Let's determine B2B payment processing by dividing the term into two parts.

B2B, or business-to-business, is a type of company that provides services or goods to other companies. Respectively, when a company offers services to consumers, its business model is B2C or business-to-consumer.

Payment processing means a sequence of steps or processes required to finalise each online transaction or a transaction made using payment methods other than cash or check. These steps depend on the method and transaction type but mainly involve data entrance, authentication, verification, and approval or decline.

This way, the term B2B payment processing refers to how a business that works with other companies handles its transactions.

As we've just discovered, payment methods are the basis of processing. For businesses working with other businesses, payment methods have their specifics compared to consumer-oriented companies. Some options better serve the B2C model and are almost inapplicable to B2B, while others work better and are widely used to pay from company to company.

Let's learn more about the best solutions for this segment.

Cash is the oldest method for payment acceptance. Although handling business payments in cash is very complex and inconvenient, good old paper money is still somehow in use, primarily among small businesses.

However, many businesses tend to decrease their use of cash already, and this trend is projected to persist.

Another traditional option, paper checks, is the most popular form of payment in B2B processing, although it's far from the best. The disadvantages that business owners mention include high cost ($4 to $20 per check) and low speed. Besides, checks are error-prone and complex to keep track of.

All these drawbacks repel entrepreneurs and make them look for more efficient electronic alternatives.

ACH means Automated Clearing House, an electronic settlement system in the USA with debit and credit solutions.

Basically, the system allows making payments and payouts using electronic checks that can be settled digitally.

Many developed markets have similar systems, and such a form of payment is one of the most preferable by businesses due to low transaction cost, convenience, and high speed. According to a survey by Mastercard, entrepreneurs are most content with making recurring ACH payments.

Credit, debit, and prepaid cards issued through banks and payment institutions allow businesses to pay mainly for some inexpensive items, given that large amounts may lead to greater bank or regulator scrutiny. Moreover, the company incurs fees close to 3% per credit card transaction.

Credit card B2B payments are on the rise these years thanks to fast processing and the simplicity and convenience of use.

Bank and wire transfers are complex to start with, so this form of money transfer is typically used by larger firms to send and receive international transactions. Transactions using wire transfers can be of any amount, so it's an excellent way to send large payments between businesses.

Wire transfer via a banking network like SWIFT or SEPA is a type of electronic funds transfer, or EFT, meaning the digital money movement directly from one bank account to another. Historically, Western Union has been the trailblazer in the wire field, but now wire transfers are widely used by many businesses worldwide.

Sending money via wire implies fees varying from $15 to $50, while receiving funds is usually free.

Cryptocurrencies are digital assets designed as a decentralised digital analogue for traditional money.

In the B2B field, cryptocurrencies' significant benefit to businesses is the high speed and ease of international payments.

However, the price volatility of digital currencies, the need to exchange them, and regulators' concerns regarding them are major challenges.

Businesses also can send and receive money to and from each other using online payment methods. Some options, like PayPal, are available after a fast registration process, while others require an account with a provider.

Working with a payment platform not only gives access to various online methods but also facilitates the payment process and allows to make subscription, regular, recurring, and one-time transactions simply and efficiently.

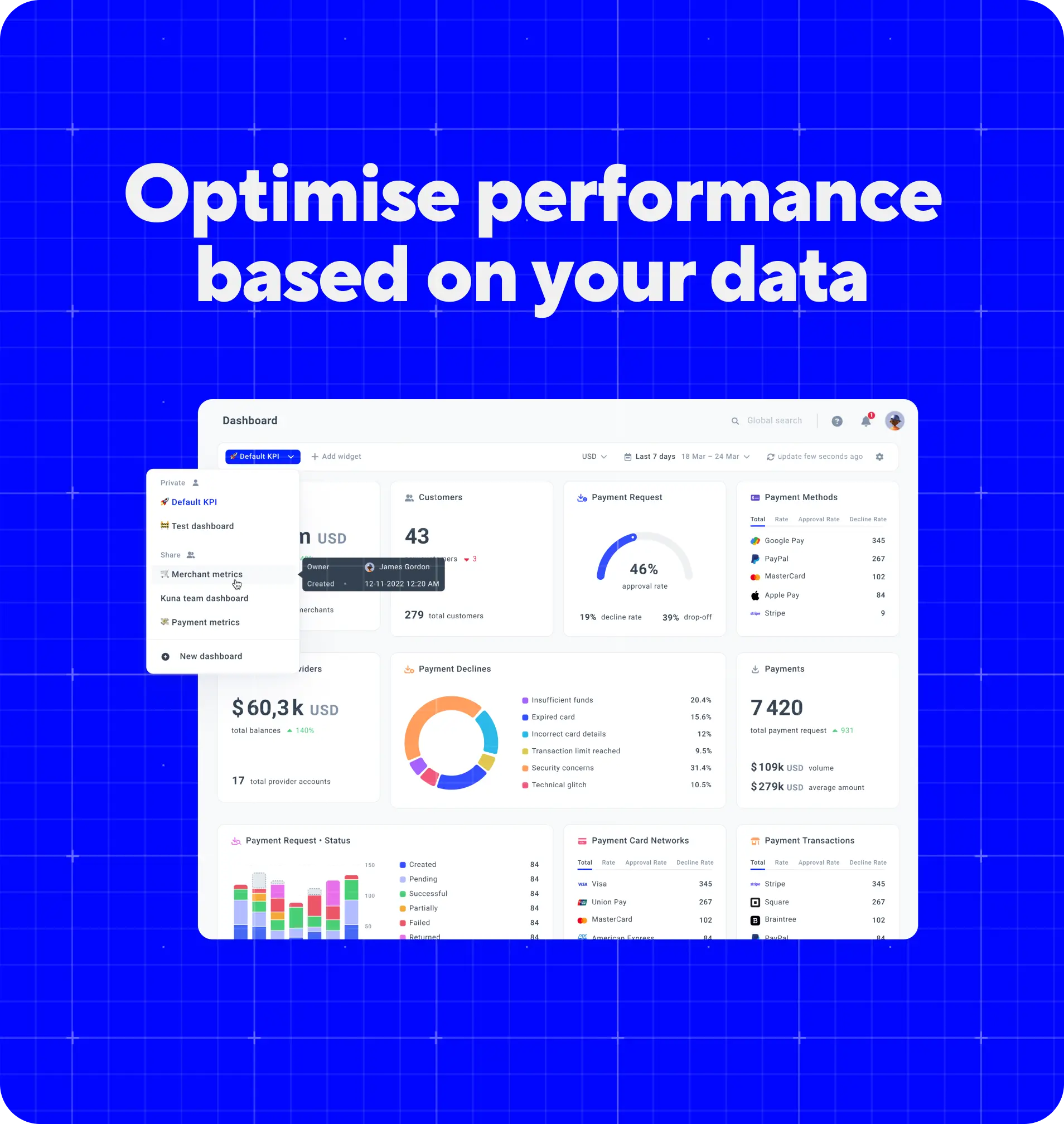

Some platforms, including Corefy, offer additional features, like advanced invoice and fee management options, the opportunity to integrate multiple providers, processors and methods in a few clicks, collect analytics and have a single access point to all the data, route transactions, and much more.

Let`s get started!

Let`s get started!

There are a few trends that drive specific changes in the way B2B payments are made. Namely, a global upswing in card usage and real-time payments, growing investments in fintech, and open banking.

According to expert estimations , in 2021, the global B2B payments market was valued at $1,000 billion, projected to reach $2,515 billion by 2030.

All these factors drive technology innovations and result in a growing variety of payment options for B2B. Some tendencies we already witness are decreased cash and check usage in favour of virtual cards, electronic payables, and even cryptocurrencies.

If you work with B2B money transfers, you already know a lot about payments (if not, please do not hesitate to look at guides and articles on our blog ). So, here are a couple of significant checkpoints to look at when choosing a payment partner:

Define the ones you need for work and ask if the chosen platform supports all of them. It also helps to have access to more than on your list.

Payment expertise is a valuable asset for business, as it allows for optimising many processes and discerning more opportunities. We at Corefy use our 15+ years of experience in fintech to help our clients reach their business goals faster.

Work only with reliable and well-established PCI DSS-certified partners.

Look for a platform that allows you to access statistics easily and generate reports for all the payments your company makes and accepts, as it's a key for optimisation.

Nobody wants to end up with unbearable processing costs. Make sure to examine and calculate all the charges you'll face carefully. Compare offerings on the market and choose the optimal one.