Why would a company want to integrate multiple payment service providers? The main reason boils down to the good old quote:

Relying on a single payment partner could be risky, primarily because of possible outages and downtimes. Being able to switch to another provider saves your sales and protects you from financial and reputational losses.

Of course, it is not the only benefit of having multiple payment service providers connected. We’ve touched upon the pros and cons of having multiple payment partners in one of our previous articles.

Now, let’s learn how the integration of payment service providers happens, what difficulties may occur, and how to avoid them.

Integrating multiple payment providers through your own efforts

First of all, keep in mind that the development and setup of your own integration with PSP can be very resource-draining. The more payment handlers you want to integrate, the more complicated the process. However, integrations can be established faster if you have a highly skilled development team.

Each PSP has its own technical specificities, and the integration process may differ. Let’s focus on a general flow:

- Analyse the documentation of the chosen PSP. Do they offer the features you need? Would you be able to integrate them into your current technical infrastructure? Do you have enough information to start working on your own integration, or should you contact the payment service provider for additional details? Deep dive into parts of documentation explaining the implementation processes for each feature you would like to integrate.

- Once you are sure the payment provider meets your needs, reach out to them to request, set up and activate development credentials. Keep in mind it may take some time. You may also ask for assistance or consultancy if you need any.

- Based on the documentation, define the transaction flow, explore requests and responses, statuses, fields’ requirements, etc., and project your integration.

- Develop your integration. If you didn’t skip the previous step, you know exactly what to do and what your code should look like. Perform A/B testing of your integration in the sandbox environment before proceeding to the next step.

- Deployment and support. It is recommended to start processing transactions through the new integration gradually, tracking its performance to avoid losses and malfunctions and ensure everything works smoothly.

All these steps should be performed for each new integration you want to establish. It requires significant development effort and is a neverending process, as the technical infrastructure needs maintenance and timely updates.

Moreover, working with multiple payment service providers creates the need for an entire payment team. The thing is, alongside the integration, there comes administration and management. You’ll have to monitor payment service providers’ health and stay in contact with every payment partner to solve issues and make amendments to your partnership.

Having your transactions processed through multiple payment gateways also deprives you of a comprehensive view of your performance. It leads to the need for manual systematisation and analysis of all that data. The more gateways and merchant accounts you have, the more manual work and time you’ll need to reconcile, and the more errors you can make.

Integrating multiple PSPs through Corefy

Now, let’s compare the abovementioned process of integrating multiple payment providers with the one our clients are facing.

To integrate multiple payment providers, Corefy users should:

- Create a merchant account with a PSP of their choice.

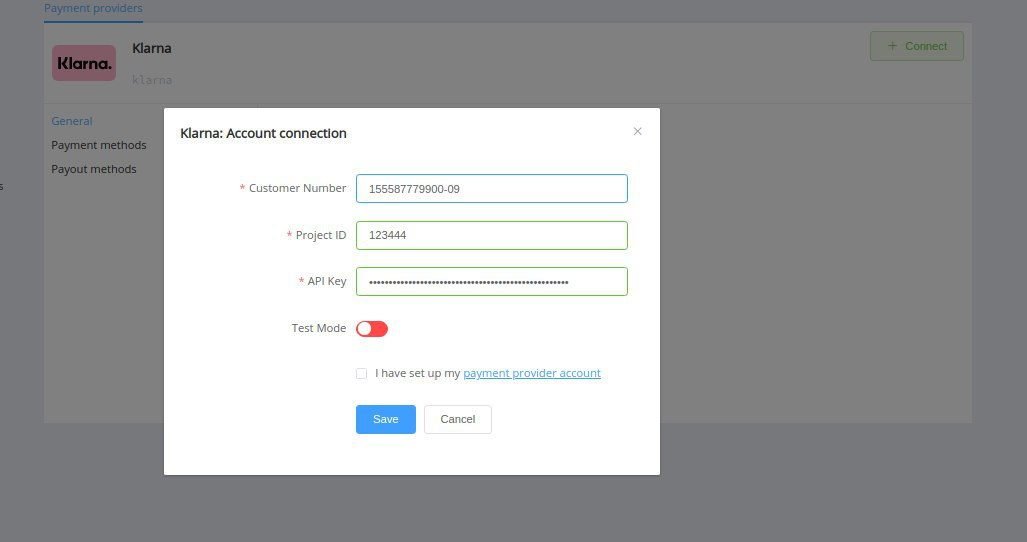

- Go to the Payment providers tab on the Dashboard.

- Find their new payment service provider among a myriad of available options and click on its logo.

- Enter the details PSP provided to them.

- Click Save.

That’s it. No development efforts are needed at all. It was made possible due to our Development team’s ongoing work on implementing hundreds of connections with payment service providers worldwide. We continue establishing new connections and maintaining them for our clients, making handling their cash flows simple and efficient.

Managing the infrastructure is also much easier with Corefy. We provide a single access point to all your business activities. You can monitor your performance across multiple payment providers, switch between them in real time, set up routing schemes, gain insights from automated reporting and analytics, save time and effort with our automated reconciliations, and many more. We aim to be a payment partner, offering technical support and assistance and continually expanding our platform’s functionality. If that sounds compelling, get in touch through our brief contact form.

.jpg)