Each transaction your business processes online or in-store comes with costs, collectively known as payment processing fees. These fees may seem small on a per-transaction basis but can accumulate to a significant expense, affecting your business's profitability over time.

This article delves into the payment processing fees, breaking down their types and roles in digital commerce's financial ecosystem. Whether you're a seasoned merchant or new to the online marketplace, gaining insights into these fees will equip you with the knowledge to make informed decisions about your payment processing strategy.

Brushing up on online payment processing

Before diving into payment processing fees, let's refresh our knowledge of the fundamental payment processing concepts.

Essentially, payment processing involves a series of steps and interactions among multiple parties to complete a transaction successfully. Here's a simplified overview:

- Transaction initiation. A customer makes a purchase using a credit card on a merchant's website.

- Authorisation request. The merchant's bank (acquiring bank) requests transaction authorisation from the payment processor.

- Transaction validation. The payment processor forwards the details to the card network, which then verifies with the customer's bank (issuing bank).

- Approval or rejection. The issuing bank checks the transaction for issues like funds availability and fraud risk before approving or rejecting it.

- Funds transfer. Upon approval, the transaction details flow back through the network, resulting in the merchant receiving the payment.

This process encompasses three main stages: authorisation (confirming the transaction's validity), funding (transferring the funds), and settlement (completing the transaction). Understanding these steps provides a foundation for comprehending the various fees involved in payment processing.

What are payment processing fees?

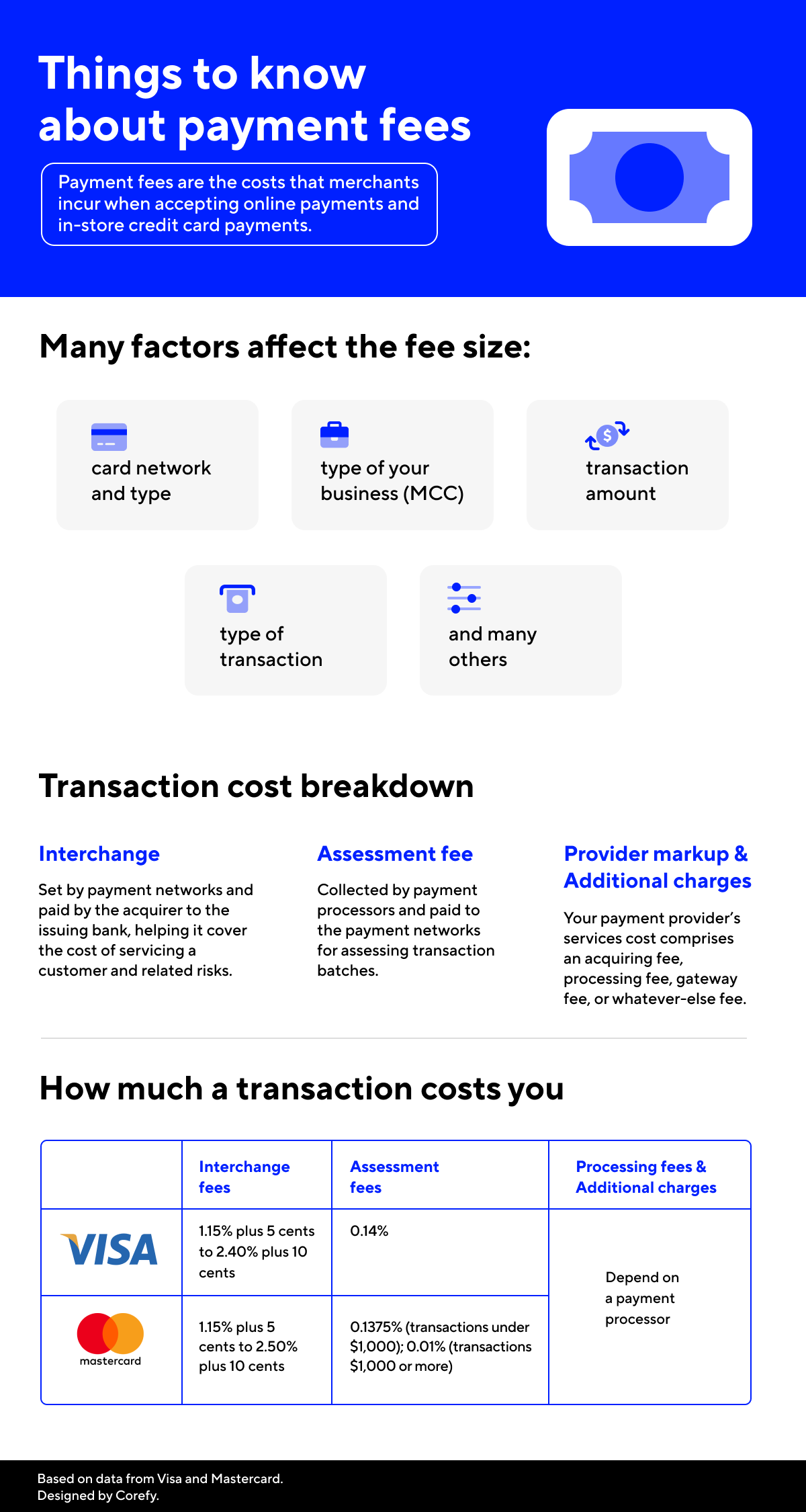

Payment processing fees are the costs merchants incur every time a customer uses a credit card or online payment method to make a transaction. These fees are pivotal because they enable the seamless operation of the payment processing system, ensuring that transactions are swift, secure, and reliable.

The magnitude of a payment processing fee is influenced by a myriad of factors, such as the type of payment method used (e.g., credit, debit, or prepaid card), the transaction's risk assessment determined by factors like transaction amount and historical fraud data, and the pricing model of the payment provider.

Understanding payment processing fees is crucial for merchants, as these costs directly impact the pricing of goods and services and, ultimately, a business's profitability. By delving into the composition and drivers of these fees, merchants can make informed decisions about their payment processing strategies, potentially identifying ways to optimise their operations and reduce costs.

Types of payment processing fees

Payment processing fees are pivotal in the seamless execution of digital transactions, enabling businesses to accept payments via various channels. These fees are divided into three primary categories: Interchange, Assessment, and Processing. Besides, there may be additional charges. Each category plays a unique role in the transaction process, and understanding them is crucial for merchants aiming to manage costs effectively.

Interchange fees

Interchange fees, often referred to as interchange reimbursement fees or interchange rates, are a fundamental component of the card payment ecosystem. They are fees collected by the merchant's bank (acquirer) from the merchant and paid to the cardholder's bank (issuer) to cover handling costs, fraud and bad debt risks, and the risk of approved but unpaid transactions. These fees are a significant portion of the card processing costs businesses face when accepting card payments, often accounting for up to 70-90% of the total fees.

The amount of interchange fees can vary widely due to a plethora of influencing factors, such as the card scheme (Visa, Mastercard, etc.), whether the transaction is card-present or card-not-present, the type of card (credit, debit, immediate debit, prepaid), the merchant category code (MCC), and whether the card is consumer or commercial. For example, transactions in Europe may attract interchange fees of around 0.3-0.4% of the transaction amount, while in the US, the costs can be as high as 2%.

Interchange fees are determined by card networks and are subject to periodic adjustments to reflect changes in the market. For the most current rates, consult the card schemes' official websites:

- Visa: Europe, USA

- Mastercard: Europe, USA

- For data on other regions or card networks, search the web for 'Interchange fees + card network name + region or country of interest'. Only use card networks' official websites for precise and up-to-date information.

Despite their complexity and variability, interchange fees are crucial in facilitating secure, efficient, and reliable card transactions, underpinning the global payment system's functionality.

Assessment fees

Assessment fees, commonly referred to as card brand fees, network access and brand usage (NABU) fees, or card association fees, are essential charges card networks impose to finance their operating expenses. These fees are a critical component of the costs incurred by businesses when processing credit card transactions, payable to card networks.

Distinguished from interchange fees — which are directed to the cardholder's issuing bank — assessment fees are paid straight to the card brands.

Typically adjusted biannually, these fees reflect the networks' need to adapt to operational cost changes and market conditions. Each card network has its unique set of assessment fees, making it crucial for merchants to grasp the specific expenses tied to each network.

For instance, Visa's assessment fees might include a credit assessment fee of approximately 0.14% of the credit card volume plus a fixed fee per transaction, and additional fees for international transactions might apply. Mastercard, on the other hand, could charge an assessment fee on transactions below $1,000 at around 0.1375% of the total card volume plus a per-transaction fee, with different rates for transactions exceeding $1,000 and additional charges for digital transactions and cross-border payments.

Assessment fees are generally structured as a blend of a flat fee per transaction and a percentage of the transaction volume. These fees underpin the card networks' ecosystem, covering the costs of technology, security measures, and fraud prevention efforts.

Merchants should regularly consult the latest fee schedules provided by each card network to navigate the complexities of these fees and ensure financial transparency. By staying informed about these costs, businesses can better anticipate the expenses associated with various payment methods and strategically manage their payment processing operations.

Processing fees

Processing fees are charged by the payment processor for the use of their payment gateway and services, constituting the remainder of the total payment processing costs.

These fees can vary significantly based on the processor's pricing model but generally include a mix of fixed per-transaction fees (e.g., $0.20 to $0.30 per transaction) and a percentage of the transaction amount (e.g., 0.5% to 1.5%).

The best way to find out the processing fee size is to examine the pricing page of the payment service provider you're interested in.

Processing fees cover the cost of technology, customer service, and security measures provided by the processor to facilitate transactions.

Additional charges

When navigating the complexities of payment processing fees, merchants must also account for additional charges that can influence the total cost of accepting card payments. These extra costs vary depending on the specifics of the transaction and the payment processor used.

Common additional charges include:

- PCI compliance fees. Yearly charges for adhering to the Payment Card Industry Data Security Standard (PCI DSS).

- Monthly service fees. Fixed fees for account maintenance and customer support.

- Terminal rental fees. Monthly fees for renting credit card terminals for in-person transactions.

- Gateway fees. Charges associated with using a payment gateway for online transactions, which may be billed monthly or per transaction.

- Chargeback fees. Fees incurred when dealing with disputed transactions resulting in chargebacks.

- Early termination fees. Potential costs for terminating a contract with a payment processor ahead of the agreed-upon period.

These additional charges underscore the importance of thoroughly reviewing and negotiating the terms with payment processors to understand fully and minimise the impact of these fees on your business operations.

How much does it cost to accept card payments?

Accepting card payments involves several types of fees, making the cost structure complex. However, by breaking down these costs, businesses can gain insights into how much they're actually spending per transaction. You can summarise the total cost of accepting a card payment with the following formula:

- Interchange fees. These fees are paid to the cardholder's bank and vary based on card type, transaction size, and whether the transaction is card-present or not-present. They typically range from 1.5% to 2.9% of the transaction amount plus a fixed fee (e.g., $0.10).

- Assessment fees. These fees are paid to the card networks to cover their operational costs. They're generally lower than interchange fees, about 0.13% to 0.15% of the transaction volume, depending on the network and transaction type.

- Processing fees. The payment processor charges processing fees to facilitate the transaction. These fees can vary significantly but often include both a percentage of the transaction (e.g., 0.5% to 1%) and a fixed per-transaction fee (e.g., $0.20).

- Additional charges. Depending on the payment processor and the transaction specifics, merchants might incur various other charges, such as PCI compliance fees, monthly service fees, or terminal rental fees.

Example processing cost calculation

For a $100 card-not-present transaction, assuming an interchange fee of 2%, an assessment fee of 0.14%, and a processing fee of 0.75% + $0.20, the total cost would be:

Assessment fee: $0.14 (0.14% of $100)

Processing fee: $0.95 ($0.75 + $0.20)

Total cost: $3.09

This formula provides a framework for businesses to estimate the costs associated with card payments. However, it's important to note that actual rates can vary based on numerous factors, including your industry, sales volume, and the specifics of your merchant services agreement. For the most accurate information, consult directly with your payment processor.

Remember about additional charges

The cost of payment processing and card payment acceptance isn’t limited by the transaction processing fee. You'll have to spend some amount on equipment if you want to accept card payments in-store or on software to accept transactions online. Also, many payment service providers charge one-time setup and monthly fees for using their infrastructure.

Ensure you know the pricing of the chosen payment partner well enough to avoid unexpected charges.

How to save on payment processing fees?

There are two ways to cut the cost of online payment processing. The first one is to look for tips on what can be done in our article ‘How to reduce online payment processing costs’.

Alternatively, just contact us! Serving companies that work with multiple payment providers, Corefy empowers them to save on payment processing fees without lowering conversion rates. We’re ready to share our knowledge and tools with you.

Key takeaways

Here are the basics of all the fees described, gathered into a small table for your convenience.

| Criteria/Fees | Interchange fees | Assessment fees | Processing fees & Additional charges |

|---|---|---|---|

| Charged on | Each transaction | Total monthly transaction volume | One-time, monthly, per transaction basis, specific conditions, etc. |

| Set by | Card association | Card association | Payment processor |

| Paid to | Issuing bank | Card association | Payment processor |

| Size range | 1.5% to 2.9% | 0.13% to 0.15% | See provider’s pricing |

| Revisable | Yes, twice a year | Yes, twice a year | Yes, upon the processor’s decision |

| Negotiable | No | No | Yes |

And here are the essential points from the article:

- Payment processing involves several fees: interchange fees, assessment fees, processing fees, and additional charges. Each plays a significant role in the cost of accepting card payments.

- Interchange fees are the largest component of payment processing costs, paid to the cardholder's bank. They vary based on factors such as transaction type and card scheme, and are non-negotiable.

- Assessment fees are charged by card networks like Visa and Mastercard. They cover operational costs and are non-negotiable. They are generally lower than interchange fees.

- Processing fees, which cover the technology and services provided by the payment processor, can vary widely and often include both a percentage of the transaction and a fixed per-transaction fee.

- Beyond the main fees, businesses may encounter various other charges, such as PCI compliance fees, monthly service fees, terminal rental fees, and more. These charges can vary based on the specifics of the transaction and the payment processor used.

- The total cost of accepting a card payment can be estimated using the formula: Total cost per transaction = Interchange fees + Assessment fees + Processing fees + Additional charges. This formula helps businesses anticipate expenses and manage their payment processing strategies effectively.

- While some fees are non-negotiable, others may be subject to negotiation with your payment processor. Understanding the fee structure and seeking transparency in pricing can help businesses minimise costs and choose the best payment processing services for their needs.

- Payment processing fees and policies can change, so it's essential for businesses to review their arrangements regularly and stay informed about any updates from their payment processors and card networks.

- Staying informed about the latest changes in payment processing fees and regulations can empower businesses to make strategic decisions, negotiate better terms, and, ultimately, reduce the costs associated with accepting card payments.

.png)

.png)

.png)