People worldwide are increasingly engaging in mobile gaming, with the number of players expected to reach 1.9 billion by 2027. It inevitably affects the industry's revenue. According to Statista, the global mobile gaming market is projected to generate a revenue of over $98 billion in 2024, with China topping the charts. The popularity of mobile gaming is driven by the high smartphone penetration and strong consumer demand for interactive and immersive gaming experiences.

Today's article focuses on one of the fascinating aspects of mobile gaming — virtual economies and virtual currencies in games and apps. We will learn more about in-app virtual currencies and answer your whys and hows.

What is a virtual in-app currency?

A virtual in-app currency is a specialised form of digital currency created and used within a specific software application, often a mobile app or an online platform. Unlike traditional currencies issued by governments (fiat currencies), virtual in-app currencies are designed and controlled by the developers of the app or platform. They function as an internal economy, facilitating the exchange of goods, services, or enhancements within the app environment. These currencies can be earned through in-app activities and achievements or directly purchased with real money, providing a monetisation strategy for developers and enhancing user engagement.

Virtual in-app currencies typically serve multiple functions: they simplify the transaction process within the app by offering a standardised medium of exchange, they encourage user participation and retention by rewarding users with currency for engaging in activities, and they create a scalable economy that can be adjusted by the developers based on the app's needs and market dynamics. These currencies can be specific to individual items or services within the app (e.g., coins, gems, or energy) and often come with varying levels of value or power, designed to fit within a carefully crafted reward and progression system.

Why do in-app currencies exist?

One of the main reasons developers add virtual currencies to their mobile apps is to enable in-app purchases, which is a great way to monetise the app.

Different app monetisation strategies allow developers to generate revenue from their apps, thus turning this activity into a viable business. These strategies are often mixed into omnifarious hybrids, but we can also use them separately. To name a few:

- Paid download

- Subscriptions

- Advertising

- Virtual economy

- In-app purchases.

The first type implies that a user has to pay for the mobile app before downloading it. This pricing model is not in demand, with most developers preferring subscriptions or a free-to-play model. Customers are more likely to back these models, too, as they allow them to try playing a game before deciding whether they want to commit time or money.

Besides, virtual game currencies are a cornerstone in the design of freemium business models, where the app itself is free to use, but users can spend real money on virtual currencies to enhance their experience or progress more quickly. This model taps into the psychological principles of value perception and instant gratification, as users are more inclined to make purchases when they perceive they are getting value or advancing their status within the app community.

Developers tend to accrue higher revenues using free-to-play or freemium monetisation strategies and allowing in-app purchases. While most customers consider advertising annoying, they usually don't mind or even appreciate smartly crafted virtual economies and an opportunity to buy additional game items or premium content.

What kinds of virtual currencies are used in apps and games?

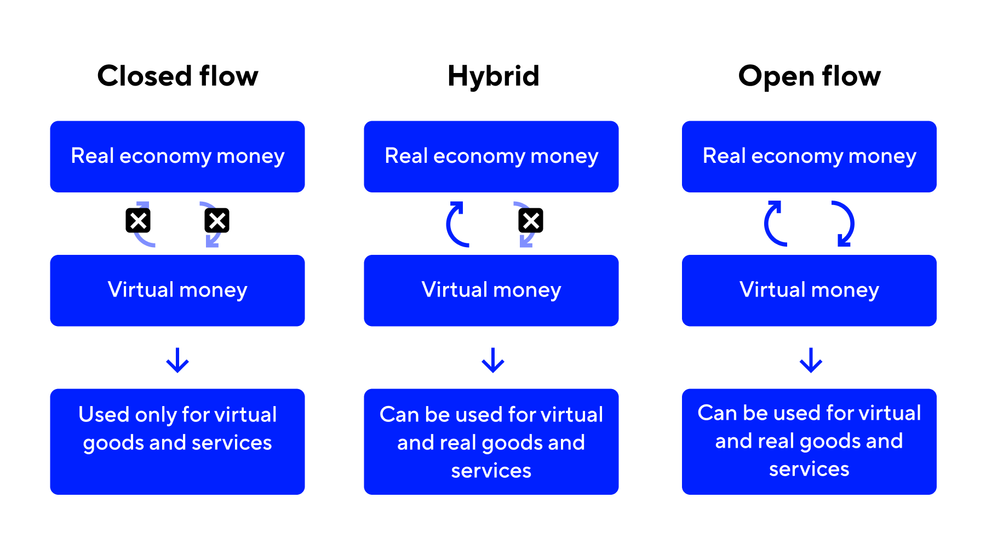

The classification of virtual currencies in games depends on the types of virtual economies. If economic activity occurs solely in a virtual setting, such a virtual economy is called closed. If the economic activity occurs in both the virtual environment and the real economy, it is called open.

In any case, virtual currency is a digital exchange unit within the virtual economy. Depending on the interaction with the real economy, we can separate three types of virtual currency systems:

- Closed flow. Users can use the virtual currency in apps for purchases only within the app. All the virtual goods and services a user can buy with a closed-flow currency represent no value outside the app and can not be exchanged for traditional currency. The best example is Monopoly Money or Simoleons from The Sims.

- Hybrid. Usually, users can earn a hybrid currency virtually by completing tasks or watching ads. They can also purchase it with traditional money but not exchange it for real cash. Such a virtual currency only has value to the issuer (app developer) and its customers (players). The issuer is also liable for taxes on profits from selling a hybrid currency for real money. Most mobile apps and games use this type of virtual currency — for instance, World of Warcraft and many other MMORPGs.

- Open flow. Virtual currencies used in open-flow systems are called convertible virtual currencies (CVCs). Users can use them to purchase both real and virtual goods and services and exchange them for traditional currency. Second Life's Linden dollars are the most prominent example of convertible virtual currency. The developers of this virtual world allow residents to trade their Linden dollars for real dollars on the LindeX exchange, which uses third-party payment networks. Open-flow virtual currencies are subject to taxation in most jurisdictions.

Are in-app currencies regulated?

As one could have guessed from the previous mentions of taxes, virtual currency in apps and games may be regulated. Watchdogs often take a similar regulatory approach to virtual currencies as to cryptocurrencies. In-app currencies may also be subject to anti-money laundering laws.

For instance, the virtual currency issuer can be considered a money transmitter in the US. It means they accept funds or other value substitutes for currency from one person and transmit another value that substitutes for currency to another person or location. Money transmitters must register with FinCEN.

To avoid triggering strict regulatory obligations, developers should create virtual currencies for in-app use only and state this fact clearly in the app's Terms of Use. To avoid misunderstandings, experts from Venable LLP suggest stating that:

How to create your own in-app purchase currency?

Integrating in-app purchases into your mobile game enhances the user experience and creates significant revenue streams. This process requires meticulous planning, adherence to legal and regulatory guidelines, a focus on user-friendly interfaces, and ensuring transaction security. Here's a brief 3-step guide to creating your own in-app purchase currency:

1. Set up developer and merchant accounts

Creating a solid foundation for in-app purchases starts with establishing necessary accounts on platforms like the Apple App Store or Google Play Store.

- Create a developer account. Register with the platform's developer program and pay the fees required (annual for Apple, one-time for Google). Then, you'll need to ensure your in-app purchases comply with the platform's guidelines, focusing on transparent information presentation, pricing accuracy, and functionality of purchasable items.

- Set up a merchant account with a reliable online gaming payment provider. You can streamline payment processing by integrating a secure gambling payment gateway, which is also suitable for handling in-app and gaming-related transactions. This setup requires submitting financial and tax details to meet regulatory requirements.

2. Decide on the currency type and in-app purchase items

A pivotal decision in creating your in-app purchase system is selecting the type of virtual currency to implement:

- Closed-flow currency is simple and not exchangeable for real money, sidestepping many legal and tax complexities.

- Open-flow currency is exchangeable for real money, requiring detailed legal and tax consultations to ensure regulatory compliance.

- Hybrid currency merges elements of both, offering flexibility and new revenue opportunities by treating virtual currency as a digital good.

Another critical decision is what in-app purchase items to offer. It requires both strategic and creative input to ensure they are appealing and valuable to users. Aim for offerings that enhance gameplay and incentivise purchases. Design clear, engaging icons and descriptions for each item, with pricing strategies reflecting their value within the game's economy.

3. Implement the in-app purchase system

The technical side of in-app purchases involves integrating platform-specific billing systems and ensuring user-friendliness.

- To manage the purchasing process, implement the right software development kits (SDKs), such as StoreKit for iOS and Google Play Billing Library for Android.

- Develop and integrate code to manage the purchase flow, transaction handling, and purchase verification with the platform's SDKs.

- Follow platform guidelines for in-app purchases, ensuring clear descriptions, accurate pricing, and an intuitive purchase process.

- For open-flow and hybrid currencies, prioritise securing transactions through reliable payment gateways and updating security measures to prevent fraud.

- Design the purchasing process to be straightforward, allowing users to easily buy, spend, and view their currency within the game.

- For games offering open-flow or hybrid currencies, it's crucial to work with legal and tax experts to navigate the complex landscape of digital goods regulations.

- Post-launch, actively monitor the system for any issues. Collect and analyse user feedback, adjusting pricing and offerings based on real-world performance data.

Additional tip: Look for an expert consultation

If you're unsure about handling the complexities of in-app currencies, especially at scale, consider consulting with payment processing experts. They can provide insights into optimising your currency system for better efficiency, lower fees, and higher user satisfaction.

.png)