Let’s analyse the checkout as a process from two perspectives: consumers’ and sellers’.

The consumer’s point

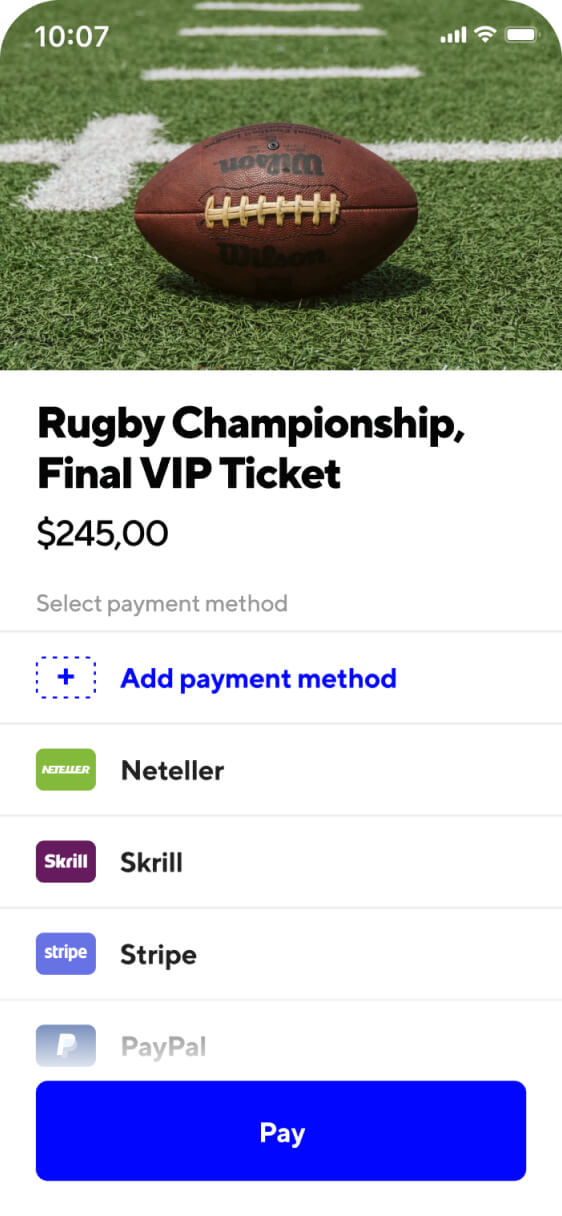

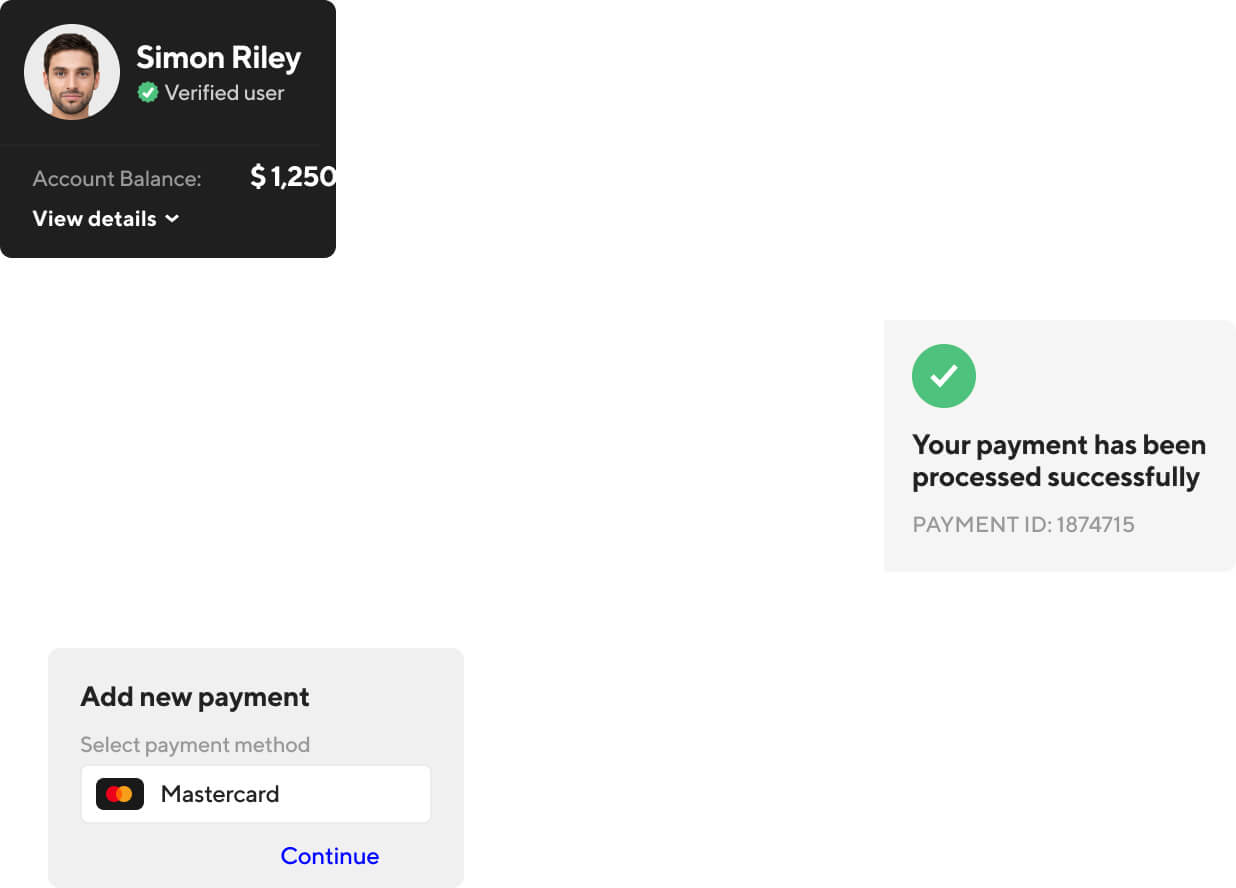

The online checkout process is pretty intuitive from the consumer’s point. For instance, shopping at an e-commerce website is similar to making purchases at a regular retail store: a consumer picks the goods, puts them into a cart, and proceeds to the checkout to pay. In real life, we pay at the counter. As for online shopping, we use an online checkout — a payment page, where we often have a selection of payment methods to choose from. Once we’ve decided, we’re required to input the information needed to pay with this particular method. It can be an account or credit card number, ID, card expiry date, our full name, etc. The next step is the verification process that ensures security and prevents fraud, and that’s it — we’re supposed to get some receipt and later our order.

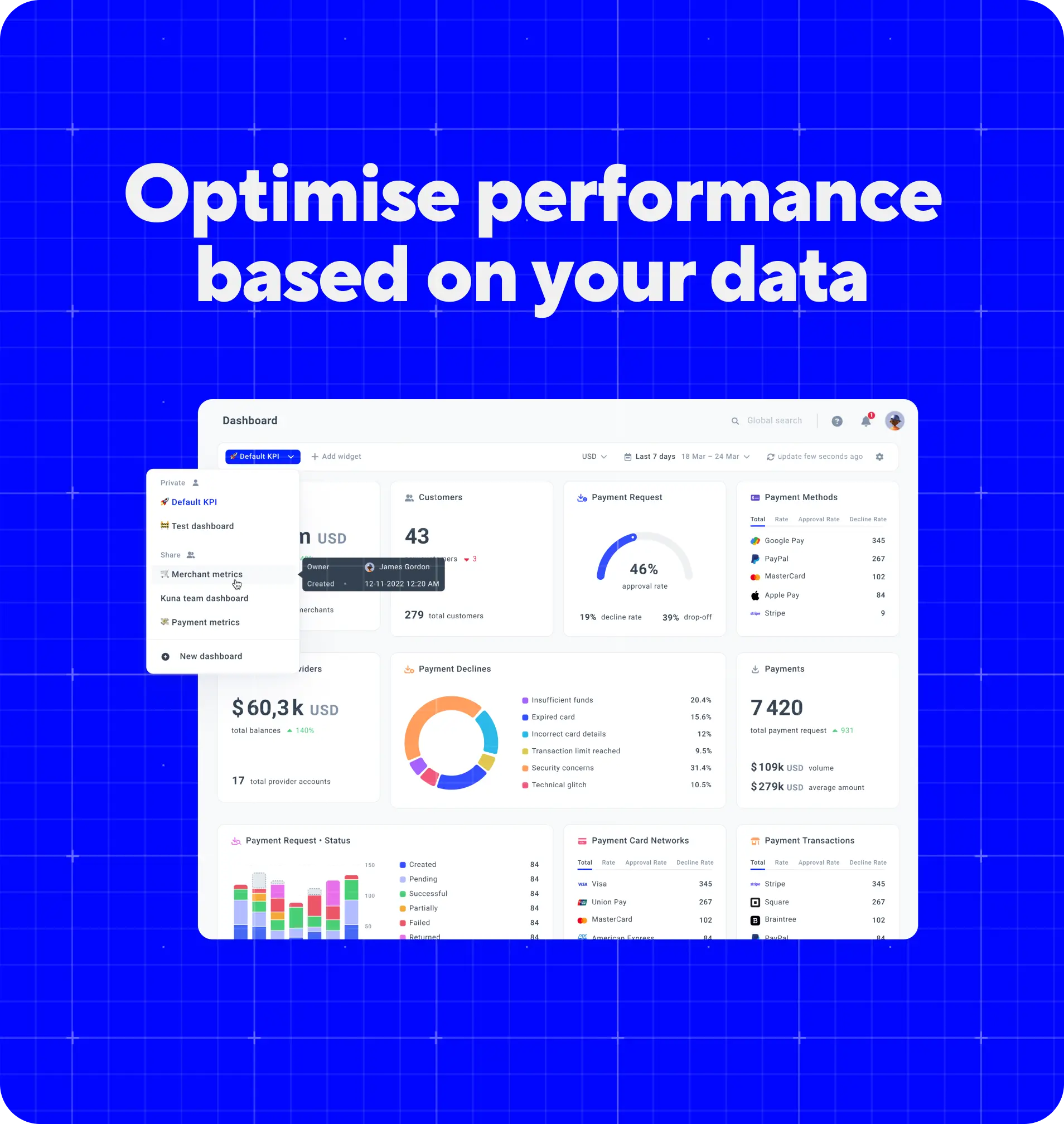

The seller’s point

It’s a bit more complicated from the sellers’ point of view. As an entrepreneur, you need to open a bank account, an account at a payment service provider, or both. Then, you’ll have to get an online checkout solution and integrate it into your app or website. After that, your company can start selling, fulfilling orders, and collecting online payments. While the latter is usually not a problem, getting a checkout for website may be a hassle.

5500 **** **** 1124

5500 **** **** 1124

4111 **** **** 3285

4111 **** **** 3285

Austria

Austria

Scotland

Scotland

Norway

Norway

GBP

GBP

Portugal

Portugal

Australia

Australia

KRW

KRW

Turkey

Turkey

Israel

Israel

Hong Kong

Hong Kong

Armenia

Armenia

EUR

EUR

Japan

Japan

Hungary

Hungary

Denmark

Denmark

United Arab Emirates

United Arab Emirates

England

England

Czech Republic

Czech Republic

China

China

Greece

Greece

Sweden

Sweden

Luxembourg

Luxembourg

UAH

UAH

Bulgaria

Bulgaria

India

India

Estonia

Estonia

Finland

Finland

Argentina

Argentina

USD

USD

Belgium

Belgium

Croatia

Croatia

Georgia

Georgia

Italy

Italy

Canada

Canada

Ukraine

Ukraine

France

France

Germany

Germany

Spain

Spain

United States

United States

JPY

JPY

South Korea

South Korea

Ireland

Ireland

Switzerland

Switzerland