Alternative payment methods for modern businesses: a must or an advantage

Non-cash transactions are accelerating worldwide, pushing e-commerce toward a cashless default. Customers want to pay fast and friction-free, so alternative payment methods (APMs) — from wallets and instant bank transfers to local favourites — are now a key driver of checkout success.

In this article, we explain what alternative payment methods are, why adoption is rising, which APMs matter most by region and industry, and how to add the right mix without overcomplicating your payment stack.

Alternative payment methods are any payment methods other than credit/debit cards or cash. Simply put, they're the ways customers pay using bank accounts, digital wallets, mobile devices, or region-specific networks.

APMs include digital wallets (Apple Pay, Google Pay, PayPal, Alipay), account-to-account and open-banking payments (instant bank transfers, Pay by Bank), mobile payment apps and QR-based payments (WeChat Pay, Pix QR, UPI), Buy Now, Pay Later (BNPL) services (Klarna, Afterpay, Affirm), prepaid and gift cards, direct debit and e-mandates, cash-based digital vouchers (PaysafeCard, OXXO), and cryptocurrency payments.

What ties them together is that they let customers pay in the way that feels most convenient and trusted to them, often with one-click checkout, biometric authentication, or instant confirmation.

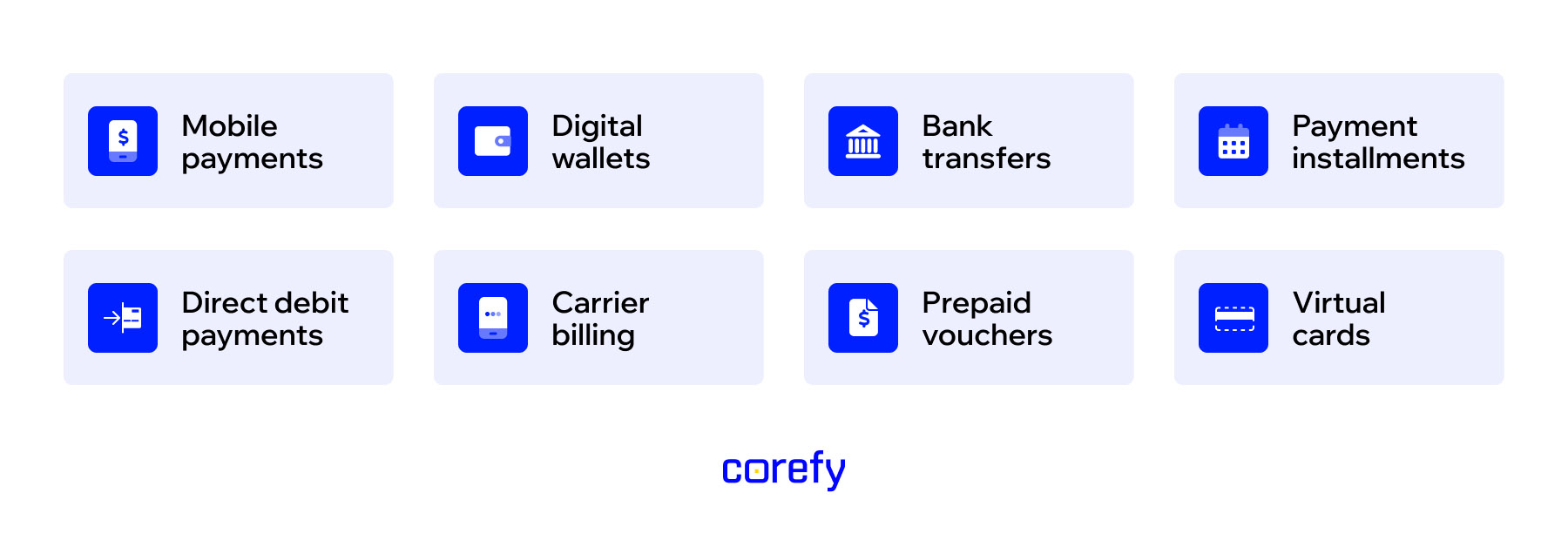

Popular alternative payment methods cover a mix of ways customers prefer to pay today, especially online and on mobile. Below are the most common APM types you'll see globally, what makes each one distinct, and where they typically fit best in the checkout experience.

Mobile payments are transactions initiated and completed on a smartphone, often through native apps or tap-to-pay flows. They usually rely on tokenised credentials and biometric authentication, making checkout faster and more secure on mobile.

Examples: Apple Pay, Google Pay, Samsung Pay, WeChat Pay (in-app), UPI apps (India), Pix apps (Brazil).

Typical use cases: mobile-first e-commerce, in-app purchases, omnichannel retail.

Digital wallets store payment details or balance so customers can pay without re-entering card/bank data. Wallets can be card-based, bank-based, or stored-value, and are often the default choice for repeat purchases.

Examples: PayPal, Alipay, WeChat Pay, GrabPay, Mercado Pago, Skrill, Neteller.

Typical use cases: fast checkout, cross-border sales, markets with strong wallet preference.

Bank transfers (account-to-account or A2A) move funds directly from a customer's bank account to the merchant. Customers authorise the payment in their banking app, often via open banking or instant rails, with real-time confirmation in many regions.

Examples: iDEAL (NL), Sofort/Klarna Pay Now (DACH), Trustly, SEPA Instant (EU), Faster Payments (UK).

Typical use cases: high-trust local payments, low-fraud flows, regions where cards are less dominant.

Instalment payments let customers split a purchase into multiple payments over time. These can be interest-free ‘Pay in 3/4' options or longer-term financing, typically approved instantly at checkout.

Examples: Klarna, Afterpay/Clearpay, Affirm, Zip, PayPal Pay Later.

Typical use cases: higher-ticket items, conversion uplift, shoppers seeking budget flexibility.

Direct debit pulls funds from the customer's bank account with their prior authorisation. It's widely used for recurring payments, subscriptions, and utilities, offering predictability and low processing costs.

Examples: SEPA Direct Debit (EU), Bacs Direct Debit (UK), ACH Debit (US), eMandates in various markets.

Typical use cases: subscriptions, memberships, recurring invoices.

Carrier billing charges purchases directly to the customer's mobile phone bill or prepaid balance. It's frictionless for users without cards/banks and common in digital goods and emerging markets.

Examples: Bango, DCB platforms, operator-specific billing in SEA, LATAM, and Africa.

Typical use cases: games, streaming, micro-transactions, unbanked audiences.

Prepaid vouchers enable online payments using cash purchased at retail outlets or online. Customers enter a voucher code at checkout, making this a key bridge between cash economies and e-commerce.

Examples: PaysafeCard, Neosurf, OXXO vouchers (Mexico), Boleto Bancário (Brazil), retail cash barcodes.

Typical use cases: cash-reliant regions, privacy-seeking users, gaming and digital services.

Virtual cards are digital, often single-use card numbers generated for a specific transaction or merchant. They add a security layer while still running on card rails, and are popular for both consumers and businesses.

Examples: Revolut virtual cards, Wise digital cards, Apple Pay/Google Pay tokenised cards, corporate virtual cards.

Typical use cases: safer online card payments, controlled B2B spending, subscription management.

APMs grow as people form payment habits in their everyday lives and bring those habits to checkout. As a result, what feels normal to customers in one region can feel awkward or even unavailable in another. That's why global expansion or even just improving local conversion rates increasingly depends on offering payment methods that align with regional expectations.

Below is how the shift plays out across major markets and what it means for your payment mix.

Europe is steadily shifting from a card-first mindset toward wallets and bank-based payments. As open banking matures and SEPA Instant becomes the norm, paying directly from a bank app feels faster and more transparent for many consumers. Capgemini predicts instant payments will reach 22% of global non-cash volume by 2028, and Europe is one of the main engines of that growth.

Local favourites like iDEAL in the Netherlands or BLIK in Poland have set the tone: seamless bank-to-bank payments with instant confirmation. Once buyers get used to that level of convenience, typing card numbers feels outdated.

What it means for merchants: Success in Europe increasingly depends on offering trusted, locally rooted APMs. Wallets, bank transfers, and BNPL options are part of the expected checkout experience.

APAC is the world's most APM-driven region. Here, wallets and QR-based payments overtook cards early on. Super-apps like WeChat, Alipay, Grab, and GoPay turned mobile payments into a daily habit long before many Western markets caught up. Worldpay highlights APAC as the most wallet-forward region and notes the long-term surge of wallets and mobile payments globally.

This region also shows how fast adoption can move when payments align with mobile behaviour. Once people use their phones for everything — ordering food, booking rides, scanning QR codes in stores — they expect the same ease online. That's why digital wallets dominate online checkouts across most APAC countries.

What it means for merchants: If you want to convert customers in APAC, wallet-first experiences are essential. Cards alone won't meet user expectations in China, Southeast Asia, or increasingly India.

North America remains card-centric, but consumer behaviour is subtly shifting. Cards are still used, just inside wallets rather than manually entered at checkout. That means customers increasingly choose Apple Pay, PayPal, or similar options first, even if the underlying payment method is still a card.

BNPL has also carved out a stable place in checkout for many categories, especially where shoppers want flexibility without leaving the purchase flow.

What it means for merchants: In the US and Canada, APMs are a conversion booster. Wallets and BNPL improve speed, reduce friction, and can meaningfully raise approval rates.

LATAM is leapfrogging traditional payment models. Instead of slowly moving from cash to cards to digital, the region is jumping straight to instant transfers, QR payments, and mobile wallets.

Brazil's Pix is a standout example: widely used across demographics, free, instant, and embedded in everyday life. Once consumers trust a method offline, they naturally expect to use it online too.

What it means for merchants: Winning LATAM means supporting instant A2A payments, digital wallets, and cash-based digital alternatives. Card-only checkout flows will struggle with both conversion and accessibility.

The Middle East is one of the fastest-growing regions for digital payments, driven by both government policy and consumer behaviour. Countries like the UAE and Saudi Arabia are actively pushing toward cashless economies through incentives, digital ID systems, and national instant-payment schemes.

A young, tech-savvy population, high smartphone penetration, and the rapid rollout of instant transfers make wallets and A2A payments increasingly popular.

What it means for merchants: To meet customer expectations in the Middle East, offering wallets, bank-based payments, and local digital options is becoming essential, not experimental.

Alternative payment methods are among the most reliable ways to boost conversion and keep payments resilient across markets. As APMs now drive about two-thirds of global e-commerce value, they've become the default expectation for a huge share of customers.

APMs can boost conversion and unlock new markets, but every new method changes your stack, checkout UX, and ops workload. Here's what to watch out for.

Each APM comes with its own flow, API quirks, and ongoing updates. Add a few directly, and you’ll quickly end up with a patchwork of SDKs, redirects, certificates, dashboards, and version changes to maintain.

Risks: development time shifts from building product to babysitting payments.

A method that crushes it in one country might underperform in another. Banks behave differently, local uptime varies, and customer familiarity isn't universal. Fraud patterns also shift by APM type (A2A vs vouchers vs BNPL), so one-size-fits-all risk rules won't hold.

Risks: carrying low-value methods and missing real fraud signals.

APMs are great when they feel native to the customer and chaotic when they don't. Too many options, inconsistent UX patterns, or showing the wrong methods to the wrong users can create more friction than cards ever did.

Risks: decision paralysis, mobile drop-offs, and lower conversion despite more choices.

Some APMs come with licensing, local compliance, or data-residency requirements. On top of that, many methods are tied to specific local PSPs, and once a branded method becomes part of your checkout routine, switching later can get expensive.

Risks: delayed launches, compliance exposure, and reduced flexibility.

APMs are worth it, but only when added strategically. Pick methods that align with real regional demand, keep checkout clean, and continuously monitor performance. With orchestration, you can do all of that without turning your payment stack into spaghetti.

Unlike cards, APMs don't follow a single rulebook. Settlement speed, refund logic, dispute handling, and reporting formats vary a lot by method and provider. Finance and support teams feel that pain first.

Risks: reconciliation headaches, slower refunds, and unclear cash flow.

Accepting alternative online payment methods is an opportunity to grow your sales and attract more customers. So, it would help if you were conscientious about choosing the right ones to provide the smoothest online shopping for your customers.

Here are the steps you can take right now.

Here are the market segments that require alternative online payment methods — check if your business is among them.

If the answer is 'yes', move to the next step.

APMs are never universal. What converts in Germany may be irrelevant in Canada. So before choosing methods, look at:

Output: a short list of 'must-have' APMs per priority market.

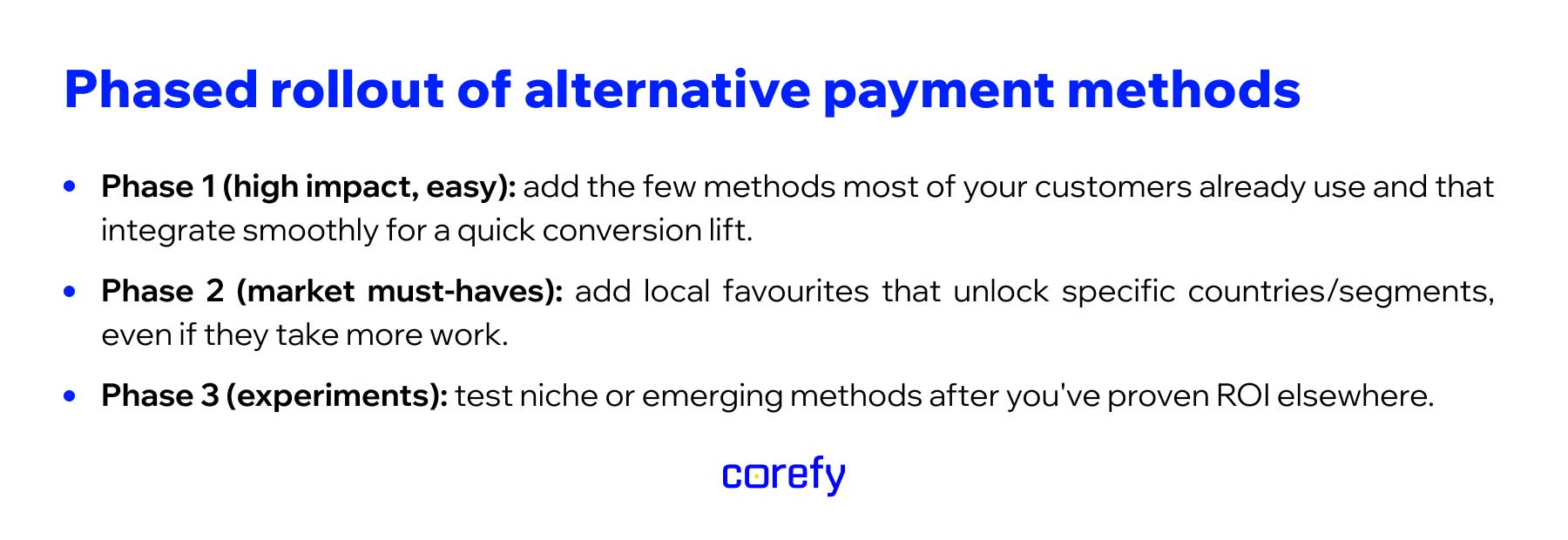

You don't need 20 methods, you need the right 5–7. The simplest way to get there is to rank every candidate by how much volume or conversion uplift you expect it to bring, how well it covers your priority markets, how heavy it will be to integrate and support (including checkout flow changes, refunds, reporting, and risk rules), and its real cost profile.

Output: a phased rollout with adding APMs in waves, so you get wins without bloating checkout.

Why do it? You get results early, avoid 20 useless buttons, and scale based on data instead of guesswork.

Why do it? You get results early, avoid 20 useless buttons, and scale based on data instead of guesswork.

APMs can raise conversion or spoil it if the UI is cluttered. Decide:

Output: a clean, logic-driven payment widget instead of a supermarket shelf.

Start with 1–2 markets or segments. Track:

Output: validated proof of value before you scale complexity.

Demand shifts and providers degrade over time, so after launch, you need to keep monitoring how each APM performs in each country and through each PSP, what it actually costs you per approved transaction, how well your fallback logic saves failed payments, and whether every method is paying for its place in the stack in terms of ROI. If a method starts underperforming or becomes too expensive, reroute traffic to a better option or retire it altogether.

Output: an APM mix that stays profitable and high-converting over time.

Corefy makes APM adoption practical, not painful. Instead of integrating each method one by one, you connect to Corefy once and get a unified layer to add and manage alternative payment options across markets.

Here's what that looks like in real terms:

If you're growing locally or going cross-border, we are ready to help you launch the right alternative payment methods quickly and keep checkout clean.

The most widely used alternative payment methods in 2025 are digital wallets, A2A bank payments (including open-banking and instant transfer rails), and BNPL instalments. Wallets are the everyday default in many countries and the biggest share of non-card online payments globally. A2A and instant bank payments are the fastest-growing structural alternative to cards, especially where “pay by bank” or real-time transfers are common. BNPL is smaller in total share than wallets, but it has become a standard checkout option in many retail and digital-service categories.

In many cases, yes. Mainstream APMs like wallets and bank-authenticated transfers usually reduce risk compared with typing card details into a form, because they authenticate users in trusted environments such as banking apps or biometric flows and often use tokenisation so sensitive card data isn’t exposed to the merchant. That said, safety depends on the method and how it’s implemented. Some APMs have different fraud patterns than cards, so they’re not automatically risk-free; they just shift the risk profile and need their own monitoring and rules.

For cross-border audiences, the safest approach is to start with globally recognised wallets that most international shoppers already trust, then add the top local methods in each priority market. There isn’t one universal set that works everywhere: Europe tends to expect pay-by-bank and local transfer schemes alongside wallets, APAC is heavily wallet and mobile-payment led, Latin America relies strongly on instant A2A rails, and the Middle East is rapidly adopting wallets and national bank-based methods. The goal is to cover what feels 'normal' to customers in each region without overcrowding checkout.

There’s no universal number, but there is a universal mistake: adding everything at once. The right approach is to cover the methods your customers already expect in your priority markets, then expand based on proven uplift. In most cases, a focused mix of a few global wallets plus the top local methods per region performs better than a cluttered checkout with dozens of options. Corefy helps here by letting you add and test APMs quickly without hard-coding each method into your product, so you can scale based on data, not guesswork.

It can, if you integrate them one by one directly into your stack. Every APM has its own flow, reporting, and maintenance cycle, which adds technical and operational weight. With orchestration through Corefy, you avoid that snowball effect: you connect once with our platform, configure methods through one layer, and keep checkout logic clean while still offering local variety.

Start from customer behaviour – look at where your traffic comes from, which devices your users shop on, and what local payment habits dominate those markets. The best APMs are the ones that remove a real, measurable conversion barrier for your specific audience. Corefy’s analytics and routing tools make this easier by showing success rates by method and region, so you can prioritise based on performance instead of assumptions.

Yes, and you should. The most effective checkout experiences are contextual: a shopper in the Netherlands expects iDEAL; a shopper in Brazil expects Pix; a mobile iOS user expects Apple Pay; a returning customer might prefer the wallet they used last time. Corefy’s checkout capabilities enable this kind of smart presentation and routing without you having to build separate checkout versions for every market.