Maximise acceptance rates and reg2dep conversions, expand into new markets, deliver fast withdrawals, and protect your revenue with advanced fraud prevention — all through single online gambling payment gateway that requires minimal development effort.

The payment gateway built for both operators and gambling platforms — deliver seamless player payments, streamline operations, and scale globally with one secure, high-performance solution.

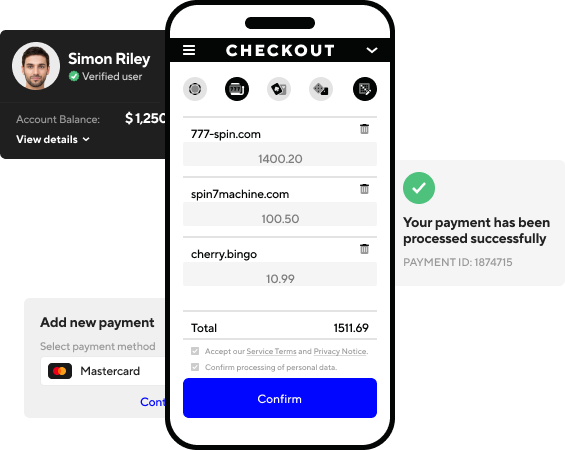

Customisable payment pages and hosted iFrames with full PCI DSS compliance

Convenient portal to manage all in one point and deliver players support for every project

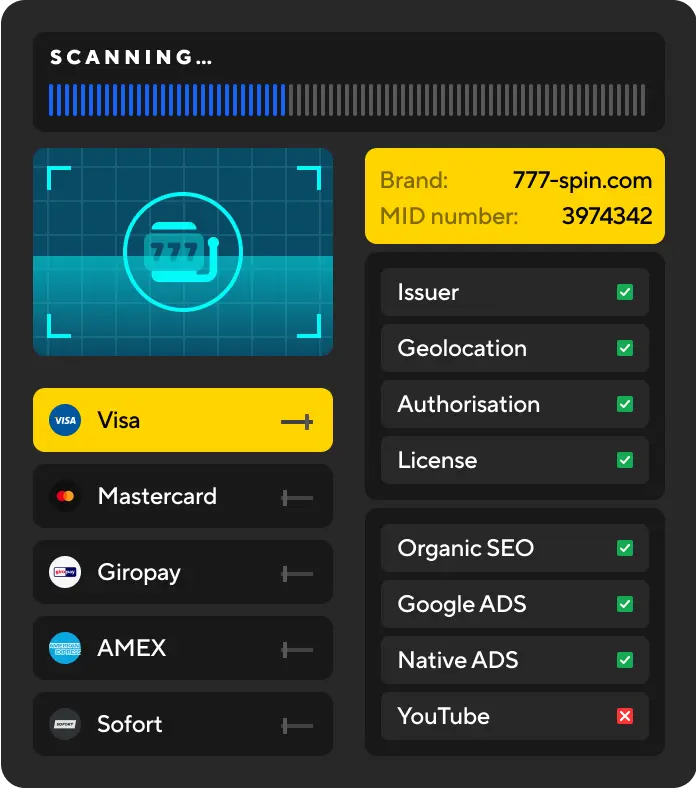

Work with the payment gateway for online gambling business that strengthens the security of your high-risk business, assists on fraud prevention, and ensures all-round compliance.

Card number

Result

Allowed

Result

Denied

Scanning

Scanned

Combat bonus abuse, player collusion, account takeover, chargebacks, and self-exclusion with our ready-made antifraud solutions.

Automatically cut off suspicious or undesirable traffic using blocking schemes with configurable dynamic rules.

Eliminate security threats by automatically granting or denying access based on contextual information.

Enable or disable 3DS when needed, or apply it selectively for transactions filtered by relevant parameters.

Connect your trusted antifraud and risk scoring systems, like Sift, MaxMind or Ravelin, for an extra layer of protection.

Card tokenisation with a white label payment page

Data collection, storage, and transmission are secure and PCI-compliant

Absence of the compliance burden and enhanced payment acceptance rates

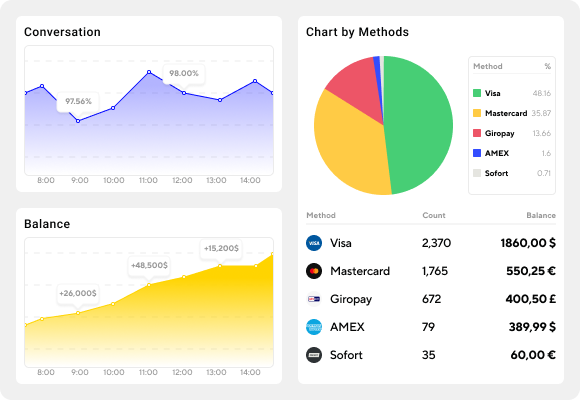

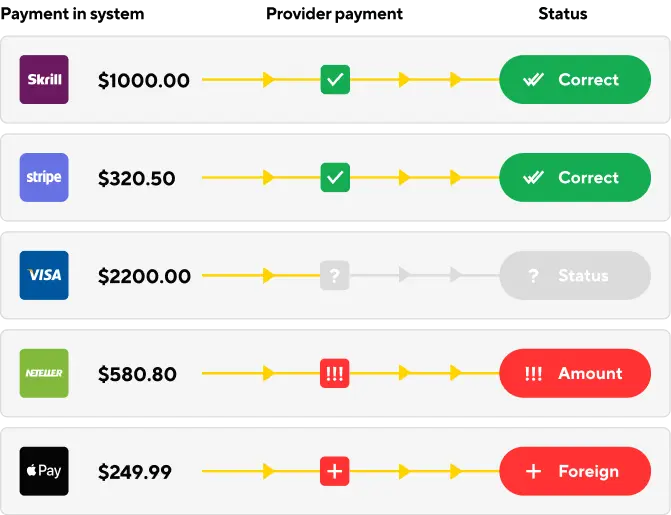

Organise and unify gambling payments transaction data with fully-equipped reconciliation software for gambling businesses.

Payment in system

Provider payment

Status

We assign an account manager to every client, taking a personalised approach to support and utilising our 15+ years of techfin expertise.

Standard

For small and medium-sized businesses

Price for each transaction exceeding the plan

Top features:

Professional

For larger businesses or those seeking advanced administration tools

Price for each transaction exceeding the plan

Standard features plus:

Enterprise

For very large businesses or those in highly regulated industries

Price for each transaction exceeding the plan

Professional features plus:

A gambling payment gateway is a type of payment gateway designed specifically for online gambling businesses such as casinos, sports betting sites, poker rooms, and lotteries. Like any payment gateway, it is a secure technology that authorises and processes online transactions by encrypting payment details, sending them to the payment processor or acquirer, receiving the approval or decline, and returning the result to the merchant’s website or app.

What makes a payment gateway for gambling different is that it operates in a high-risk industry. Online gambling involves wagering money for the chance to win more, and is considered high-risk by banks and payment processors due to strict regulations, fraud risks, and chargeback potential. This means a gambling payment processor must support high acceptance rates, advanced fraud prevention, and compliance with local gambling laws in each target market.

The global online gambling market is projected to exceed $112 billion by 2025, but growth depends on navigating diverse regulations and ensuring compliant, reliable payment processing for players worldwide.

Running an online gambling business comes with unique payment hurdles. At Corefy, our gambling payment gateway is built to help operators and platforms tackle them head-on:

With Corefy, you get one payment gateway for online gambling that simplifies operations, boosts acceptance rates, and protects your revenue.

When selecting a payment gateway for online gambling, look for one that solves your industry-specific challenges — from maximising player conversions to meeting strict compliance requirements. The right gambling payment gateway should:

Corefy is built for online casinos, betting, and poker platforms that need more than just one gateway. Our platform connects you to 550+ payment service providers, enabling smart routing, global coverage, and seamless player experiences — all from a single integration.

Yes. Corefy provides a payment gateway for gambling that supports online casinos, poker rooms, and sports betting sites. With 550+ providers integrated, we enable you to process deposits and payouts through cards, e-wallets, bank transfers, and crypto — all from a single connection. Our smart routing boosts acceptance rates, while fast payouts and fraud protection keep players satisfied.

If you already have merchant accounts, you can connect them to our platform instantly. If not, we can help you secure a gambling merchant account through our PayAtlas project. With a global network of acquirers and PSPs experienced in high-risk sectors, we match you with the right partners for your online casino payment gateway or betting payment gateway needs.

With Corefy, you can launch your payment gateway for casino or payment gateway for betting app in as little as a few weeks if you already have merchant accounts. Our ready-made integrations mean no lengthy development — simply connect your MIDs, configure payment methods, and go live. For businesses starting from scratch, our team at PayAtlas can help you choose payment partners and open merchant accounts with them.