Corefy's white label gateway opens the door for any business to step into the world of payments. Expand your offering, create a new revenue stream, and strengthen customer loyalty — all with a scalable, ready-made gateway that our experts continuously enhance and support for you.

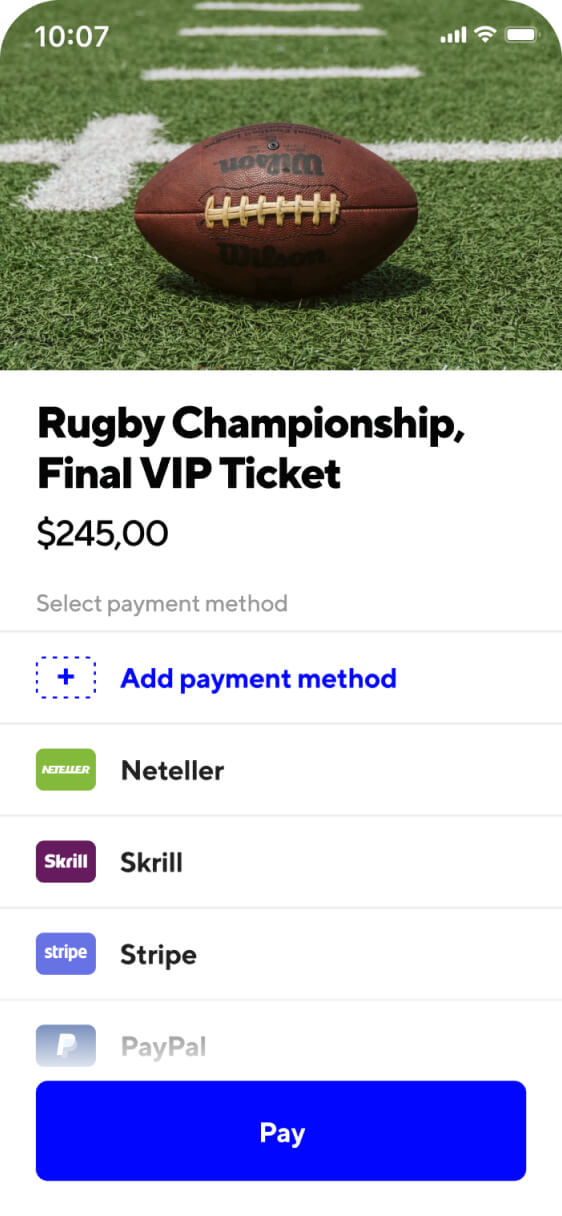

Processing your payment…

Transaction completed

Check your email. We've sent you the ticket and transaction details.

Get the optimal payment setup for your industry to ensure better payment experience for you customers and win over competitors.

We assign an account manager to every client, taking a personalised approach to support and utilising our 15+ years of techfin expertise.

Standard

For small and medium-sized businesses

Price for each transaction exceeding the plan

Top features:

Professional

For larger businesses or those seeking advanced administration tools

Price for each transaction exceeding the plan

Standard features plus:

Enterprise

For very large businesses or those in highly regulated industries

Price for each transaction exceeding the plan

Professional features plus:

Every business is unique, but many have something in common. We collected the essentials on what companies of different types, sizes, and industries should look for in a payment gateway.

White label payment gateway is a ready-made solution that allows businesses or brands to start processing payments under their own brand using the third-party technical infrastructure.

To put it simply, a brand just purchases a ready-made payment gateway and puts its own logo on it to start processing payments right away.

White label payment gateway solutions offer businesses of all sizes the opportunity to build an online payment infrastructure quickly and efficiently. Companies that provide services that help accept digital payments via API integration with PCI compliance allow businesses to focus on developing their own unique brand while also receiving access to an established network of technical solutions and payment service providers.

Any business considering offering digital payments processing should investigate what opportunities a white label gateway system presents – not only for helping them build brand trust but also for providing advanced security measures which keep customers’ payment data safe at all times.

Opting for a white label model, business owners preserve their peace of mind, knowing they use a comprehensive technical solution from an established provider with a solid reputation.

So, what businesses can opt for a white label payment gateway solution? White label payment gateways are an end-to-end solution specifically designed for:

Efficiency. Integrating a payment gateway into the existing brand’s website or application can be difficult, time-consuming, and expensive. The white label payment gateway software is easier to implement and allows business owners to save resources.

Time to market. Apart from being cost-efficient, white label payment gateways help businesses to decrease the time to market and start offering services to their merchants right away after a single integration with the white label payment gateway provider.

Payment methods availability. Starting your own payment gateway, you’ll have to establish integrations with payment method providers one by one and on your own. It takes quite a lot of time, and each connection requires constant maintenance and updating. On the contrary, by choosing a white label payment solution, you’ll have a bunch of ready-made integrations to connect and offer to your merchants at the very start.

Security & compliance. Providing payment processing services to merchants requires your gateway to comply with a range of standards. For example, it takes time and money to get PCI compliance validation and undergo yearly audits to reaffirm it. When you use white label payment solutions, you eliminate this burden, as it is the service provider’s responsibility.

While choosing a white label payment platform provider, businesses should thoroughly investigate their needs and the providers’ offer. For many, the main criteria can be pricing. And here is the list of other important criteria:

With white label payment processing solutions, businesses can customize the checkout page with their own branding so that customers will see the company’s name as they complete their purchases. This ensures that the customer knows they are paying via a trusted source while helping to build your brand loyalty.

A white label payment gateway gives you the infrastructure to route and manage online transactions under your brand, while a white label payment processor actually handles the transaction processing itself. Many businesses choose a merchant white-label payment solution that combines both, giving them end-to-end control over payments without building technology from scratch.

Yes. With our white label payment gateway, you can provide full white label merchant services, including payment acceptance, routing, reporting, and risk management. This allows you to expand your portfolio, add value for your clients, and generate a new revenue stream without taking on the heavy lifting of compliance and infrastructure management.

White label merchant processing enables you to process payments for your merchants under your own brand, keeping you at the center of the payment experience. Instead of referring clients to external providers, you maintain the customer relationship, gain transaction-based revenue, and strengthen long-term loyalty with a merchant white-label payment solution.

Yes. Our white label payment gateway comes with a customizable merchant portal that empowers you to deliver a complete merchant white-label payment solution. Through the portal, your clients can easily track transactions, manage payouts, view detailed analytics, and configure settings — all under your brand. This white label merchant management tool helps you provide transparency and control to your merchants while strengthening your role as their trusted payment provider.