Payment routing is a go-to technology for payment processing, built for online businesses and institutions that accept payments by working with multiple payment service providers (PSPs). It implies sending each transaction after checkout to the most suitable PSP or acquirer based on selected parameters. That’s why it’s inapplicable to merchants with a single PSP.

How does it work?

There are two fundamental ways in which payment routing works.

The first is known as static payment routing and requires the manual creation of complex routing schemes. Then, such a scheme will unswervingly be used to transfer each transaction to the relevant payment service provider, regardless of any occurrences.

The second one is called dynamic payment routing and is much more agile. In this case, the rules used for payment allocation are dynamic, meaning they can switch in real time to adapt to changes.

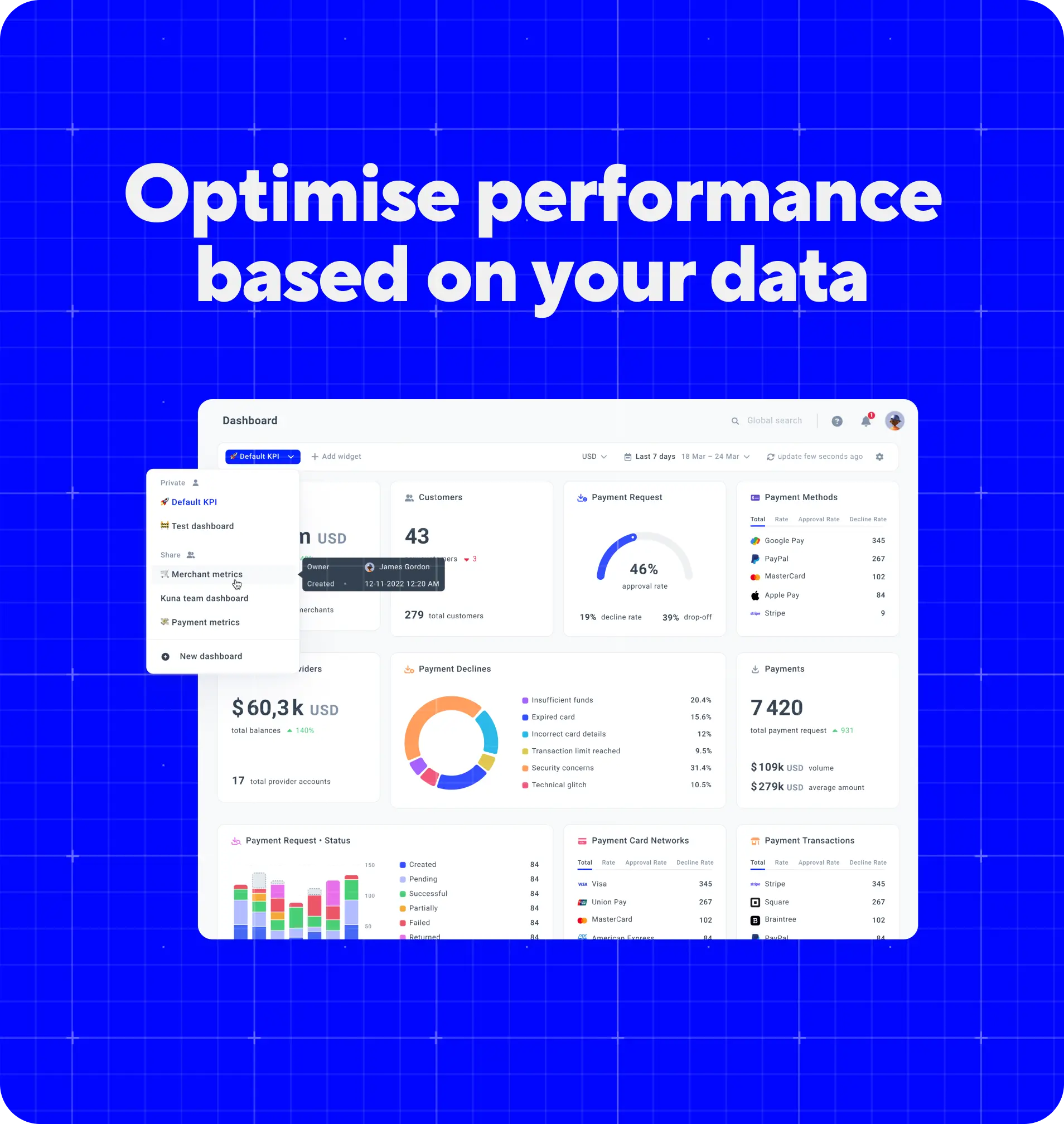

Moreover, some payment service providers enable intelligent or smart payment routing. Basically, it’s a solution that uses the company's transaction data to train itself and predict the best possible route across banks for every single transaction in real time.

Should I use it?

It is recommended to look for a solution for transaction routing If:

- Your processing setup features more than one PSP or acquirer;

- You provide services to buyers from different countries and need support for local methods along with international ones;

- The number of transactions your business processes exceeds tens of thousands;

- You’re a high-risk business;

- Your company suffers from low conversion levels and PSP downtimes.

Mastercard

Mastercard

Visa

Visa

PayPal

PayPal

Skrill

Skrill

Stripe

Stripe

Alipay

Alipay

Giropay

Giropay