Jeder Händler, der sich auf die eine oder andere Weise mit Online-Zahlungen beschäftigt, hat schon einmal von einem Zahlungsgateway gehört. Wenn Sie jedoch ein Neuling im E-Commerce sind, vermitteln wir Ihnen gerne ein tieferes Verständnis darüber, was genau ein Zahlungsgateway ist und welche Rolle es bei der Zahlungsabwicklung spielt.

Ein Zahlungsgateway ist eine Technologie, die es Händlern ermöglicht, Online-Transaktionen sicher anzunehmen und abzuwickeln. Wir können es mit einem normalen POS-Terminal vergleichen, das Verkäufer zur Annahme von Debit-/Kreditkarten in stationären Geschäften verwenden. Wie ein POS-Terminal ist ein Gateway für die Übertragung von Zahlungsinformationen zwischen allen an einer Transaktion beteiligten Parteien konzipiert, wird jedoch speziell für die Abwicklung von Online-Zahlungen verwendet. Daher benötigt jeder Einzelhändler, der Online-Zahlungen akzeptieren möchte, ein sicheres Gateway, das die sensiblen Daten seiner Kunden durch Datensicherheitstools wie Verschlüsselung, SSL und Tokenisierung vor Betrug schützt.

Lassen Sie uns genau herausfinden, wie das Gateway an einer Online-Transaktion beteiligt ist:

Ein Verbraucher wählt das Produkt aus und gibt auf der Website eines Händlers eine Bestellung auf. Sie wählen eine bevorzugte Zahlungsmethode aus und geben auf einer Checkout-Seite Debit-/Kreditkartendaten ein.

Ein Gateway empfängt die Informationen, verschlüsselt sie und sendet eine Autorisierungsanfrage an die erwerbende Bank.

Die erwerbende Bank sendet eine Anfrage an das Kartennetzwerk (Visa, Mastercard oder andere), das den Karteninhaber bedient.

Das Kartennetzwerk kontaktiert die ausstellende Bank des Verbrauchers, um zu prüfen, ob die Karte gültig ist und ob genügend Guthaben zum Abheben vorhanden ist.

Der Emittent autorisiert die Transaktion und sendet über ein Gateway eine Bestätigung an die erwerbende Bank.

Das Zahlungsgateway informiert den Verbraucher über eine erfolgreiche Transaktion. Anschließend wird der Betrag vom Konto des Verbrauchers abgebucht und dem Konto des Händlers gutgeschrieben.

Ein Zahlungsgateway kann als Vermittlungsdienst beschrieben werden, der elektronische Transaktionen verarbeitet und Zahlungsinformationen zwischen Händlern, Banken und anderen Verarbeitungsteilnehmern über ein einziges Kommunikationsprotokoll weiterleitet. Es begleitet jede Transaktion von Anfang bis Ende, gewährleistet den Schutz der Kartendaten und verhindert mögliche Datenlecks oder Betrüger. Daher umfasst die Funktionalität eines Zahlungsgateways Folgendes:

Authentifizierung

Verschlüsselung der Kundendaten

Weiterleitung der Daten zwischen Verarbeitungsteilnehmern (Auftragsverarbeiter, Acquirer, Issuer, Kartennetzwerk)

Benachrichtigung über Genehmigung/Ablehnung der Transaktion.

Zahlungsgateway-Funktionen sind für jedes E-Commerce-Unternehmen unverzichtbar, da ihr Hauptzweck darin besteht, potenzielle Risiken im Zusammenhang mit elektronischen Transaktionen zu verhindern.

Marktplätze stellen eine besondere Kategorie des E-Commerce dar, da sie sehr unterschiedlich sind und einen individuellen Ansatz zur Integration von Zahlungslösungen erfordern. Nicht alle Gateways sind für die Marktplatzintegration geeignet. Hier müssen Sie zahlreiche Faktoren berücksichtigen, wie z. B. die Art des Marktplatzes, die verkauften Produkte, die abgedeckten Regionen, die Lieferart und andere. Hier sind ein paar Beispiele.

Nehmen wir einen Single-Vendor-Marktplatz, auf dem nur ein Verkäufer seine Produkte anbietet. Am Verkaufsprozess sind drei Teilnehmer beteiligt: der Verkäufer, der Käufer und der Vermittler zwischen ihnen (PSP, Acquirer usw.). Daher sollte der Händler bei der Einrichtung einer Online-Zahlungsabwicklung für einen Single-Vendor-Marktplatz ausschließlich die lokalen Zahlungspräferenzen der Verbraucher berücksichtigen und mithilfe eines Dienstleisters die auf seine Bedürfnisse zugeschnittene Lösung integrieren. Dabei handelt es sich in der Regel nur um ein Land und eine Währung, was die Integration viel einfacher macht. Bei einem Multi-Vendor-Marktplatz werden die Dinge jedoch komplizierter.

Ein Multi-Vendor-Marktplatz ist eine komplexe Interaktionskette, bei der der Marktplatz selbst als Vermittler zwischen den Verkäufern, die ihre Produkte auf der Plattform platzieren, und den Käufern fungiert. Parallel dazu kann der Marktplatz eigene Produkte verkaufen. Auch das Auszahlungssystem ist anders. Wenn ein Kunde über die Plattform einen Kauf tätigt, sammelt der Marktplatz Gelder ein und zahlt diese dann an die Verkäufer aus, wobei ihnen zunächst Gebühren in Rechnung gestellt werden. Je größer der Marktplatz ist, desto mehr Währungen und Zahlungsmethoden sollten angebunden werden, um den Bedürfnissen der Verbraucher gerecht zu werden.

Trotz der Art des Marktplatzes gibt es nur eines, was ihn vertrauenswürdig macht: die hohe Sicherheit der Zahlungsabwicklung. Genau dafür sind Zahlungsgateways zuständig.

Einfache Integration

Verbesserte Sicherheit

Betrugserkennung und -prävention

Anpassung der Kasse

Reibungsloses Einkaufserlebnis für Kunden

Günstige Voraussetzungen für globale Expansion

Normalerweise dauert es nicht lange, ein Zahlungsgateway in einen Marktplatz zu integrieren, wenn Sie mit einem Zahlungsdienstleister (PSP) zusammenarbeiten – einem Drittunternehmen, das vorgefertigte technische Lösungen für jede Art und Größe des Marktplatzes anbietet.

Let`s get started!

Let`s get started!

Wenn Sie sich für die Schaffung einer sicheren und bequemen Zahlungsinfrastruktur einsetzen, ist es an der Zeit, eine Lösung auszuwählen, die am besten zu Ihrem Markt passt. Wie oben erwähnt, kann nicht jedes Dienstleistungsunternehmen gleichzeitig die Anforderungen von Käufern, Verkäufern und dem Marktplatz erfüllen. Daher ist es sehr wichtig, den Dienstleister (PSP) zu finden, dem Sie bei der Abwicklung Ihrer Zahlungen und Auszahlungen vertrauen können.

Bei der Auswahl einer relevanten Verarbeitungslösung für den Markt empfehlen wir, mehrere Kriterien zu berücksichtigen:

Rückbuchungen kommen auf Marktplätzen sehr häufig vor, da Käufer beim Online-Einkauf oft die falsche Wahl treffen oder das Produkt nicht ihren Erwartungen entspricht. Um mögliche Probleme mit unbezahltem Geld zu vermeiden, wählen Sie einen Prozessor, der Rückbuchungen abwickelt.

Rückbuchungen kommen auf Marktplätzen sehr häufig vor, da Käufer beim Online-Einkauf oft die falsche Wahl treffen oder das Produkt nicht ihren Erwartungen entspricht. Um mögliche Probleme mit unbezahltem Geld zu vermeiden, wählen Sie einen Prozessor, der Rückbuchungen abwickelt.

Für große internationale Marktplätze, die Waren in die ganze Welt liefern, ist die Verwendung mehrerer Währungen unerlässlich. Das Gleiche gilt auch für die Zahlungsmethoden, da die Präferenzen der Käufer von Land zu Land sehr unterschiedlich sind. Lassen Sie Ihre Kunden genau wählen, wie sie bezahlen möchten: Debit-/Kreditkarte, Banküberweisung, Apple Pay, E-Wallet, Krypto-Wallet oder eine andere Methode.

Da das Zahlungsgateway eine wichtige Rolle beim Datenschutz spielt, kann die Arbeit mit einem ungeschützten Tool negative Folgen in Form von Datenlecks und Betrug nach sich ziehen. Daher ist die Integration eines PCI-konformen Zahlungsgateways von entscheidender Bedeutung für den reibungslosen Ablauf Ihres Unternehmens. Überprüfen Sie die Lizenzen und Unterlagen eines PSP, bevor Sie einen Vertrag abschließen.

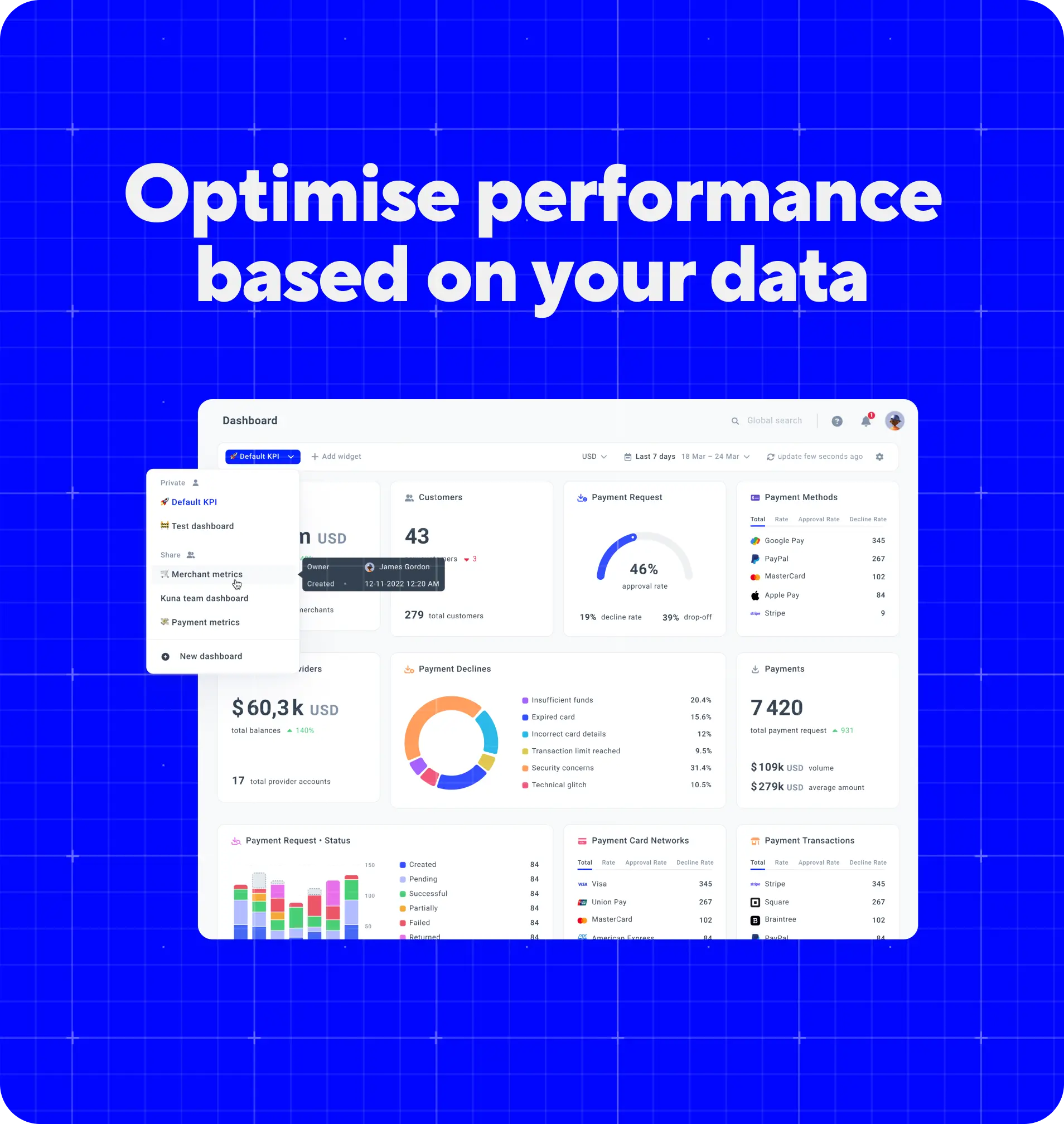

Eine bekannte Tatsache ist, dass der Betrieb eines Marktplatzes den Umgang mit zahlreichen Händlern und Hunderten von Transaktionen pro Tag bedeutet. Glücklicherweise kennen PSPs die geschäftlichen Anforderungen und stellen sie dem Händler zur Verfügung Managementlösungen für komfortable und systematisierte Überwachungsvorgänge. Darüber hinaus können Sie von maßgeschneiderten Berichtsformaten profitieren und detaillierte Umsatz-, Demografie- und Wettbewerbsberichte erhalten.

Es ist schwer, die Funktionalität eines Zahlungsgateways für Marktplätze zu unterschätzen, da die Sicherheit von Transaktionen für Kunden, die online einkaufen, von größter Bedeutung ist. Indem Sie ihnen auf Ihrem Marktplatz maximalen Datenschutz bieten, erhöhen Sie die Bindung an Ihr Unternehmen und steigern entsprechend Ihren Umsatz. Bei Corefy bieten wir viel mehr als nur ein Zahlungsgateway. Bringen Sie Ihren Marktplatz mit unseren E-Commerce-Management-Tools auf ein neues Niveau. Finden Sie heraus, was wir für Sie tun können!