The flipside of the payments industry: highlights from Corefy’s rooftop meetup

.jpg)

.jpg)

Autumn has already come, and informative meetups have become a good tradition of our company at this time of the year. Yesterday, September 16th, we were delighted to once again welcome payment experts and guests to our R&D office in Kyiv to discuss the trends and prospects of the payment business.

The main substantive issues on the agenda were:

Corefy’s CBO Den Melnykov shared some insights on the localisation and adaptability of a payment business on a global scale.

Here are the highlights from his speech:

Our CTO Dmytro Dziubenko was responsible for the payment processing security cluster. He shared everything there is to know about building a safe and secure payment infrastructure.

Here are some key takeaways:

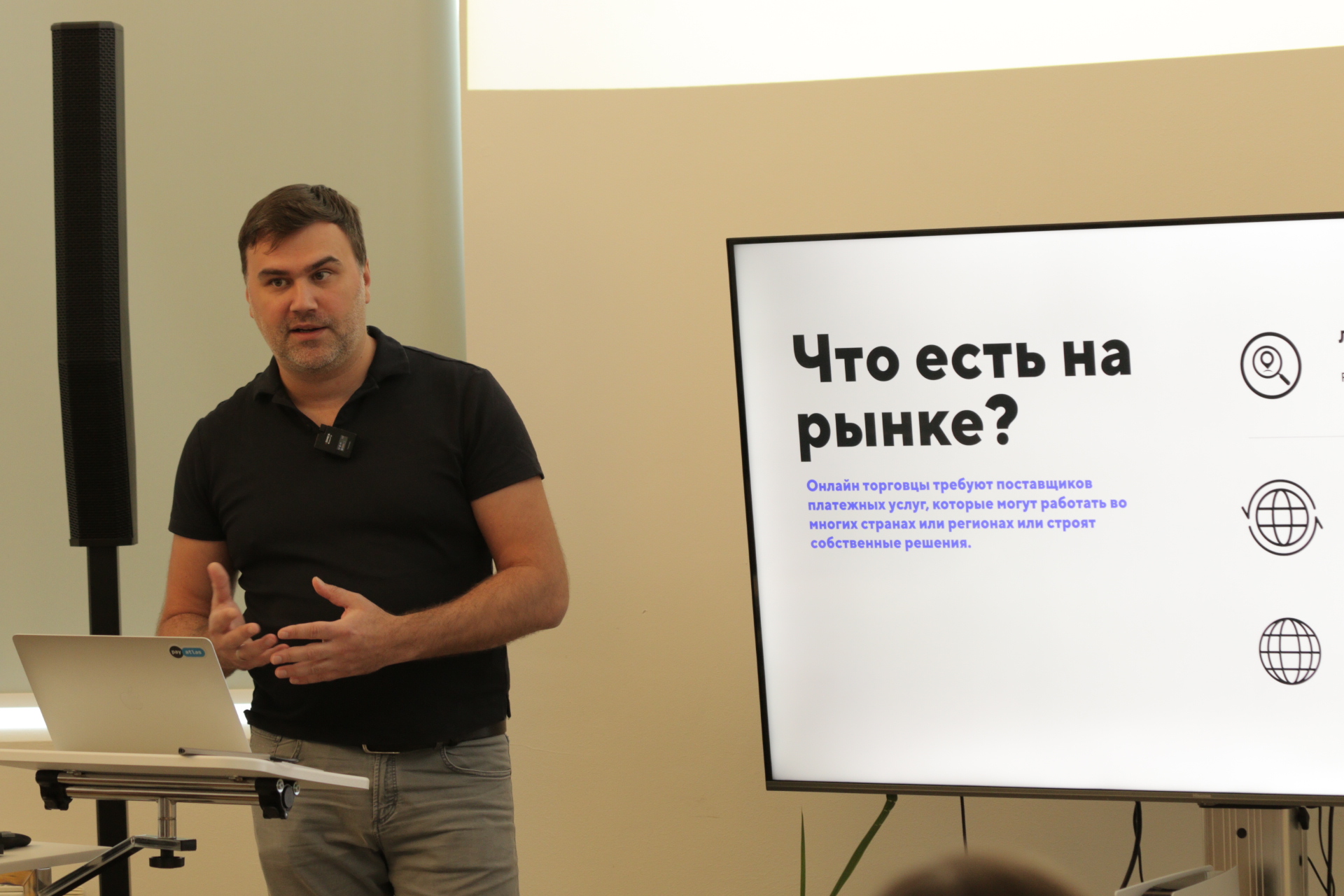

The final part of the speeches was devoted to the optimisation of payment processing. Our CEO Denys Kyrychenko prepared a comprehensive presentation in which he analysed the constraints a business may face, shared payment trends, as well as assessed financial risks and opportunities for payment industry players.

Here are some of the points he shared with guests:

After the experts shared all the secrets from the world of the payment industry, the entertainment part of the evening started — a networking rooftop party on the terrace with a breathtaking view.

We thank everyone who took the time to attend our meetup. Subscribe to our Facebook page to not miss the announcements of Corefy’s next events. We look forward to meeting you again!

Subscribe to our newsletter

We'll be sharing useful tips and guides to help you optimise your payment and payout processes.

Thank you for subscribing!