Searching for a reputable and reliable payment gateway to handle transactions from your customers is not an easy task, especially if you’re a high-risk merchant. But before we dive into the issue, let’s start from the basics and define the payment gateway.

A payment gateway is a technical middleman between a merchant and a payment processor. It’s a piece of software that transfers the encrypted credit card data and transaction information from the merchant’s checkout to the payment processor, enabling secure online payments acceptance and transaction processing.

Respectively, a high-risk payment gateway is the same service but a type that works with merchants who are falling into the high-risk category. Actually, there are specialised payment gateway solutions for high-risk merchants.

Let`s get started!

Let`s get started!

Any business assumes certain risks, and e-commerce is not an exception. Moreover, the exposure to failures or different profit-lowering factors may vary for two companies of similar sizes and from one industry. Given this fact, who exactly needs a high-risk payment gateway and a high-risk merchant account?

The answer is a bank and a credit card processor. Acting as payment service providers to merchants, banks and card processors assess the risks associated with payment processing for a particular business client before offering them a merchant account. They evaluate various factors, from products a company sells and its sales volume to lousy credit card processing history, chargebacks, and fraud rates. That’s because payment processing is also a business, and its owners want to avoid unexpected losses and problems, or at least to charge more for providing services to potentially troublesome businesses. Moreover, payment providers are responsible for what they process, and they may face problems with issuing banks if fraud or chargebacks soar.

Each provider decides which factors to take into account when determining if the industry is high-risk. Hence, the list of industries falling under this category varies from one processing provider to another. Still, there are certain types of businesses that many payment services call high-risks:

Airline and event tickets

Dating and adult

Auctions, credit collection, crypto, pawn shops

Attorneys and brokers

Gambling, betting, gaming

Smoking-related products

Health and wellness products

Membership or subscription-based services

Companies assisting in offshore business activities

Real estate, furniture retailers, etc.

Again, this isn’t an exhaustive list, and each provider has its criteria for identifying the merchants that belong to the high-risk industry. One PSP can deny your merchant account application, while others may approve your high-risk merchant account. In the next part, we’ll dig a bit deeper into the issue.

Take this quick 2-minute quiz to determine the payment maturity level of your high-risk business. You'll receive tailored recommendations and an opportunity to book a payment health check with our experts.

What’s tricky in terms of accepting online payments as a high-risk business is securing a merchant account. We already know why banks and payment processors are cautious when it comes to working with such companies. However, the increased demand drives supply, so numerous companies are currently claiming to offer high-risk merchant accounts, sometimes even with so-called instant approval. Be careful when trusting such claims, as even low-risk businesses can’t get approved instantly. The average high-risk merchant account approval duration is no less than a few days. And, of course, take some time to do your research and read reviews on payment processors before applying for a merchant account with them.

The good news is that obtaining a high-risk payment gateway is a piece of cake once you have an account. That’s because payment gateways only encrypt card data to transfer it to the processor securely, so they don’t take on any merchants' risks.

So, to start accepting payments from your customers, you need a high-risk merchant account and a high-risk payment gateway. These two fundamental things can be given to you by any merchant services provider who is ready to take a high-risk merchant under their wing. But how to choose the best one?

Here are the key points to pay attention to.

Sophisticated payment fraud schemes require the most advanced security solutions to protect your clients. Fraud monitoring, tokenisation, encryption, and PCI DSS Level 1 compliance – this is the minimum security set that any payment provider should have.

This is a common occurrence when providers take advantage of the difficult situation of high-risk merchants. They know how hard it is to open a high-risk merchant account and find a high-risk payment gateway, so they charge a large markup on their services.

Be vigilant, because the processing cost for high-risk merchants is only slightly higher than for low-risk ones.

An ideal high-risk payment gateway provider supports multiple payment methods and currencies, which allows merchants to expand globally. Before opening a high-risk merchant account with some merchant services provider, make sure that it not only meets your current requirements, but also can help you grow in the future.

There are many high-risk payment gateway providers on the market, but it is worth choosing the one who will help you optimise your payment processes and overcome the main payment challenges, which we will talk about next.

If banks or merchant services providers consider your company or the industry you’re in risky, getting a merchant account will be quite a challenge. And when you’ve got one, the fight is not over: you’ll face some restrictions and will have to pay higher fees than usual. Moreover, your merchant account can get blocked if you break the conditions, resulting in lost sales.

There’s nothing we can do about it: high-risk payment gateway providers charge more for processing transactions. That’s because they want to recoup the risks. Most commonly, companies are charged 3-4%, and the types of fees applied vary greatly. Still, there’s always a chance for negotiating better terms.

As a high-risk merchant, you have to maintain a rolling reserve. It’s when a particular share of your transaction volume (up to 20%, but usually less) gets kept on hold for a specific period and is released and settled afterward. This mechanism allows banks to protect themselves from anything that can possibly go wrong with a risky business.

high-risk industries statistically have a higher average chargeback rate than others. Moreover, high-risk payment gateway providers may set monthly thresholds. We recommend looking for chargebacks prevention tools and strategies to avoid facing high chargeback fees and tarnishing your reputation.

Same as consumers, online businesses are fraudsters' targets. There is a myriad of fraud schemes that are constantly evolving in response to technological solutions aimed at preventing them. Still, an advanced anti-fraud is a must for high-risk businesses. Isn’t it better to pay for the handy tool than face losses due to not having it?

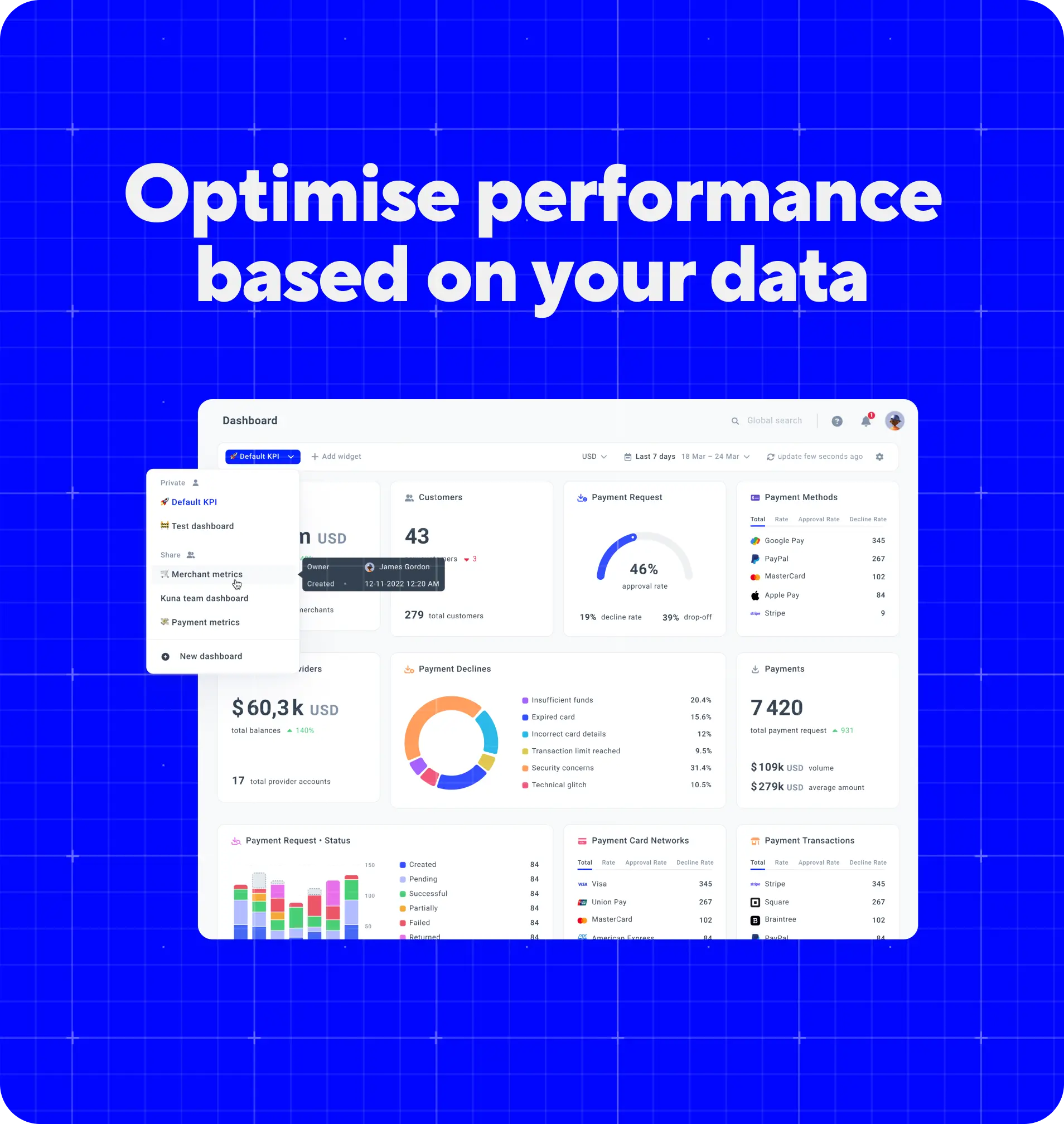

Payment orchestration platform Corefy is very appealing for high-risk merchants, as one of its fundamental benefits is the opportunity to work with multiple providers conveniently. By connecting merchant accounts at different PSPs, you can manage all your accounts in one place. The more PSPs you work with, the more features they support are available for you, and the more methods you can use to accept payments internationally. Another perk is continuity of operations. Sometimes high-risk accounts get blocked by PSPs, so the ability to quickly forward your traffic to another vendor is invaluable. Get in touch with us to see what’s more in it for you!