration platforms and payment gateways are related concepts, they slightly differ in their performance.

A payment gateway acts as a bridge between a merchant's website and a payment processor, facilitating the secure transfer of payment data.

In contrast, payment orchestration platforms offer a comprehensive solution that manages and optimises payment processes by working with multiple payment gateways, acquirers, and alternative payment methods.

Generally, a payment gateway is software that facilitates payment processing, and a payment orchestrator represents a holistic platform that unifies many capabilities and services apart from payment processing.

How to choose the best payment orchestration platform?

After getting familiar with the benefits payment orchestration brings for businesses, you might wonder about the choice criteria. We’ve collected a brief go-to list of factors to consider when selecting a payment orchestration platform:

- Security and compliance. Check if the platform is PCI DSS compliant and implements encryption and tokenisation to protect sensitive payment data.

- Integration options. Ensure the platform integrates smoothly with your existing systems, including e-commerce platforms, payment gateways, and other payment service providers.

- Vendor reputation and support. Evaluate the vendor's track record, customer reviews, and the availability of technical support. A reliable vendor ensures a smoother implementation and ongoing support.

- Scalability and flexibility. Confirm that the platform can scale with your business's growth and accommodate future payment requirements, such as expanding into new markets or adding alternative payment methods.

- Reporting and analytics. Consider the depth and breadth of reporting and analytics capabilities offered by the platform. Robust data insights will enable you to optimise your payment processes effectively.

The best way to ensure a payment orchestration platform suits your business is to book an online demo and speak to a company’s sales representative. Even a quick discovery call allows you to ask some questions and get to know if the solution suits your needs.

How to integrate a payment orchestration platform?

Payment orchestration platforms offer various integration options, including:

- API integration. This involves direct integration of the payment platform's API into your website. Such type of integration offers the highest level of customisation but requires more development effort. Allowing for seamless communication and data exchange between systems, API integration ensures real-time information transfer.

- Pre-built plugins and extensions. Some orchestrators offer pre-built plugins and extensions for popular e-commerce platforms, simplifying integration and reducing development effort. Such type of integration is easier than the previous but offers less flexibility and control.

- HPP. A hosted payment page provides a quick and easy integration option where a third-party payment platform hosts the entire payment process, requiring minimal development effort.

Which option is the best fit for your project depends on its specific needs and your team’s technical expertise. Direct integration may be your best option if you have developers in your team. Remember to consult the documentation provided by the payment orchestration platform you choose, as they often have detailed guides and code samples to help with the integration process.

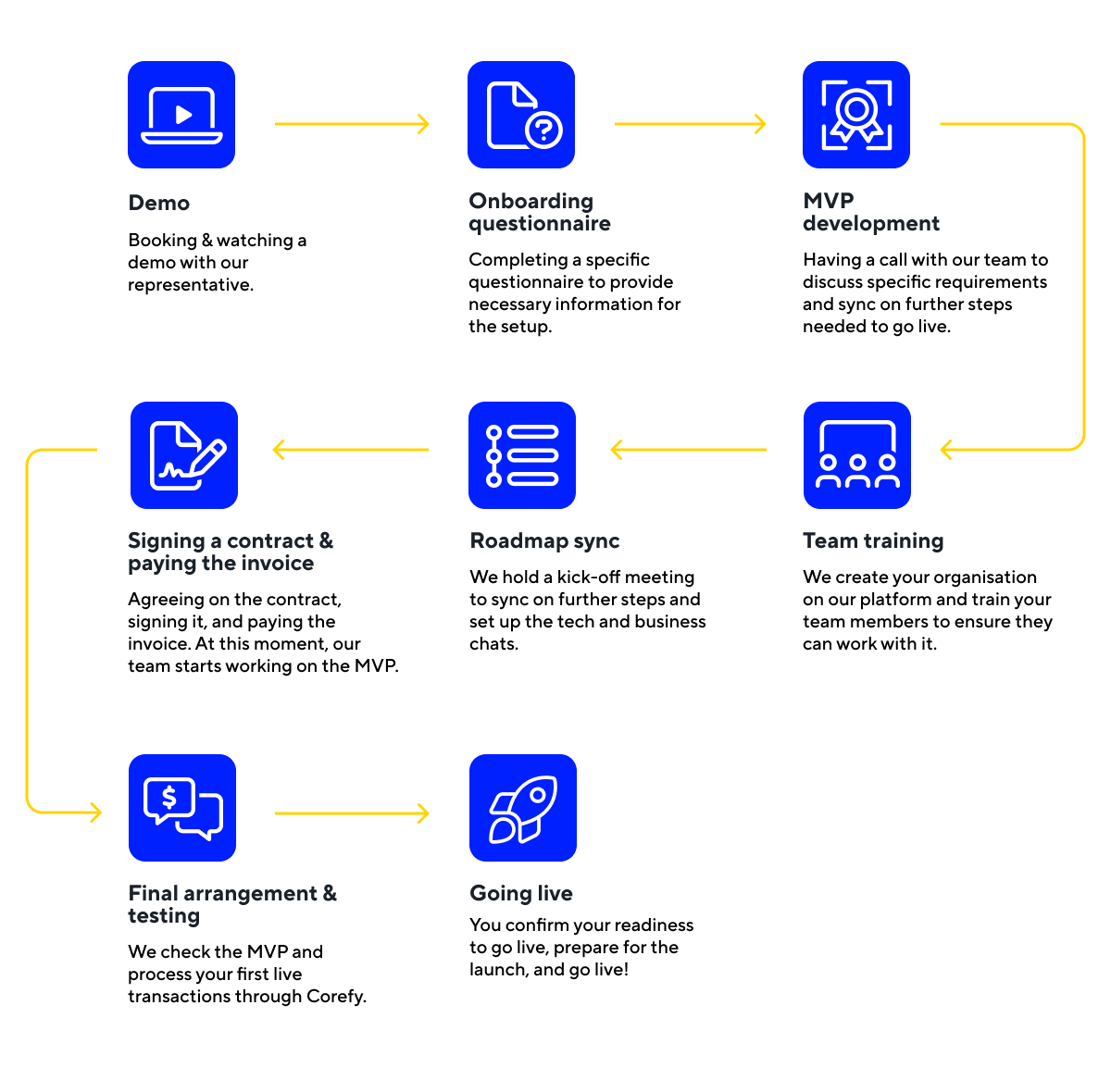

How to get started with a payment orchestration platform?

Given the intricate and sophisticated nature of the payment orchestrator, users often need help understanding how to use it to its full potential. Recognising this need, payment platforms offer a payment team as a service to assist their clients. It means they get a dedicated account manager who helps and supports them all the way.

So, to start leveraging the benefits of payment orchestration, businesses communicate with their onboarding manager, define their MVP, configure their payment setup, test it with the first live transactions, and go live.

Getting started with Corefy

Here’s a high-level view of the first steps of our clients:

Cost of payment orchestration platform

Payment platforms usually charge their clients monthly or annually plus for each successfully processed transaction, and the sums depend on the business size, transaction volume, and chosen pricing plan. To give you a rough idea, a monthly price for basic features for a small business ranges between $200 to $2000 and can run up to $6000 for large businesses requiring advanced features, like white label solutions, enhanced support, and on-demand development requests. Still, the cost varies based on the vendor, the breadth of offered features, transaction volume, and customisation requirements.

Pricing models may include monthly subscriptions, transaction fees, or a combination of both. Evaluating the total cost of ownership is essential, considering both direct costs and potential cost savings resulting from improved efficiency and conversion rates.

Conclusion

Payment orchestration platforms have emerged as a powerful tool for online businesses seeking to optimise their payment processes, enhance customer experience, and improve operational efficiency.

By centralising and streamlining payment management, payment orchestrators offer businesses flexibility and scalability, enabling them to adapt to evolving market trends. However, the complexity of integration and potential additional costs must be considered. By carefully evaluating and choosing the right payment orchestration platform for their needs, businesses can gain a competitive edge, boost customer satisfaction, and drive revenue growth.

.png)