Leverage the advantages of a scalable technical infrastructure that we enhance and maintain for you. Connect international acquirers and accept multiple currencies to expand your operations globally regardless of the country you operate in.

Expand your global coverage by connecting and combining multiple acquirers.

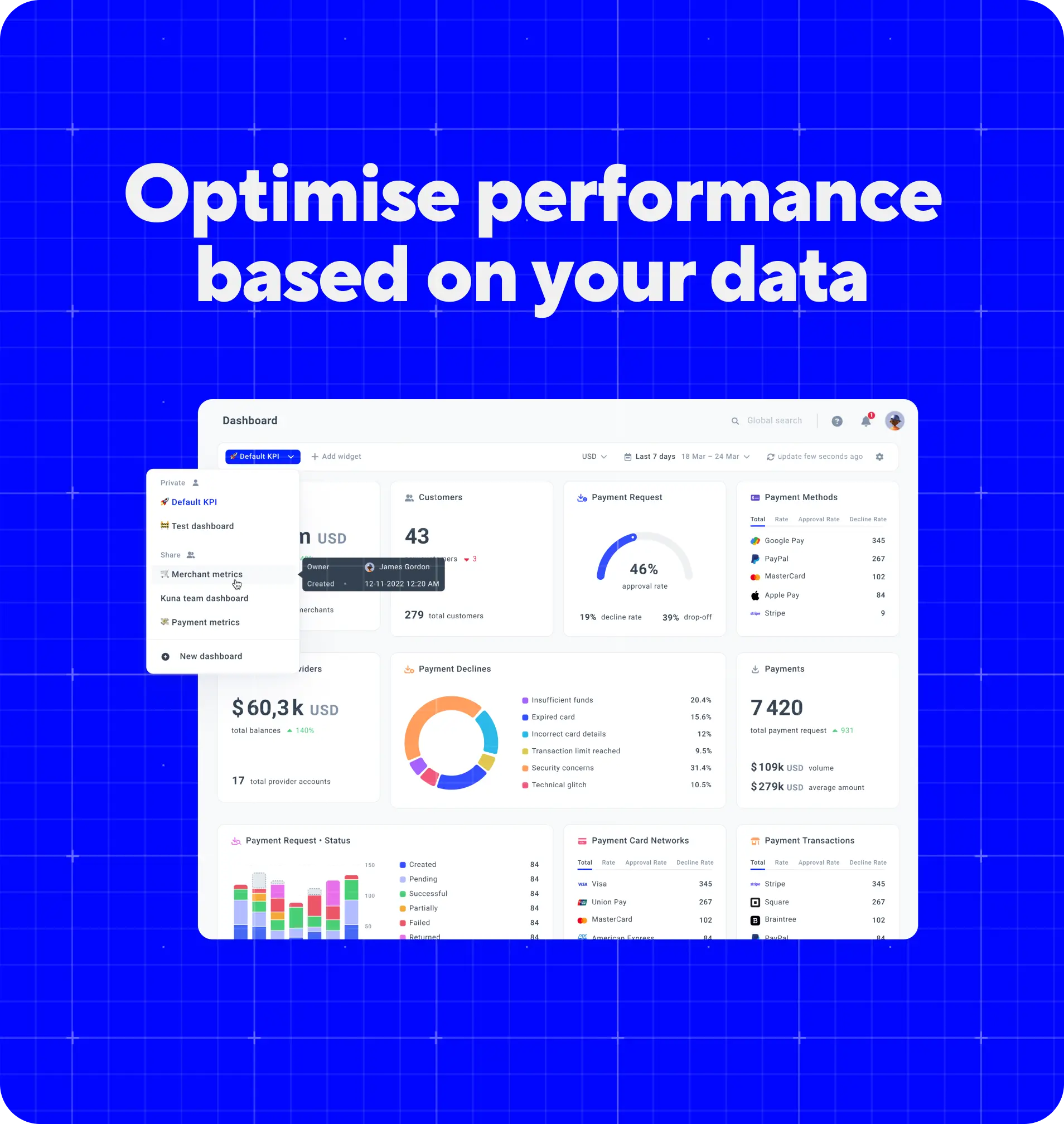

Route payments efficiently and set up a smooth checkout experience to gain higher conversions.

Maintain cross-device and cross-browser compatibility.

Overcome security and fraud protection issues with a powerful PCI-compliant toolkit to keep fraudsters at bay.

Virtual multicurrency merchant accounts provide additional flexibility for processing and managing incoming and outgoing payments.

Streamline your traders’ payment experience with tokenisation.

We remove the need to reenter the payment details, decreasing the likelihood of data theft and enabling fast & safe one-click payment for your returning and VIP customers.

Absence of the compliance burden and enhanced payment acceptance rates.

Data collection, storage, and transmission are secure and PCI-compliant.

Card tokenisation with a white label payment page.

Grant your payments with ultimate security. Belonging to the high-risk industry, Forex projects are prone to fraud attacks and have to strictly comply with the regulations.

Organise and unify the transaction data with fully-equipped accounting software for Forex businesses.

Payment in system

Provider payment

Status

We assign an account manager to every client, taking a personalised approach to support and utilising our 15+ years of techfin expertise.

Standard

For small and medium-sized businesses

Price for each transaction exceeding the plan

Top features:

Professional

For larger businesses or those seeking advanced administration tools

Price for each transaction exceeding the plan

Standard features plus:

Enterprise

For very large businesses or those in highly regulated industries

Price for each transaction exceeding the plan

Professional features plus:

Let`s get started!

Let`s get started!

The Forex market is the largest and most active financial market in the world. It is considered one of the most popular ways to make money online. If you want to start a Forex trading business, you can’t do without an efficient Forex payment processing solution.

To become a Forex trading player, you will need an online payment gateway and a Forex merchant account. A merchant account is a type of business bank account designed to accept all types of electronic payments. In turn, a payment gateway is a technology that securely processes digital transactions and establishes data transfers between a customer, a merchant, and their banks. The Forex merchant account and Forex payment gateway are two integral components of your payment processing environment.

Due to the fact that Forex trading involves a variety of currencies, many of which can be volatile and unpredictable, this industry entails many financial risks. That’s why Forex is considered a high-risk business by most payment providers.

However, it’s still possible for a Forex merchant to get reliable and cost-efficient payment processing services and open a Forex merchant account. There are plenty of Forex payment solutions to choose from.

Forex belonging to a high-risk industry can make choosing a forex payment gateway a challenge. To choose the best solution, please check whether the payment processor has:

Are you ready to conquer the foreign exchange market? Then be sure that you have a reliable Forex payment partner on board. Leverage the advantages of a scalable technical infrastructure that we enhance and maintain for you and build various Forex payment strategies with our powerful PCI-compliant toolkit. With hundreds of ready-made integrations with payment providers, you can develop and expand your business quickly and easily. Get in touch with us!