PayCore.io v0.57 (March 11, 2019)¶

By Dmytro Dziubenko, Chief Technology Officer

Hello all, here is an update on what the dev team has been working on the last week. We are currently still in the process of migrating existing customers to the new PayCore.io Commerce, which was recently released and fixing some previously unknown issues. Our frontend dev team is testing PayCore.io Commerce Batch Payouts user interfaces and other new features, which we hope to release in the coming week, so stay tuned for that.

List of changes¶

- API Update: Batch Payouts

- Merchant SDK.js

- Improvements and Bug fixes

New API endpoints for Batch Payouts¶

Batch Payouts enables you to simultaneously send payouts to an unlimited amount of recipients by creating an array of batch payout items. Each Payout Item has information on the amount, currency and service will be used to make a payout. So, you can initiate payouts using multiple payouts methods simultaneously, e.g. a mix of SEPA and SWIFT transfers, Visa OCT and Mastercard MoneySend services, and PayPal wallets both by account number and phone. So, there are no limits on the number of recipients or payout methods.

Batch Payout Items are simply mirroring Payout Request functionality but can be verified by PayCore.io prior to the processing. Batch Payout has its own workflow. Concurrently, Batch Payout and Batch Payout Items have different statues than Payout Request or simple Payout. More information can be found in the Documentation and the API Reference.

Commerce Public API Client¶

Overview¶

We’ve recently released PayCore.io Commerce Public API .

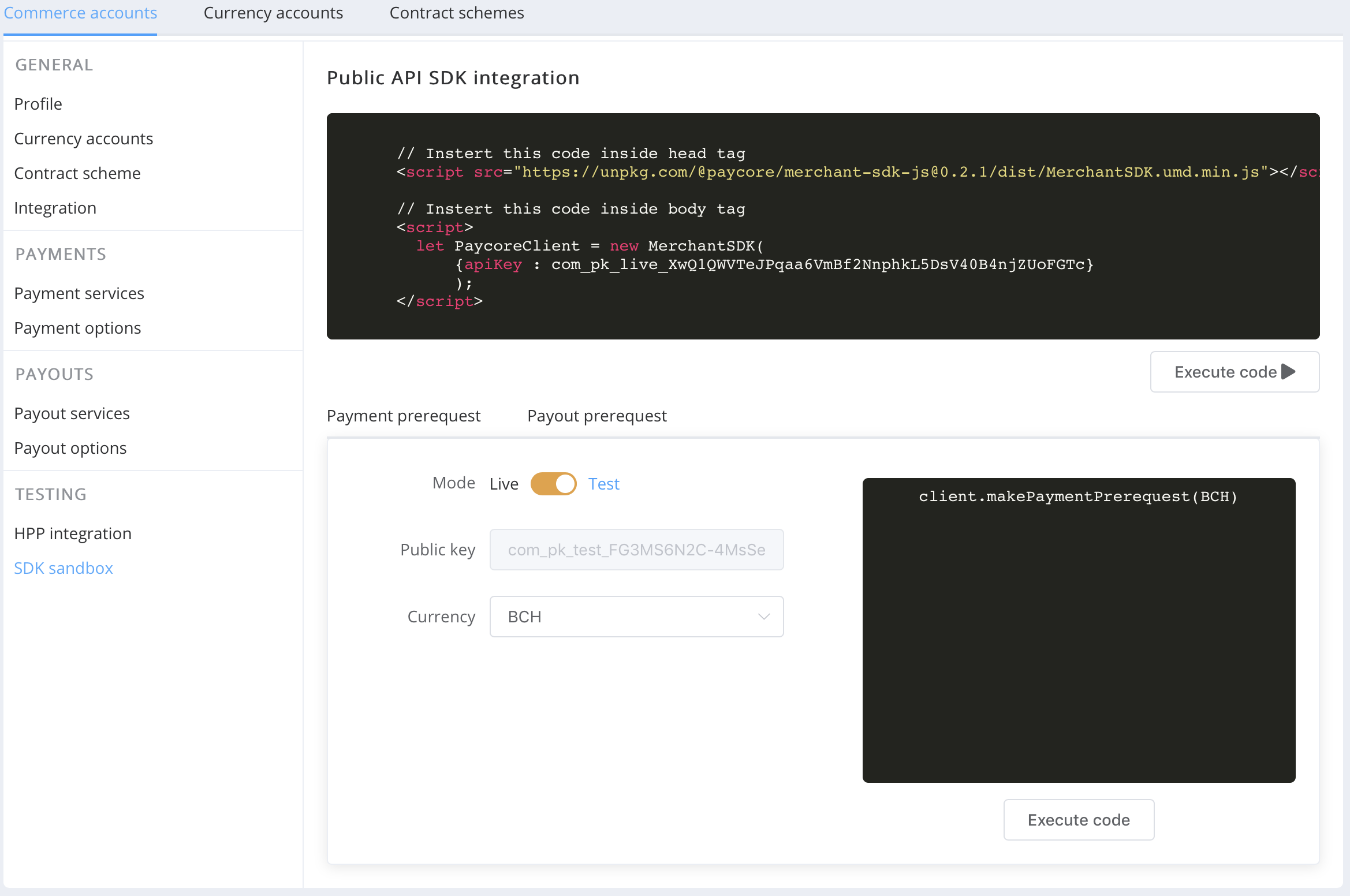

Commerce Public API Client simplifies creating custom payment pages for your checkout. Since every Commerce Account has its own public API key, you'll be able to have custom payment pages to support different types of offerings or multiple storefronts or create commerce accounts for your merchants, when it comes to payment service.

How it works¶

With the JavaScript library, you can send a pre-request for both Payments and Payouts and design your own payment page to show available services and payment methods for a particular currency and amount (in case of Payouts). By knowing payment and payout methods, you can list them in your checkout as payment or payout options that user can choose from. In the same time, you'll get information about payment requisites required to process a payment or payout for every service. The term 'Service' means a combination of payment or payout method and currency. By knowing available services, you get the freedom of choice to process a Payment Invoice in the currency you wish the funds to be settled. For outgoing transactions, this means an ability for your user to choose from available currencies. So now, you have all the tools you need to create a 'choice' and 'details' screens or steps for your payment page.

When a user made a choice of the payment or payout method and entered the required details, you can use information about available services to create a Payment or Payout Request with a particular service. Take into account that Payout Invoices can either be processed in the currency of the Payout Invoice or the Service currency. The response to the Payout Pre-request will also include the exchange rate to be used for processing the Payout Invoice and the transaction fee. You can get information on the exchange rate and the transaction fee for incoming transactions only when you'll create a Payment Invoice. Due to the requirements of the EU's revised Payment Services Directive (PSD2), a Payment Service Provider (PSP) must provide information on all charges payable by the payment service user to the PSP, including interest and exchange rates. So, when you'll get this information for the payment, you're able to provide it to comply with the PSD2 requirements.

New option to test your integration¶

In order to test your integration, you only need to select a preferred currency to test this code without a need to replace the actual Public API key through your Commerce Account SDK Sandbox screen.

Performance improvements and bug fixes¶

We also made general performance improvements and various bug fixes.

Trademarks: SWIFT, Visa, PayPal and Mastercard Moneysend are trade names, trade marks or registered trade marks of their respective holders.