Payouts are an indispensable part of business activity for most companies. They make payouts to their suppliers for goods or services, pay salaries to their employees, pay a commission to their partners, etc.

For some business models, payouts are a bedrock of operations. Companies use them for cashback, rewards and loyalty programs, refunds, and many more.

The larger a business gets, the more payouts it makes. Forming separate payout invoices gets more complicated and takes much more time. This is when batch payouts come to the rescue.

Let's learn more about batch payouts, how they work, and why this tool is worth using.

What is a batch payout?

In other words, this feature enables sending hundreds of payments to your customers and counterparties simultaneously by creating a batch file in CSV or XLS format and uploading it into specialised payout software.

To make batch payouts, merchants can use the API or Dashboard of their payout solution provider. Large merchants that frequently deal with payouts may opt for developing their own batch payout capabilities if they have enough time and resources. However, getting the ready-made solution from the payment service provider or technological platform is much easier and more efficient.

Who needs batch payouts the most?

As mentioned above, some businesses use payouts more frequently than others and, therefore, may benefit the most from batch payouts.

Here is the list of industries and working processes where using batch payouts is game-changing:

- HR management — paying out salaries and bonuses to your employees;

- Affiliate programs — making regular commission payouts to your affiliates;

- Gaming & Betting — distributing winnings, prizes, and rewards;

- Retail merchants & Marketplaces — initiate mass payouts to suppliers and vendors.

- Freelance or influencers platforms — paying multiple contractors for their services;

- Insurance — process and send payouts for claims;

- Loyalty programs — send earnings to customers through their preferred payment methods.

How to make batch payouts?

It's worth navigating the documentation of the payout solution provider of interest for the detailed tutorial and requirements for sending payout batches.

Let's examine a step-by-step process of sending batch payouts through Corefy.

1. Create a batch payout file

Batch payouts imply spreadsheet-like execution. The first step is to create a spreadsheet — a file in .csv format.

It depends on the payout solution provider which columns to include in the file and how to fill the fields.

Usually, batch payout files that Corefy merchants make contain the following columns:

- service — specifies which payment method and currency should be used for every payout;

- service_amount — specifies the payment amount in the currency indicated in the previous column;

- fields_data — a column for payment details that a chosen payment method may require, such as a bank account or card number;

- reference_id — a unique identifier for each item (payout invoice) in the batch.

In some cases, not all these columns are required; in others, more columns can be added (like customer and customer_metadata).

If it seems like a lot to handle, don't worry: we've created an example of a batch payout file in a .csv format you can use as a reference. Besides, the dedicated Account Managers we assign to every client will gladly help if needed.

2. Upload the file to the platform

Once your file is ready, go to the Dashboard and click Transactions → Batch Payouts → New. You can either browse to find your .csv file or just drag and drop it.

There will also be a couple of fields to go through, like the name of a batch payout, for your team's further reference. You can also add the description if needed. The system will also ask you to select the currency account for the write-offs. If you've listed different currencies for different payments in the batch payout file, the system will convert the funds according to the current exchange rate.

When you upload the file, the platform will validate it and verify that all the specified services are available for payouts and that all parameters are correct.

If some payouts weren't validated because of mistakes in the .csv file or conditions that haven't been fulfilled, you'd instantly see their statuses. It allows you to leave it as is (such payouts will be skipped at the processing stage) or edit the items in the Dashboard to fix the errors.

3. Process your payouts

There are two processing options for batch payouts. When all checks are completed, you can submit your file for processing in the preferred mode:

- sequential — one payout by one;

- parallel — all payouts simultaneously.

You can monitor the processing and, if necessary, suspend it before it's completed.

The platform monitors and displays the status of the whole batch and each item individually.

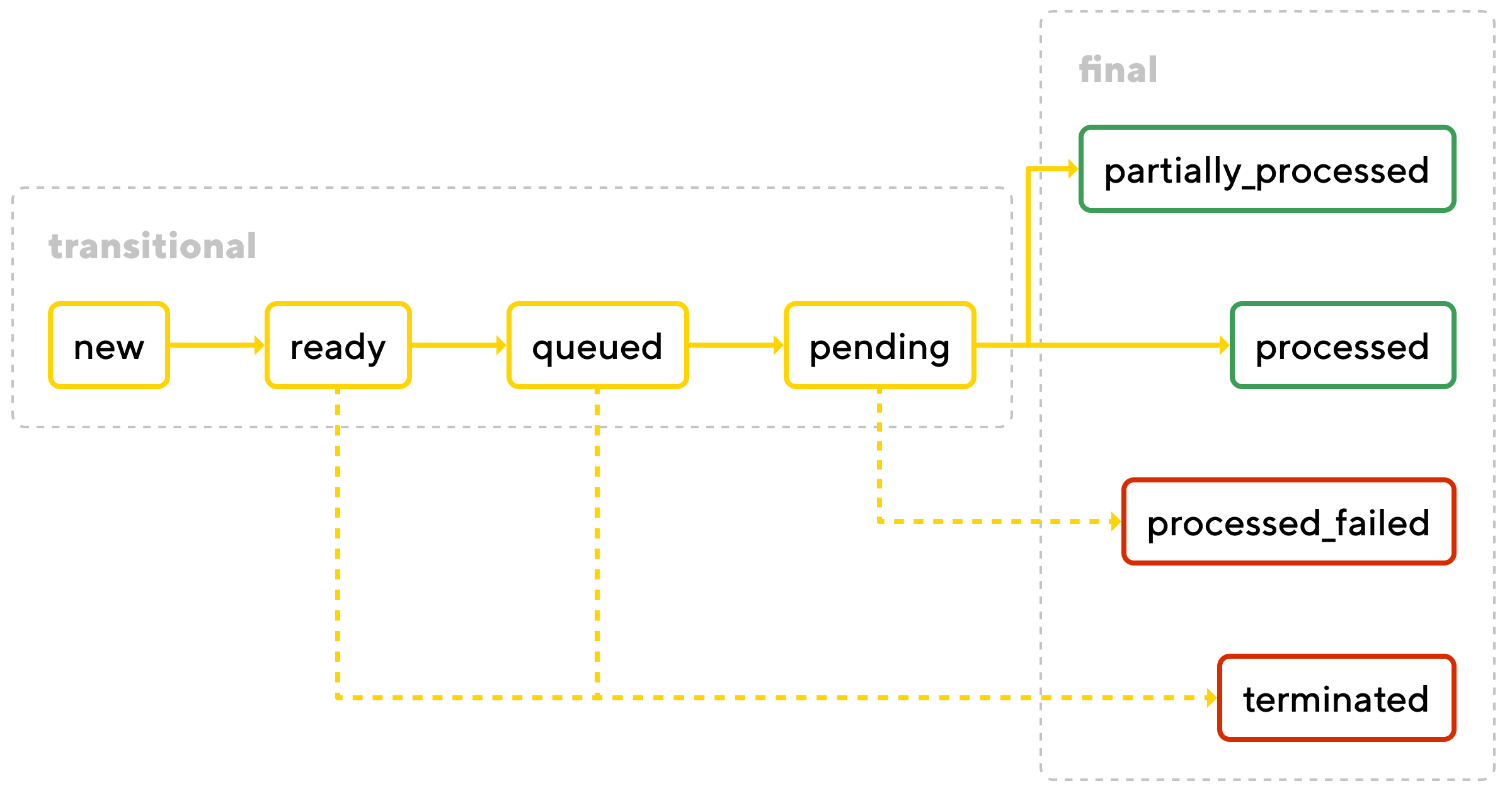

⬇️ These are the possible payout statuses on our platform

You will see two sums:

- estimated — the initial total of all payout invoice amounts in the batch;

- processed — fully or partially completed.

4. Download a detailed report

As the processing is finalised, you can filter and examine failed items, if there are any, and download a report for your records.

You can also export a file with all the failed payments, make changes if needed, and upload it for processing again to get them finalised.

How long does a batch payout take?

The speed of batch payout processing depends on numerous factors, starting from the capabilities of the payout solution you use and ending with the number of items in the batch, the currencies and payment methods you've specified, etc.

Let's say your batch payout contains 200 items with the same payment method and the same currency, and this currency matches the currency account you've selected. Such a batch will be processed the fastest — most likely, within a few minutes, if the health of the payment service you specified permits.

Benefits of making mass payouts with Corefy

The efficiency of our batch payouts tool rests on four pillars:

- Ease. With Corefy, you are just one click away from simultaneously performing batch payouts to thousands of recipients. It is as simple as clicking a mouse. It allows you to optimise the workload and shift the focus away from monotonous manual work.

- Speed. This tool saves you a lot of time and money in sending out multiple payments. Moreover, our capabilities ensure the fastest possible completion of the numerous items in your batch payout request.

- Versatility. Batch payouts is a comprehensive, all-in-one solution that lets you make mass payouts at any scale by leveraging as many payment methods and currencies as needed. One batch payout file can include payout invoices involving any payment method, currency and amount. We also offer you various supporting features to ensure unlimited payout capabilities. For instance, every item in a batch payout can be split into multiple transactions, enabling the successful processing of any amount. You can also reroute transactions until completion or suspension and manage failover by setting up attempt limits and routing rules for any resolution.

- Accountability. Monitor your batch payout progress in real-time mode, view each item's status, and generate a detailed report upon completion in a few clicks. We automatically reconcile all your transactions, depriving you of manual reconciling headaches. Learn more about reconciliation from our article.

If it resonates with your current business tasks, please reach out to us through a contact form.

We'll get back to you to help, answer your questions, and jointly find the best payment solution for your company.

.png)

.png)

.png)