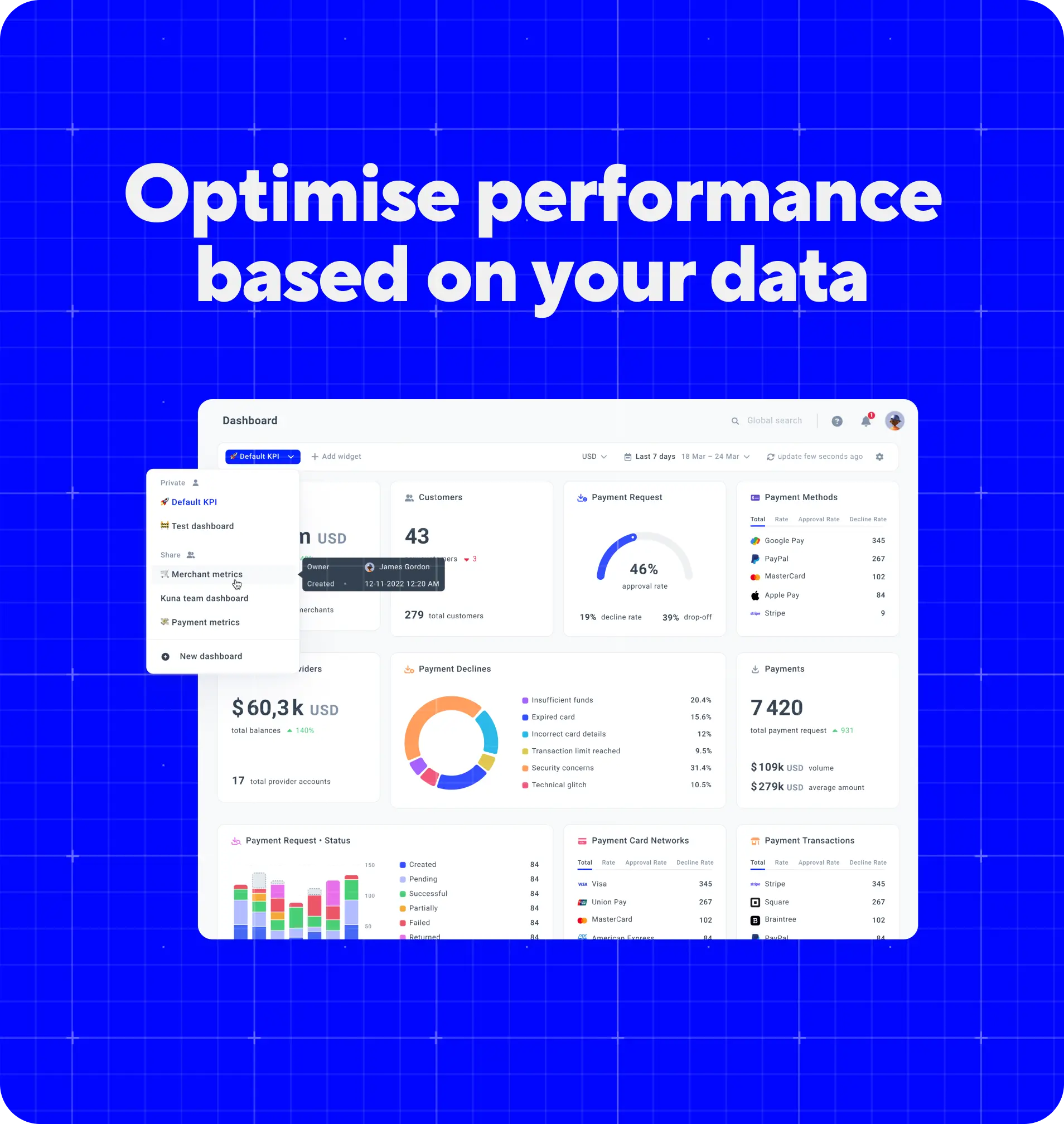

Corefy's payment analytics system gathers all your data under one roof and makes it much easier to monitor, examine, and analyse.

Key in on details or rise above them.

Switch between detailed and helicopter view for better decision making and troubleshooting.

Discern more opportunities.

Transform previously disjointed data into insights for optimising processes and costs.

Facilitate internal communication.

Grant your teammates fast access to information necessary for moving your business forward.

Produce reports effortlessly.

Turn reports from a resource-draining activity into a helpful tool for business development.

Let`s get started!

Let`s get started!

Having all the performance metrics spread before the eyes keeps you aware of health and performance of your business. Generate accurate and thorough reports and access payment analysis on the go.

Monitor the statuses of all transactions in real time to be sure that your payment traffic is stable and healthy.

This pie chart shows decline reasons over the selected period. You can analyse this data to reveal and mitigate weak points.

Learn what payment methods your customers prefer to gain insights on how to optimise your payment orchestration strategy.

Merchant account balances

Real-time view of all your merchant accounts balances at various PSPs allows you to manage your cashflows efficiently.

Live stats on the conversion across all your terminals help you to discover ways to tweak your market strategy.

Learn how each of your stores is performing and how their conversion rates change over time for informed decision-making.

Conversion chart

Keep track of your overall turnover and see which of your businesses accounts for the biggest share in total results.

Select any of our out-of-the-box reports and have them on hand right away, or create a custom report for specific business needs. Opt for auto-generation to receive fresh reports on a regular basis.

Custom reports

Generate a report for selected transactions or period of time to get a more detailed view of any aspect of your operations.

Whether you need to filter a report for a specific time period or see results for a particular product, Corefy's financial report system has got you covered. Easily create custom reports for all of your business needs.

The flexibility of our predefined reports allows you to configure columns and time zones.

Set up report auto-generation & export to have necessary data ready for you when needed.

Decide who can access the information to empower teammates with relevant business intelligence.

If you run multiple sites, you can easily gather all the key metrics for each site into a single comprehensive report.

Get quick and simple access to your securely stored data anytime and from wherever you are.

Skip wasting effort on producing the reports and move right to working with them for the benefit of your company.

Stay on top of everything with the least possible manual work. Set and configure alerts to be timely notified of reaching crucial figures or some issues occurring.

PSP downtime. In case something goes wrong on the provider's side, transactions will be rerouted and you'll be notified.

Callback problems. If your commerce account callbacks stop working, you'll know right away.

Low balance. Get a notification about reaching critical balance value on your merchant account before it's too late.

Abnormalities. Any abnormal activity, such as the suspiciously high speed of transactions processing, will be reported to you instantly.

Conditions

Select the query you want to trigger an alert for from many available options.

Frequency

You can opt-in alerts for every time your query runs, even if it happens every 5 seconds.

Channels

Corefy can alert you in the way that suits you best, be it email, Telegram, or Slack.

Generate unique reports for selected dimensions and metrics to derive valuable insights into any aspect of your business activity.

Reporting API

Produce any kind of report with our sleek reporting API. Select the data you need, group it in a compelling way, and limit the data returned based on specific filters.

SQL Database

Write queries to sift through the whole data set and tweak a custom report. We've prepared a list of example queries to help you as you start.

Quick answers. Use the Dashboard to write SQL queries and get responses instantly.

Auto-completion. Be assisted by a popup menu of options as you type SQL statements.

Prebuilt templates. View the most common queries we've written in advance and feel free to edit them.

Create templates. Save and share queries you use frequently with your teammates to free up time.

Connectivity. Connect other business intelligence systems to have a single access point to your payment data analytics.

Ready-made. We have taken care of the technical infrastructure for data maintenance, so you don't have to.

Our reporting and reconciling capabilities are tied in closely, letting you quickly and accurately pull your transaction data from disparate sources into a single report.

Payment in the system

Provider's statement

Status

All transaction data flows in and out of our system ensuring consistency between your sales and payment provider's statements.

Benefit from improved visibility throughout the whole transaction lifecycle, as well as full control over payment and payout flows.

Accessibility and visibility of accurate complete data reduce potential fraudulent transactions and help to reveal hidden activity.

Corefy automates transaction matching across multiple PSPs and accounts, updating the data according to providers' statements.

Identify and manage mismatches, errors and collisions between transaction data from the provider and payment details inserted into Corefy.

Ensure that all your funds are correctly accounted for and solve possible issues with payment providers by accessing statement history and logs.

Payment processes in your business are a thousand-piece jigsaw puzzle you are trying to complete. Dashboard by Corefy is that final piece to snugly fit the blank space and make the overall picture perfect and understandable. Just sit back and admire the seamless flow of your transactions.

Get in touch with us and we will try to provide you with the most relevant offer.

Learn more about Corefy’s analytics tools, reporting capabilities, and how to leverage data for better decision-making.

Payment data represents an insightful set of transaction details that help businesses analyse their performance. Regularly monitoring and analysing the data enables merchants to track vital factors and changes in consumers’ behaviour and make more educated decisions in further business development. It can be done with the help of payment analytics software.

How it works

Our payment platform allows merchants to gain insightful transactional data for customer experience optimisation and fraud management.

This software represents a set of smart payment analytics tools that automatically aggregates and unifies all your business data. For your convenience, the data is further displayed in a coherent form, instead of elaborate datasets. This allows you to choose the necessary indicators — payers’ countries, currencies, payment methods, periods, etc. — and monitor them in real time without dispersing your attention to extraneous details.

Your business radar

Payment analysis software by Corefy allows you to have all the key payment metrics and historical data spread in front of your eyes, giving you a real-time view of your business performance:

Being up to date on crucial metrics helps you to maintain your business health and stability.

Benefits of payment data analytics

Corefy's payment analytics solution provides a set of data analysis tools for effective business operation and payment optimisation:

The Reports solution aggregates all the necessary data into insightful records. Our payment analytics solution provides a range of predefined types of reports: choose among out-of-the-box reports with the showings on payment & payout flows, providers, currency conversion, revenue changes, etc. Or customise any of them according to your specific business needs, adding or removing certain criteria. You can also create a customised report with the particular aspects of your business operations, such as trend analysis, commission income, distribution, etc., using filters.

Benefits of Reports

Producing reports is a time and effort-consuming activity. But our payment analytics solution allows you to save lots of resources on creating these datasets and dedicate your precious time to working with the data. Furthermore, customisable analytics and reporting provides you with the ability to choose only the essential indicators — it is incredibly convenient for businesses with several storefronts or projects.

All the data you need is at your disposal whenever you need it, thanks to the scheduling feature. You can set up the date and time for report generation and export. Moreover, you can control your teammates’ access to the information.

Integrate Corefy and get a reliable financial partner for frictionless payment processing along with a range of smart analytics tools. Corefy's payment analytics solution allow business owners to predict and prevent the negative influence of specific payment trends on successful system activity. Having all the essential information spread before your eyes at the required time enables you to increase the efficiency of your business. You can easily monitor the e-commerce trends and your customers’ satisfaction by looking through the different payment data in real-time mode.

As your payment volume increases, manually tracking data becomes time-consuming and prone to errors. A payment analytics platform automates this process, giving you accurate insights in seconds. This helps you quickly spot problems, reduce failed transactions, and improve your overall payment performance.

When comparing payment analytics solutions, look for features like real-time reporting, integration with multiple payment providers, and flexible report customisation. It’s also essential to consider scalability and global coverage. Corefy combines all these features into one platform, making it a strong choice for businesses operating across different markets and currencies.

You can analyse all key payment data, including transaction volume, approval rates, fees, chargebacks, refunds, and provider performance. This comprehensive view helps you understand your business's health and the effectiveness of your payment strategy.