How to become an electronic money institution (EMI): license, requirements & setup

Over 310 electronic money institutions (EMIs) are operating in the United Kingdom, the highest number in Europe. To give you some context, the second on the list is Lithuania, with 85 institutions, and the total for the region is almost 700. And the number is constantly growing, driven by immense demand. According to EY data, nearly 75% of consumers across 27 global markets use an e-money or fintech service.

In this article, we'll explore how to enter this booming market and the potential challenges and pitfalls that may arise. We'll learn how to establish an e-money business efficiently and get an electronic money institution license.

But first, let's define an electronic money institution (EMI) and explain how it differs from related concepts.

To discern the hidden meaning of the EMI term, we should define e-money.

Electronic money is a digital monetary value we can use to make payments. A digestible example of e-money is funds on PayPal or plastic gift vouchers that you can use in stores.

In the European Economic Area and the UK, companies looking to issue electronic money and provide payment services can choose between two main types of e-money institution licenses: authorised EMIs and small EMIs. While both permit e-money issuance, they differ significantly in scope, obligations, and strategic potential.

An authorised electronic money institution is the full-scale version of an EMI. This license allows the institution to issue e-money and offer a broad range of payment services, including:

Authorised EMIs must meet rigorous regulatory requirements, such as maintaining a minimum initial capital of €350,000, ensuring robust safeguarding measures, and implementing AML/CFT policies. This license is typically suitable for fintechs looking to scale, serve clients across borders, or build proprietary products like cards and wallets.

Small electronic money institutions, also known as “registered EMIs,” are a simplified version of the authorised license. These entities can also issue e-money and provide a limited range of payment services — excluding payment initiation and account information services.

To register as a small e-money institution, a company must:

Small EMIs are not required to hold the same level of capital or comply with all the full-scale EMI requirements, making them a more accessible entry point for startups or businesses testing the market.

However, the trade-off is limited scalability and growth. Many companies that start as small EMIs later upgrade to authorised status as their volumes and ambitions grow.

An EMI is authorised to issue digital monetary value, also known as electronic money. Customers can then use this money to make purchases at other parties.

An institution stores e-money in a central accounting system or an electronic carrier. In other words, EMI may use servers or electronic chips.

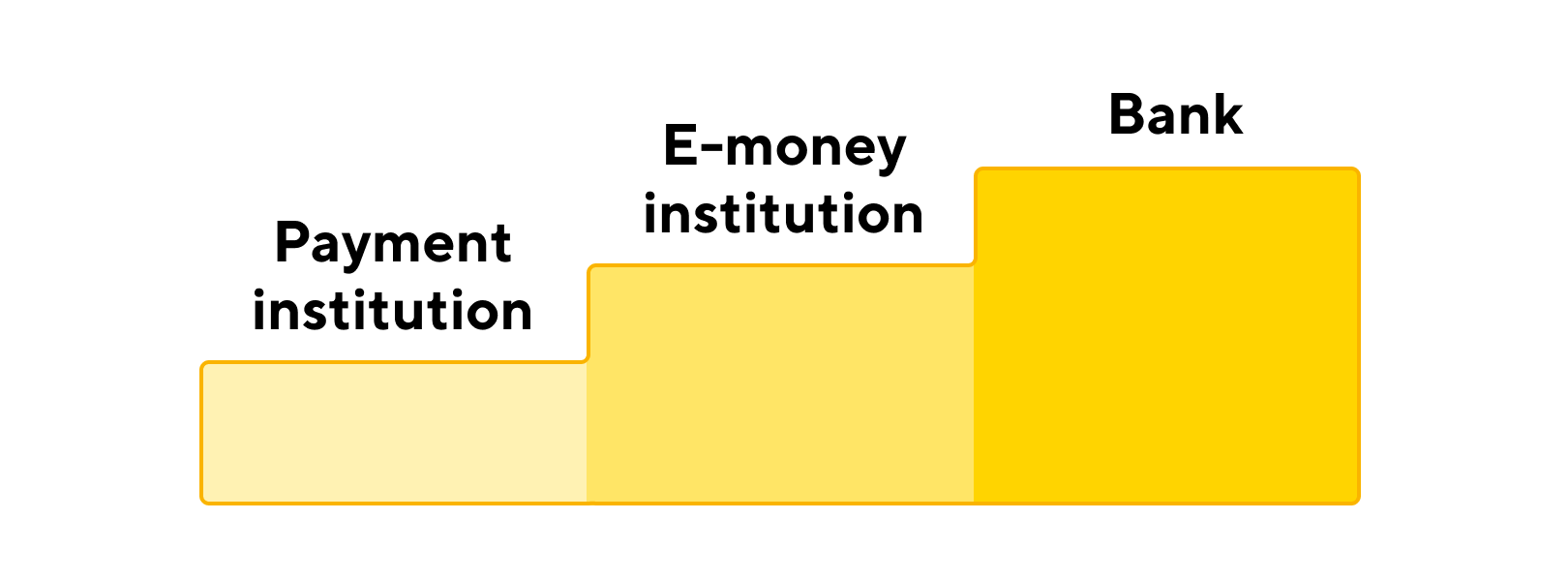

Wondering if an electronic money institution is a bank or a payment institution? The quick answer is none of the above, but let's learn how they differ.

E-money licenses and banking licenses are two completely different licensing regimes.

The essence and allure of the e-money license lie in allowing non-banks to provide payment and financial services and store clients' funds. Yet, the list of banking activities available to authorised electronic money institutions is limited. Namely, unlike banks, electronic money institutions can't provide investment, deposit, and credit services.

In their turn, banking license holders are authorised to act as EMIs to pursue the business of a credit institution.

EMIs are also more flexible and faster than traditional banks. For customers, this means an opportunity to get an account quickly and without going to the physical branch.

A payment institution license is more limited than an EMI license. Payment institutions can provide services like payment initiation, processing and remittances. But they can't issue e-money or hold customers' funds without an identifiable payment order.

This limitation makes the PI market easier to enter than the EMI. Notably, electronic money institutions need higher initial capital, and their regulation is stricter.

Still, some companies that start with a PI license may later opt to apply for an EMI license. This happens when there's a need to expand the range of services. For instance, when they want to issue their own cards.

The EU regulation allows EMIs to offer such services as:

Please see Directive 2009/110/EC for the exhaustive list of activities that EMIs are allowed to perform. Each EMI specifies what it would like to do in its application, and then only those activities are authorised.

Simply put, EMIs can usually open SWIFT, IBAN and SEPA accounts, remotely register banking accounts and issue cards for them, make and accept SWIFT payments, and much more.

Let's look at several electronic money institution examples to better grasp what they do. These are five widely known companies holding EMI licenses:

| Company | Licensing country | Details |

|---|---|---|

| Wise | United Kingdom | Wise started as a PI and later switched to EMI to issue its own cards to customers and hold their funds in payment accounts without an identifiable payment order. The primary services it offers now are money transfers, cross-border multicurrency accounts, and card issuance. |

| Airbnb | United Kingdom | The FCA EMI license holder is Airbnb Payments UK Ltd, a legal entity dedicated to payment processing on behalf of Airbnb, a major online marketplace for lodging. |

| Google Payment | United Kingdom, Lithuania | Focusing on processing payments related to Google, this EMI is licensed by both the UK FCA and the Bank of Lithuania, though the second license authorises fewer activities than the first: e-money issuance, payment initiation, account information services, and execution of payment transactions on a payment account not covered by a credit line. |

| Revolut | United Kingdom, Lithuania | The famous European neobank also holds two EMI licenses. It offers banking services like current accounts, prepaid cards, and virtual prepaid cards. It also allows crypto exchange and transfer between its users. |

| Stripe | United Kingdom | Stripe is a popular payment platform from the US. It is a SWIFT and Visa payment card scheme member. Its EMI license from the UK FCA authorised it for issuance of e-money, topping up and withdrawing cash from a payment account, execution of payment transactions on a payment account, issuing payment instruments or acquiring payment transactions, money remittance, etc. |

Now that we've brushed up on our knowledge of the e-money market and electronic money institutions, we're ready to segue into practice and learn how to become an EMI.

You'll have to undergo several steps with different levels of complexity. Here's the generalised and simplified list:

Below is a breakdown of the key eligibility and licensing requirements to obtain an electronic money institution (EMI) license in the UK or EU:

Launching an EMI is not only a regulatory hurdle but also a significant financial and time investment. Understanding the realistic costs and licensing timeline can help you plan your go-to-market strategy with fewer surprises.

Here’s what to expect in terms of fees:

| Expense type | Estimated range |

|---|---|

| EMI application filing fee (UK) | £5,000 – £25,000+ depending on complexity |

| Legal & licensing consultants | €20,000 – €100,000+ |

| Regulatory capital | €350,000+ (for authorised EMIs) |

| Internal compliance & audits | €10,000 – €50,000/year |

Aside from these fees, you’ll need to invest into personnel and technology.

Hiring qualified compliance officers, MLROs, and operations managers can be costly — especially if required to reside in the jurisdiction.

Building EMI-ready infrastructure from scratch may exceed €250,000 and take 12+ months. Alternatives like Corefy’s white-label payment infrastructure can reduce costs and go-to-market time.

As for the licensing timeline, here are some estimates for key steps:

| Step | Expected timeline |

|---|---|

| Pre-application preparation | 1–3 months |

| Formal application review | 3–12 months |

| Additional regulatory clarifications | Can add 2–6 months |

| Total realistic timeline | 6–18 months from decision to license issuance |

You'll likely face certain pitfalls on a journey to becoming an EMI. Forewarned is forearmed, so let's learn about the three most common challenges and how to deal with them.

Firstly, filing an application for the EMI license isn't a piece of cake. You have to prepare piles of documents and cover dozens of requirements.

Secondly, there are certain restrictions for EMIs on daily transaction size and number.

We highly recommend hiring a specialist who can guide you through legal peculiarities. It will save you tons of time and help you do everything correctly.

With the EMI market boom came allegations of money laundering and other financial wrongdoings. According to Transparency International UK, over one-third of EMIs authorised by the FCA have red flags related to their activities, owners, or directors.

Of course, you won't be the subject of such scandals if you are not involved in fraudulent or money laundering schemes. Still, the fact that there can be perpetrators among licensed EMIs stains the market's reputation and affects clients' trust.

Double-check all the companies you'll do business with to avoid being dragged into trouble.

You should have payment software and infrastructure to operate as EMI, which may be resource-draining. The cost of developing your own payment solution will likely be measured in hundreds of thousands of euros. Speaking of time, you'll need at least half a year for the MVP and about a dozen months to move from basic functionality to a competitive product.

The good news is that you don't need to waste so much time and invest so much money to have a robust, full-fledged payment product. You can opt for a white-label payment solution and receive advanced payment capabilities in a snap, with plenty of value-added features and services.

For instance, by choosing Corefy's white-label payment provider, you receive the following:

Yes. Most authorised EMIs integrate with acquirers, PSPs, and alternative payment methods to broaden their offering. If you’re looking to become an electronic payment institution, it’s essential to consider how you’ll support this level of connectivity. Instead of building integrations from scratch, many opt for white-label EMI platforms that come with hundreds of ready-made connections — reducing time to market and improving merchant experience.

If speed and budget are critical, consider outsourcing your EMI infrastructure. Platforms like Corefy offer pre-built, PCI DSS-compliant systems, AML/KYC-ready workflows, and multi-currency payment orchestration tools — cutting time-to-market from 12–18 months to just weeks. This approach simplifies how to set up an e-money institution without sacrificing control or scalability.

Absolutely. While many new EMIs assume they need to develop everything in-house, a growing number choose to launch on top of white-label payment orchestration platforms like Corefy. These platforms provide ready-made infrastructure for managing payment flows, routing, reconciliation, multi-provider integrations, and compliance — making getting an electronic money institution license more manageable and accelerating your ability to serve clients effectively.

In most jurisdictions, yes — but it requires a new license application with updated capital requirements and operational models. Businesses that start with a PI license often plan their tech and compliance setup in advance to make EMI transition smoother when growth demands it.

Licensing is just the beginning. Regulators expect regular compliance reporting, audits, and safeguarding attestations. You’ll also need a scalable infrastructure to serve clients, manage risk, and stay agile — especially if you plan to offer value-added services like card issuing, smart routing, or multi-currency support.