Businesses of various shapes and sizes utilise different practices to manage cash and keep all their financial operations running smoothly. One of the essential steps of financial management is synchronising inner transactions data with vendors' statements which is called reconciliation.

What are the key points of the reconciliation process, and why is it so important? We've envisaged the answers below.

What is reconciliation?

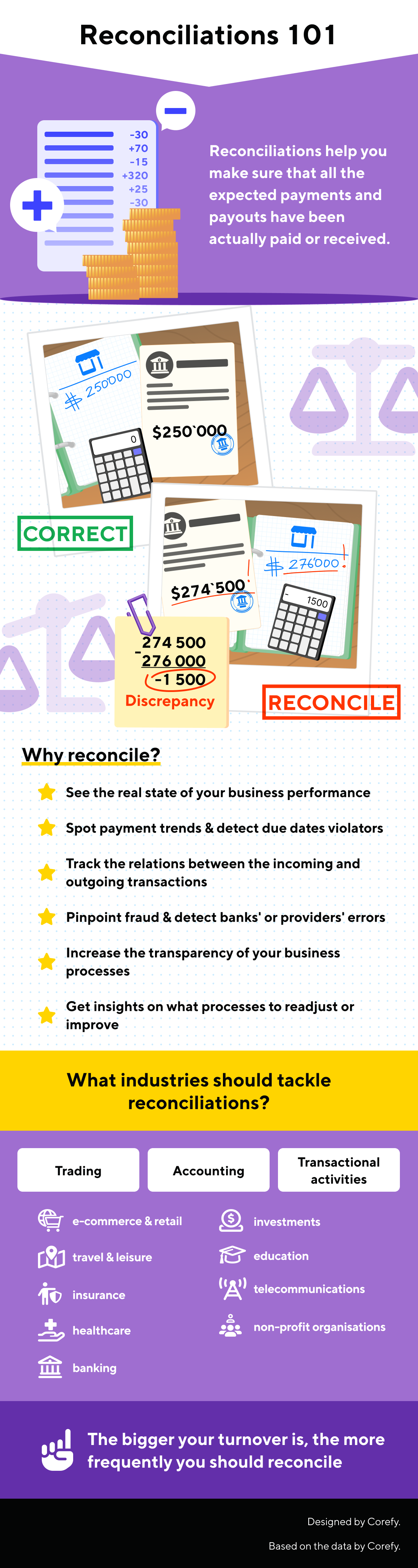

In a nutshell, it is the process of matching several data sets. It's all about finding balance — like in Zen practice. The reconciliation process helps control all payments and payouts.

Reconciliations help to ensure that all the expected transactions have actually been finalised.

When done timely and regularly, it helps to maintain the consistency of transaction flows and protect your finances from all kinds of pitfalls, like overdrawing money or fraud. The reconciliation process allows you to reveal statements that do not match and to spot fraudulent or erroneous transactions.

Types of reconciliation

The traditional payment reconciliation types are:

Cash reconciliation. The amount of money received by the end of a business day is compared with the receipts.

Credit card reconciliation. This type matches the internal records of a business with credit card statements.

Payment providers reconciliation. Almost the same as the previous one – the company's internal transaction data is compared with that of providers.

The first type usually occurs at the end of the shift or business day, and the frequency of the second and third types depends on the type and size of a business.

Methods of reconciliation

Just imagine two information ledgers to understand the essence: one from your entity and another from a bank or vendor. Both contain transaction details, including currency, amount, status, and whether it's a payment or a payout. They also may have some extra information — an invoice number or a reference. Further steps depend on the method of reconciliation. It can be manual or automatic.

- Manual reconciliation. It implies thoroughly analysing both data sets from the two ledgers by a finance team. Apart from being quite labour-extensive, comparing data line-by-line just by the naked eye implicates another tricky pitfall — the factor of human error.

- Automatic reconciliation. Historically, the process of reconciliation has been manual. But fortunately, current smart technologies and tools allow businesses to tackle it automatically with added efficiency. Most companies now stick to auto-reconciliations, for it reduces manual work and streamlines the whole process — you can process the results at once.

How often should you use reconciliation?

There is no predefined schedule on how often to reconcile your statements. You can go by the volume of transactions — the larger the number, the more repeatedly you should reconcile. If your transaction volume measures hundreds to thousands of transactions per day (oftentimes for casinos and marketplaces), it makes sense to reconcile daily. But if you run a small business and some days there are no transactions at all, you might opt for weekly or monthly reconciliations. But the general rule for any size and type of business is below.

The more often and regularly you use reconciliations, the easier each time is.

How does reconciliation work?

The procedure of reconciliation involves four interrelated steps. Whether it's a person or a tool, here's what they do:

- Retrieve the records. This step comprises gathering all transaction records for further analysis. When done manually, retrieving payment records from different sources requires unifying all data into a single format. Thus, it appears to be the most labour and time-intensive step.

- Match the statements. The name says it all, all transactions recorded on a business side are compared with the bank statements. The matching items are removed from the process at this stage. All the mismatches are transferred to the next step for further analysis.

- Reconcile. That is the essential stage when the discrepancies in statements are analysed to define the reasons and rectify the discrepancies. If it's manual reconciliation, the corrections may require a further check.

- Finalise. In the final stage, when all transactions are checked and reconciled, the system or the person can add some final fixes to the statements.

What method of reconciliation is better?

As you see from the steps above, manual reconciliation can take place, but the automatic type is chosen more often due to a bunch of benefits:

- less manual work;

- higher accuracy;

- increased speed.

In its turn, manual reconciliation requires specialists and implies the human error factor. Plus, it entails the issue of statement standardisation. All in all, it results in delayed financial visibility. But if the point is a little project with little turnover, manual reconciliation is a good choice.

What if the balances do not match?

The result of the reconciliation process helps to pinpoint the discrepancies in statements. Still, mismatches can be legitimate in some instances.

Here are the two situations worth paying attention to:

- You've issued a check or money transfer and recorded it on your books, but the bank has not yet processed it. It is an outstanding check or withdrawal.

- Your company receives some payments, and you record them in your books, but the bank has not processed them yet. Mismatches of that type are called deposits in transit or outstanding deposits/receipt.

There's nothing detrimental about these two cases so long as you keep track of them.

6 reasons on behalf of reconciliation

Maintaining financial hygiene in your business pays off tenfold. Companies in different industries see several compelling reasons to use reconciliations regularly.

- See the reality. By matching all your statements with that of providers, you see the actual state of things. It allows you to plan your further spending and investments.

- Track the transaction flows. Proper and timely reconciliation allows you to monitor all the incoming and outgoing flows and the relationship between them.

- Pinpoint fraud. Alas, it won't save you from fraud. But the detected discrepancies will let you know when it's happened.

- Detect errors made by banks or providers. Seldom or never, but such errors happen. So, if you target certain inconsistencies you can't explain, it might be time to speak to your bank.

- Identify trends. Deploying reconciliation, you might spot some trends. For instance, detect the most "popular" time for payments or the most persistent violators of payment due dates, etc.

- Increase business efficiency. Regularly staying in control of all mismatches or errors gives you insights into what processes need improvement or readjustment.

That way, you'll be able to forecast your cash flows more accurately so you don't go overdrawn.

Reconcile without efforts

Reconciliations by Corefy solve all the abovementioned challenges most efficiently. Opting for our fully-equipped finance management tool, you reduce manual work and get a reliable accounting partner. It allows you to tackle the procedure in a snap, switching your focus towards handling exceptions instead of a time-consuming manual check of each transaction. Corefy detects and alerts you about any mismatches in statements, granting consistency and facilitating the whole process.

We offer the necessary tools to resolve edge cases and eliminate your accounting headache. Get in touch today to learn more about our ready-made solution.