The world of payment processing is booming, with the market valued at $66.8 billion in 2024 and is projected to grow at a CAGR of 11.7% between 2025 and 2034. This growth shows just how important payment solutions are for businesses worldwide.

Starting a PSP business can be an exciting opportunity for entrepreneurs, but it's not without its challenges. In this article, we'll break down what it takes to launch a PSP business in simple terms so you can understand the ins and outs of this thriving industry and start your journey with confidence.

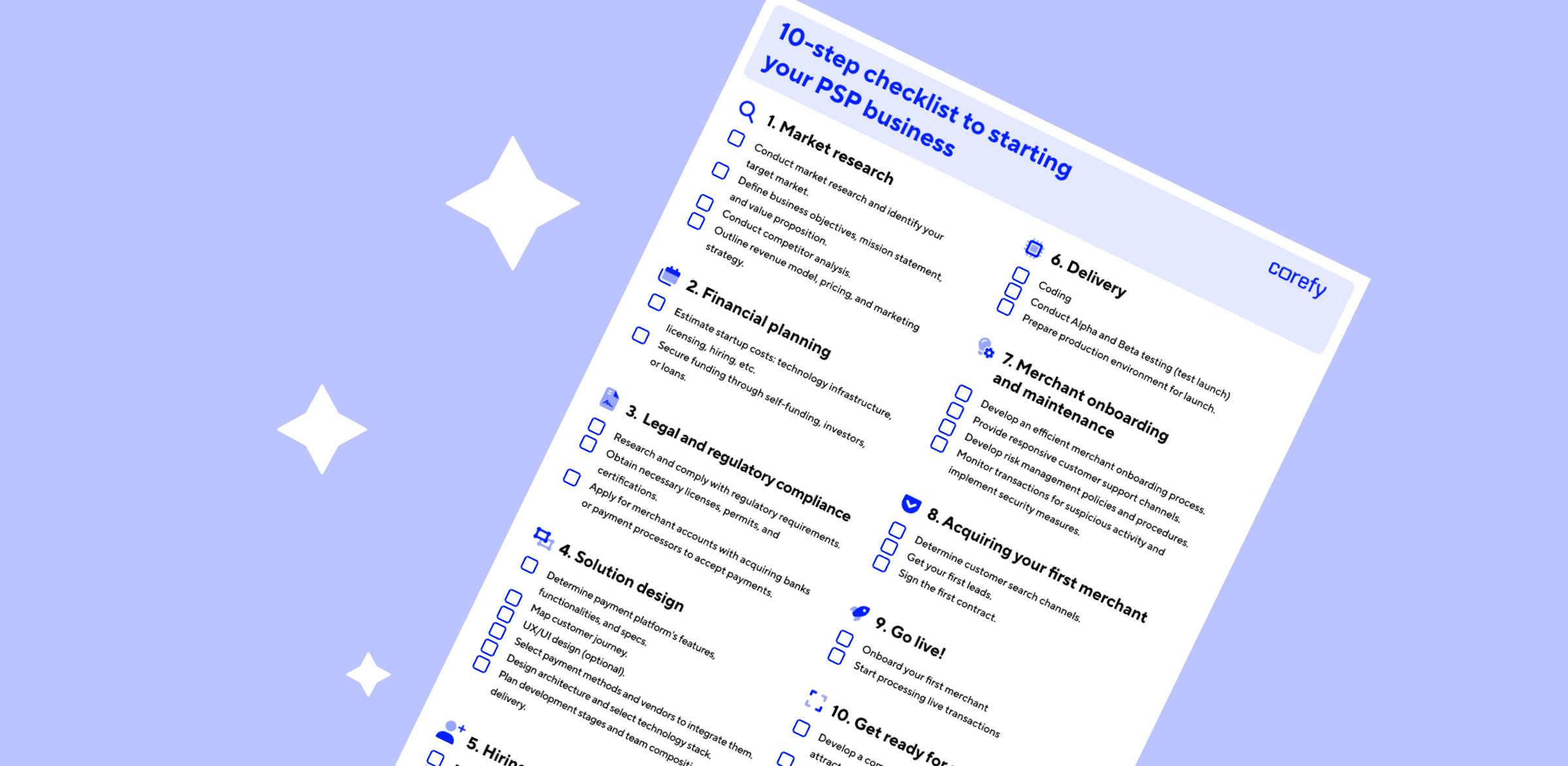

Download the checklist to kickstart your journey

The approach you take to kickstart your payment business depends on various factors. For instance, you might build a payment infrastructure from the ground up or just resell existing processing services. Your target market, budget, and scope of services you want to provide also matter.

If you choose the daring path of building a PSP business from the ground up, we've prepared a step-by-step checklist covering all the necessary points from scratch to launch.

Launching your PSP: main challenges

Entering the world of the payment business requires careful planning and an understanding of how the industry works. Below is a simplified overview of the key challenges you'll encounter when building your own PSP from scratch.

Don’t be alarmed in advance; we will offer a remedy to sidestep these obstacles effortlessly!

Navigating compliance

Licenses, permits, and certifications are essential for the legal operation of your PSP.

Here's an outline of the formalities you'll need to complete to legalise your payment business:

- Payment Institution (PI) licence

- Financial Services Authority (FSA) registration

- PCI DSS compliance

- AML/KYC procedures

- ISO 27001 certification

- Electronic Money Institution (EMI) licence

Most licensing authorities charge application fees for reviewing and processing licence applications. Additionally, ongoing renewal fees may exist to maintain licences and comply with regulatory reporting requirements. This step also involves costs associated with implementing necessary security measures, conducting audits, and hiring compliance professionals.

However, costs are not the only challenge in this step. Achieving and maintaining regulatory compliance requires significant resources in terms of time, workforce, and expertise. It’s an ongoing process of handling compliance-related tasks such as documentation, reporting, audits, and staff training.

Building a scalable technology infrastructure

Technical infrastructure development is the most labour-intensive step in opening a PSP business.

Here’s a table of the basic requirements for a PSP technology infrastructure that supports business growth, enhances customer experience, and ensures long-term success.

| Requirement | Description |

|---|---|

| Scalability | Ability to handle increased transaction volumes and accommodate business growth. |

| Performance | High performance and low latency to ensure fast and reliable transaction processing. |

| Security | Encryption, tokenisation, secure access controls, and compliance with industry standards. |

| Integration | Seamless integration with payment gateways, financial institutions, and third-party vendors. |

| Monitoring and analytics | Implementation of monitoring, logging, and analytics tools for proactive system management and optimisation. |

What are the challenges here? First, this large-scale stage requires the huge expertise of technology professionals in payment processing, software development, system administration, and cybersecurity.

Another sticking point is time to market. Developing the technical infrastructure from scratch can take two years or more, depending on the specific requirements and complexities involved. Such a long period is impractical in this fast-changing industry. Moreover, the cost can range from $200k to $500k+, depending on business requirements.

Forging strategic partnerships

Establishing partnerships is crucial for aspiring PSP businesses aiming to broaden their market reach, tap into new customer segments, and enrich service offerings.

Key partnerships you’ll need to establish include:

- Banks and financial institutions

- Card networks (Visa, Mastercard)

- Technology providers (payment gateways, fraud management tools, etc.)

- Merchant acquirers, ISOs/MSPs

Here comes the challenge: the payment processing industry is highly competitive, with established players dominating the market. Building trust and credibility with potential partners can be difficult, especially for new or lesser-known PSPs.

Getting your first merchant on board

After putting in significant effort and preparation, you find yourself ready to conquer the market. The main concern arises here: Where can we find our first client?

At the outset, your company may lack visibility, recognition, and credibility in the market. Finding your first client through marketing channels is a rather long and expensive journey. It requires a carefully thought-out marketing strategy, a unique value proposition, and building brand awareness.

Even with these steps taken, without a proven track record or references, clients may perceive your PSP as a higher-risk partner compared to established providers with proven reliability and stability.

How to avoid the hardest part of work with a white-label PSP

Instead of trying to do everything on your own, think about simpler approaches. For example, a white-label solution can take your idea from concept to first contract much more quickly than stumbling through each step individually.

A quick reminder:

In essence, you can purchase ready-made white-label payment platform infrastructure developed by payment experts, customise it to your needs, and start providing services to merchants. A white-label model allows you to enter the PSP niche with minimal investment and development time.

Choosing a white label solution: PSP success story

To avoid being unfounded, let’s consider a real-world PSP launch example of our client.

When starting a payment service provider business, our PSP client had two options: start from scratch or use a white-label solution. Opting for the latter proved to be a game-changer, offering a quicker and more cost-effective route.

This strategic choice saved our client at least two years of time on gathering their own development and support team. Plus, the array of ready-made integrations with payment providers provided a significant head start, enabling them to swiftly connect essential services and stand out amidst competitors.

Read more about the stunning results they achieved.

From scratch vs. white-label solution: key differences at a glance

To ensure a well-founded comparison, let's contrast two methods of launching a PSP business: building from scratch and leveraging a white-label solution.

| Starting from scratch | White-label solution |

|---|---|

| 2+ years to build infrastructure and software. | Infrastructure and technology are pre-built and ready for use. |

| Requires in-house expertise or hiring professionals for development and maintenance. | Leverages the technical expertise of the WL provider’s team with ongoing support and maintenance. |

| Responsible for compliance with industry regulations, such as PCI DSS and AML/KYC. | Responsibility for compliance lies with the provider. |

| Assumes full responsibility for risk management and fraud prevention. | Shares responsibility for risk management with the WL provider. |

| $200k+ for maintenance, upgrades, staffing, and infrastructure investment. | Cost varies; typically starts from $2k per month. |

| Need to establish partnerships and build a client base from scratch. | May benefit from existing partnerships and client base of the provider, facilitating business growth. |

As you can see, opting for a white-label PSP eliminates the majority of barriers to starting your own payment business. Driven by the demand for rapid market entry, regulatory compliance support, and cost-efficiency, this model stands out as a top choice for businesses seeking to enter the payment industry.

.jpg)

Wishing you success on your journey!