If you run a business, chances are you've come across the issue of fraud. In fact, in 2023, an alarming 65% of organisations fell victim to payment fraud attacks, as reported by J.P. Morgan. With numbers like these, companies are seeking ways to prevent and detect fraud proactively.

Do you want to build an efficient anti-fraud system but need help figuring out where to start? This article is here for you. Our CEO & Co-founder, Denys Kyrychenko, shared precious insights based on our own anti-fraud system development experience. Get your pen ready to write down – we promise lots of helpful information.

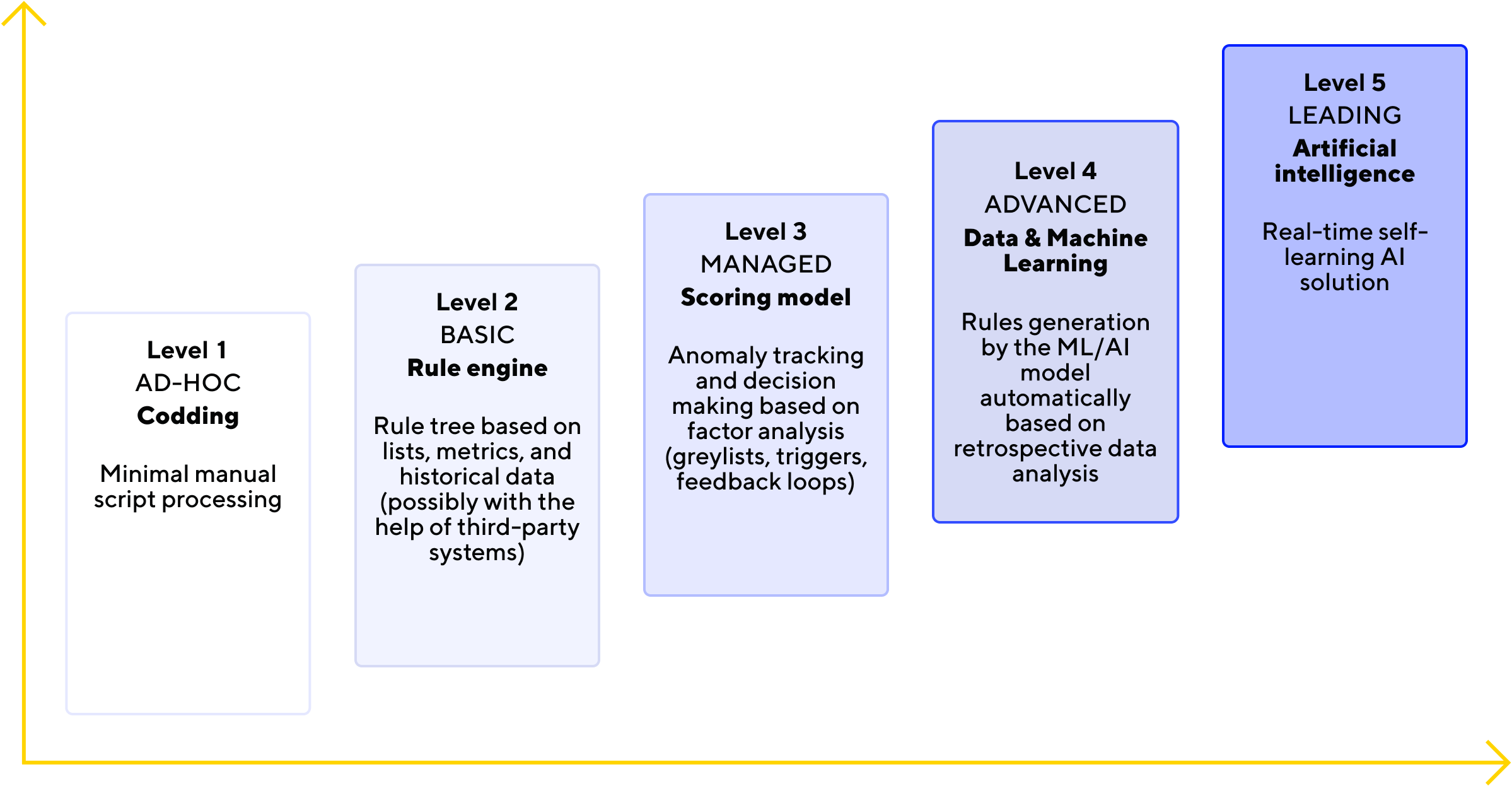

Fraud management maturity levels

There are five levels of fraud management maturity, ranging from the most basic to 'rocket science' technology. Let's learn more about each of them.

- Almost a complete lack of protection except for minimal manual script processing.

- Implementing basic blocking rules and lists, but with all the work done manually.

- Adding metrics, scoring, and accumulation of historical data to build more accurate blocking rules. Development of fraud prevention strategies based on the received data.

- A flexible and adapted system based on ML/AI that independently generates rules based on the analysis of collected historical data and metrics.

- Self-learning multi-level system that doesn’t require human intervention.

The level of antifraud maturity you need depends on your business’s risks and needs. An equally important factor is the human and financial resources you are ready to invest in building fraud prevention software.

But the critical thing you need to know is that your antifraud should be proactive, not reactive. A reactive system responds to fraud after it has occurred. It's like a fire alarm – you can only detect smoke after there's been a fire, and then you call the fire department. A proactive system, on the other hand, prevents fires from happening in the first place by detecting them before they start.

Building an antifraud system: steps to get started

There are two strategies for implementing an antifraud system: build an internal system or use external antifraud tools to prevent fraudulent transactions. However, these strategies are not mutually exclusive. Thus, you can create an internal system that integrates with external systems to verify transactions. In practice, some teams also run fraud controls through a white-label gateway with anti-fraud, so risk rules and checks can be managed centrally across providers without changing the customer-facing flow.

Here are five steps you can take right now to build an antifraud system that both protects your business and makes customers feel safe.

Identify your risks

You can't manage the unknown, so it's important to know what types of fraud you're likely to face and how much financial loss they could cause.

Here are two main questions to ask yourself:

- What are our biggest vulnerabilities?

- How much do these vulnerabilities cost us?

The goal here isn't just figuring out how much money could potentially be lost; it's also about getting an accurate picture of what types of fraud might happen at each step along the customer journey.

Develop policies and procedures

Once you've identified your risks, develop written policies and procedures for identifying suspicious activity related to those risks. You can use them as guidelines when setting up any automated tools or manual processes you use in conjunction with payment processing services.

Start developing

Now, it's time to take all of the ideas and information you've gathered during the planning stage and start putting together your fraud detection system design. Plan your steps, and just start coding! The development stage is where your antifraud system takes shape.

Test and refine the system

Once you've got a prototype built, it's time for testing. This is where all of the pieces come together and are put into action. Test your antifraud system by simulating fraudulent activity with real-world data, such as credit card numbers from past breaches or fake accounts set up with stolen information. This allows you to identify gaps in coverage before they become problems for your business and allows you to modify any automated tools or manual processes accordingly.

Implement monitoring and reporting

Once you've tested your antifraud system, you'll want to monitor its performance over time to ensure that it flags fraudulent activity accurately. You also need a way to report those results to stay informed about how well your system is performing overall. Assess your monitoring results regularly to identify if any modifications are required.

Things to know before launching

Before you dive into development, there are some crucial things you should be aware of.

Antifraud systems must adapt to changes

The threat landscape is constantly changing, and so must your antifraud system. If a new type of fraud comes up or your customers’ behaviour changes, your fraud monitoring software must adapt and evolve quickly enough to keep up with the new reality.

If you don't keep up with these changes, you'll leave yourself vulnerable to attacks.

Data, data, data

Data is the fuel that powers an antifraud system. By collecting data on transactions, user behaviour, and other relevant information, antifraud systems can analyse patterns and detect anomalies that may indicate fraudulent activity. You can also use the collected data to create models and algorithms for fraud prediction and prevention.

Without proper data collection, antifraud systems may miss critical red flags and be less effective.

Starting small is the key to success

If you're just starting out in antifraud, it's easy to get excited about all the possibilities and get overwhelmed by the mountain of things you could do. But if you try to go too big too fast, it can be difficult to manage the system and ensure everything is working as intended. Instead, begin with one type of fraud, like credit card fraud or identity theft. Once you've got that down, add another fraud type and so on until you've got a system that addresses all possible fraud scenarios.

How Corefy’s Firewall changed the game

Antifraud systems aren’t one size fits all. They're built to solve a specific problem and may use various technologies, depending on what's best suited for your organisation.

In response to the needs and experiences of our clients, we’ve developed a customisable multi-level antifraud solution called ‘Firewall’. It relies on an attribute-based rule engine to evaluate each incoming and outgoing payment in real time. Among the attributes are customer IP, transaction amount and currency, merchant account ID, card-issuing country, customer metadata, and many more.

The Firewall allows you to establish over 1000 rules for flagging suspicious transactions and use different types of blocklists that can be automatically replenished and cleared. Plus, the service can interact with external third-party services to make a final decision on a transaction (for example, MaxMind or Sift.com).

Using Corefy’s Firewall can save you thousands of dollars in development costs because we have already done much of the heavy lifting for you. Just contact us to get started!

.png)

.png)

.png)