Nutzen Sie die Vorteile einer skalierbaren technischen Infrastruktur, die wir für Sie verbessern und warten. Binden Sie internationale Acquirer ein und akzeptieren Sie mehrere Währungen, um Ihre Geschäftstätigkeit unabhängig vom Land, in dem Sie tätig sind, global auszuweiten.

Erweitern Sie Ihre globale Abdeckung, indem Sie mehrere Acquirer miteinander verknüpfen und kombinieren.

Leiten Sie Zahlungen effizient weiter und sorgen Sie für eine reibungslose Kaufabwicklung, um höhere Konversionsraten zu erzielen.

Behalten Sie die geräte- und browserübergreifende Kompatibilität bei.

Bewältigen Sie Probleme im Bereich der Sicherheit und des Betrugsschutzes mit einem leistungsstarken PCI-konformen Toolkit, um Betrüger in Schach zu halten.

Virtuelle Händlerkonten für mehrere Währungen bieten zusätzliche Flexibilität bei der Verarbeitung und Verwaltung eingehender und ausgehender Zahlungen.

Optimieren Sie das Zahlungserlebnis Ihrer Händler mit der Tokenisierung.

Wir machen die erneute Eingabe der Zahlungsdaten überflüssig, verringern die Wahrscheinlichkeit von Datendiebstahl und ermöglichen Ihren wiederkehrenden und VIP-Kunden eine schnelle und sichere Zahlung per Mausklick.

Kein Compliance-Aufwand und höhere Zahlungsakzeptanzraten.

Datenerfassung, -speicherung und -übertragung sind sicher und PCI-konform.

Tokenisierung von Karten mit einer White-Label-Zahlungsseite.

Statten Sie Ihre Zahlungen mit höchster Sicherheit aus. Da Forex-Projekte zu den Hochrisikobranchen gehören, sind sie anfällig für Betrugsversuche und müssen den Vorschriften der Regulierungsbehörden strikt entsprechen.

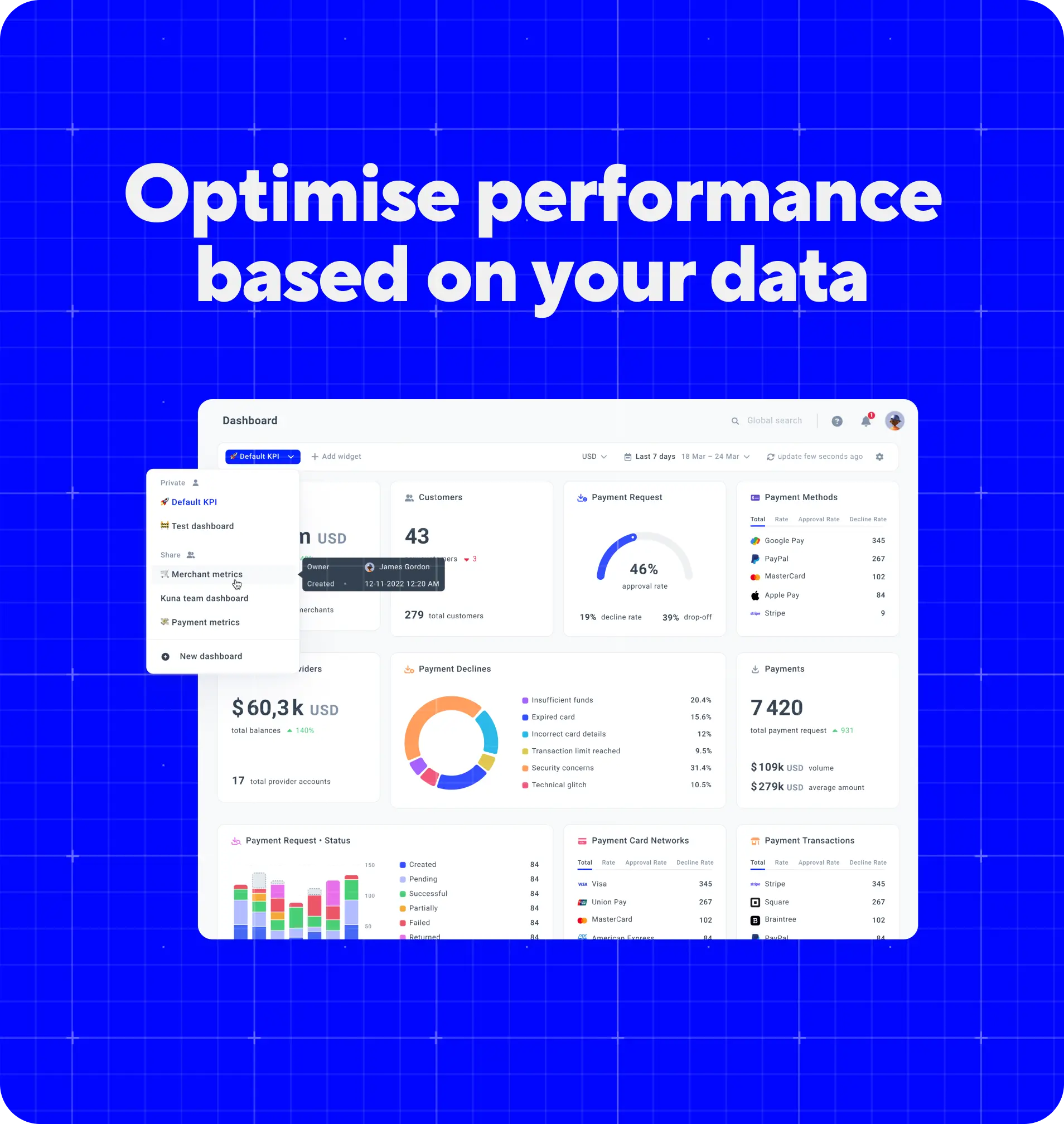

Organisieren und vereinheitlichen Sie die Transaktionsdaten mit einer voll ausgestatteten Buchhaltungssoftware für Forex-Unternehmen.

Corefy-Auszug

Anbieter-Auszug

Status

Jedem Kunden wird ein Kundenbetreuer zugewiesen, der einen persönlichen Ansatz bei der Betreuung verfolgt und unsere mehr als 15-jährige Erfahrung mit Techfin nutzt.

Standard

Für kleine und mittlere Unternehmen

Preis für jede Transaktion nach Überschreitung des Tarifs

Top-Merkmale:

Professional

Für größere Unternehmen oder diejenigen, die erweiterte Verwaltungstools suchen

Preis für jede Transaktion nach Überschreitung des Tarifs

Standard-Merkmale plus:

Enterprise

Für sehr große Unternehmen oder solche in stark regulierten Branchen

Preis für jede Transaktion nach Überschreitung des Tarifs

Professional-Merkmale plus:

Let`s get started!

Let`s get started!

Der Forex-Markt ist der größte und aktivste Finanzmarkt der Welt. Es gilt als eine der beliebtesten Möglichkeiten, um online Geld zu verdienen. Wenn Sie ein Forex-Handelsgeschäft starten möchten, können Sie auf eine effiziente Forex-Zahlungsabwicklungslösung nicht verzichten.

Um ein Forex-Handelsspieler zu werden, benötigen Sie ein Online-Zahlungsgateway und ein Forex-Händlerkonto. Ein Händlerkonto ist eine Art Geschäftsbankkonto, das dafür ausgelegt ist, alle Arten von elektronischen Zahlungen zu akzeptieren. Ein Payment Gateway wiederum ist eine Technologie, die digitale Transaktionen sicher verarbeitet und Datenübertragungen zwischen einem Kunden, einem Händler und deren Banken herstellt. Das Forex-Händlerkonto und das Forex-Zahlungsgateway sind zwei integrale Komponenten Ihrer Zahlungsverarbeitungsumgebung.

Aufgrund der Tatsache, dass der Devisenhandel eine Vielzahl von Währungen umfasst, von denen viele volatil und unvorhersehbar sein können, birgt diese Branche viele finanzielle Risiken. Aus diesem Grund wird Forex von den meisten Zahlungsanbietern als risikoreiches Geschäft angesehen.

Es ist jedoch für einen Forex-Händler immer noch möglich, zuverlässige und kosteneffiziente Zahlungsabwicklungsdienste zu erhalten und ein Forex-Händlerkonto zu eröffnen. Es gibt viele Forex-Zahlungslösungen zur Auswahl.

Forex, das zu einer risikoreichen Branche gehört, kann die Auswahl eines Forex-Zahlungsgateways zu einer Herausforderung machen. Um die beste Lösung auszuwählen, überprüfen Sie bitte, ob der Zahlungsabwickler:

Sind Sie bereit, den Devisenmarkt zu erobern? Dann stellen Sie sicher, dass Sie einen zuverlässigen Forex-Zahlungspartner an Bord haben. Nutzen Sie die Vorteile einer skalierbaren technischen Infrastruktur, die wir für Sie erweitern und warten, und bauen Sie mit unserem leistungsstarken PCI-konformen Toolkit verschiedene Forex-Zahlungsstrategien auf. Mit Hunderten von vorgefertigten Integrationen mit Zahlungsanbietern können Sie Ihr Geschäft schnell und einfach entwickeln und erweitern. Nehmen Sie Kontakt mit uns auf!